Top 6 Moneylion Instacash Alternatives: Best Instant Cash Apps of 2023

Discover the ultimate list of the top 10 Moneylion Instacash alternatives in 2023! In today’s fast-paced world, everyone is looking for quick and efficient solutions to address their financial needs. Moneylion Instacash has proven to be a popular choice for those seeking instant cash, but did you know there are numerous other reliable and convenient apps just like it? In this comprehensive guide, we have carefully selected and ranked the ten best instant cash apps offering a variety of features and benefits, all designed to help you manage your finances effortlessly. So, read on and explore these amazing alternatives, and find the perfect app that fits your monetary requirements. Time to say goodbye to financial stress and embrace the world of instant cash relief!

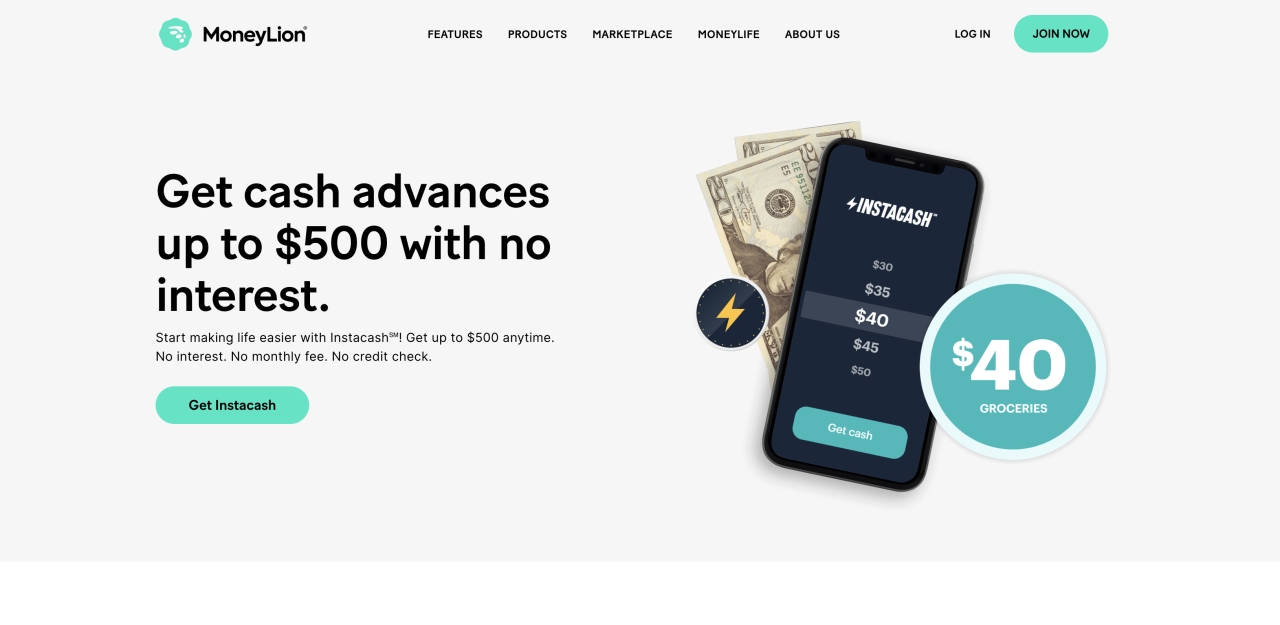

1.

Earnin

4.8

Earnin is an innovative financial app that offers users a modern approach to cash advances by allowing them to access their earned wages before payday, providing flexibility and empowering them to gain control over their financial situation. With Earnin, there are no hidden fees, interest, or credit checks, and borrowing limits are personalized based on a user’s income and work schedule. By utilizing this user-friendly and efficient app, individuals can achieve financial stability and confidently navigate the challenges of daily expenses and unexpected costs. Discover the advantages of Earnin and experience a new level of financial freedom.

Pros

- No fees or interest charges: Earnin is a salary advance app that doesn’t charge fees or interests on your advances.

- Quick and easy access to paycheck: You can access up to $100 per day or $500 per pay period in advance and the money usually gets deposited into your account within a day.

Cons

- Not available for all users: Earnin is only available to employees of companies that use time-tracking and payroll systems. This means that some users may not be able to access the app.

- Limits on advance amounts: The $100 per day and $500 per pay period limits may not be enough for some users who need more funds.

Conclusion: Earnin can be a valuable tool for those who need quick access to their paycheck without incurring fees or interests. However, not all users may be able to use the app, and the advance limits may not be sufficient for all users’ needs.

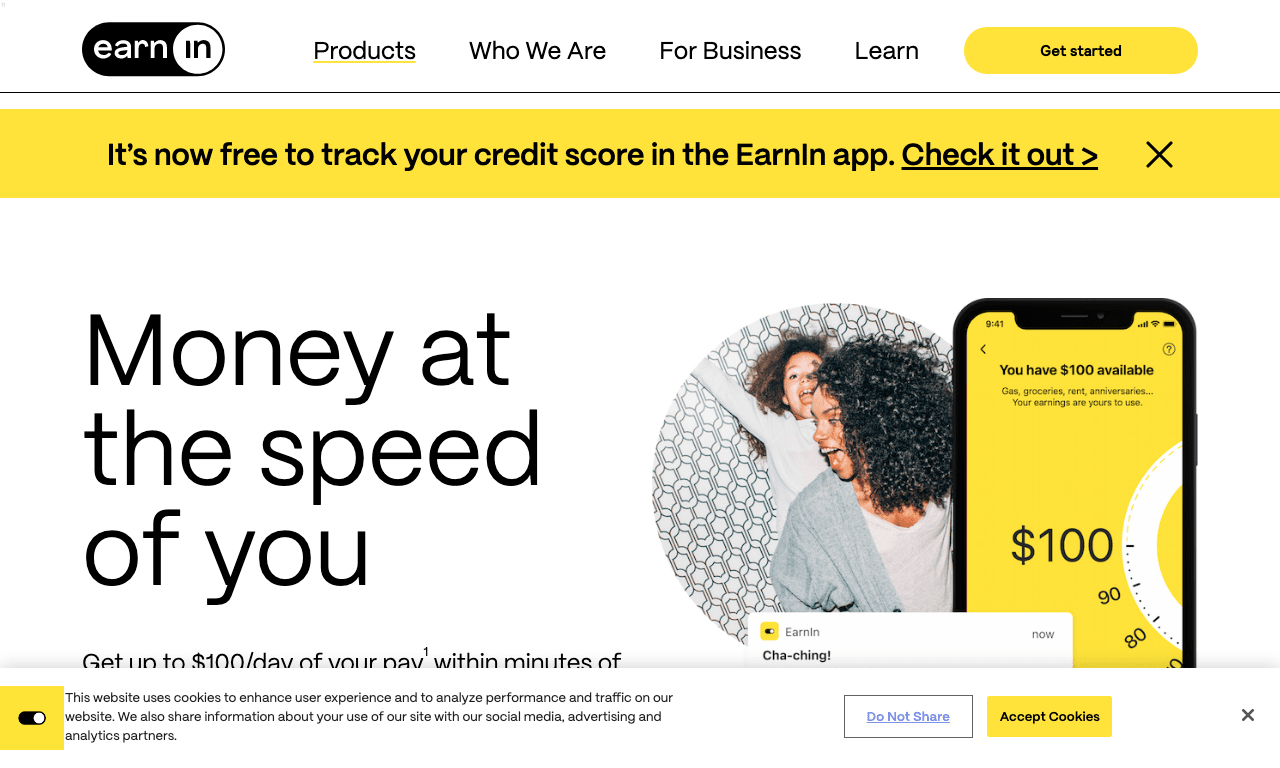

2.

Chime

4.5

Chime is a comprehensive mobile banking app that revolutionizes the way users manage their finances. With innovative features such as automatic savings and fee-free services, Chime simplifies everyday banking tasks and empowers individuals to take charge of their money. Stay connected with real-time transaction alerts, experience seamless access to essential account information, and enjoy the convenience of a user-friendly platform. Explore how Chime’s commitment to transparency, efficiency, and security is transforming the digital banking landscape.

Pros

- Chime offers a fee-free online checking account with no overdraft fees, making it a great option for those who want to avoid traditional bank fees.

- The app allows for easy money transfers between contacts and between Chime accounts, making it a convenient way to quickly send and receive money.

Cons

- Chime does not offer physical bank branches, which may be a downside for those who prefer in-person banking.

- While Chime is FDIC-insured, it is not a traditional bank and is not able to offer all of the services that a traditional bank might provide.

Conclusion: Overall, Chime can be a great option for those who want a fee-free online checking account and are comfortable with online banking. However, it may not be the best fit for those who prefer in-person banking or who require more advanced banking services.

3.

Dave

4.2

Dave is a cutting-edge financial app designed to help users monitor their expenses, manage budgets, and avoid overdraft fees. The app offers a range of innovative features, including real-time account balance tracking, predictive AI for expense forecasting, and instant access to cash advances. With a strong focus on financial well-being, Dave also includes personalized financial insights and support from expert advisors. Experience seamless money management and improve financial health with Dave, the ultimate app for smart budgeting and effective expense tracking.

Pros

- Dave provides an easy and straightforward way to access quick cash advances of up to $100 without the need for a credit check.

- Dave offers a range of budgeting and financial tracking features, including alerts for upcoming bills and expenses, cash flow forecasting, and the ability to create a personalized budget based on spending habits.

Cons

- Dave charges a monthly subscription fee of $1, which may not be cost-effective for users who only need occasional cash advances.

- Dave’s loan terms and interest rates can be confusing, and users may need to carefully read the fine print to fully understand the terms of their loan.

Conclusion: Overall, Dave is a convenient and useful financial app for users looking for quick cash advances and budgeting tools. However, the monthly fee and potentially confusing loan terms may be a downside for some users.

4.

Varo

4.1

Varo is a dynamic mobile banking app that offers a seamless digital experience, allowing users to effortlessly manage their finances. With an extensive range of features such as no-fee checking accounts, high-yield savings accounts, and advanced budgeting tools, Varo caters to the modern individual’s financial needs. Its user-friendly interface and exceptional security measures make Varo a must-have app for streamlined banking and long-term financial success.

Pros

- No monthly fees: Varo doesn’t charge any monthly maintenance fees, unlike many traditional banks.

- High Annual Percentage Yield (APY): Varo offers an APY of up to 2.80% on their savings account, which is much higher than the average rate at most other banks.

Cons

- Limited availability: Varo is only available in certain states, so not everyone can use it.

- No physical branches: Some people may prefer having physical bank branches to walk into for customer service and other banking needs.

Conclusion: Varo is a great option for someone looking for a fee-free banking experience with high interest rates on their savings account. However, it may not be the best fit for someone who prefers having access to physical bank branches or those who live in a state where Varo is not available.

5.

Even

3.9

Even is an innovative app designed to revolutionize the way people manage their finances, offering a comprehensive solution for budgeting, expense tracking, and saving. With its user-friendly interface and advanced algorithms, the app effortlessly helps users gain control over their spending habits while providing a clear and organized view of their financial health. The intuitive features of Even streamline the budgeting process, ensuring a seamless experience for individuals seeking to achieve stress-free and responsible financial management.

Pros

- Even helps users create a budget easily and quickly, with the option to link bank accounts and automatically categorize expenses.

- It also provides a feature to save for specific goals and monitor progress towards them.

Cons

- The app charges a monthly subscription fee, which may not be feasible for some users on a tight budget.

- Users have reported that the app’s customer support can be unresponsive and slow to resolve issues.

Conclusion: Overall, Even offers helpful budgeting tools and goal tracking features, but its subscription fee and potential customer service problems should be taken into consideration.

6.

DailyPay

3.8

DailyPay is a revolutionary app designed to enhance financial flexibility for employees by providing instant access to earned wages. This innovative payroll solution promotes financial well-being and reduces stress for users, as they can easily manage their expenses and budget more effectively. With DailyPay’s seamless integration with payroll systems, businesses can improve employee retention and satisfaction by offering a valuable benefit. Experience the future of payroll with DailyPay – putting financial control back in the hands of the employees.

Pros

- Allows employees to access their earned but unpaid wages before payday, which can provide financial flexibility and reduce the need for high-interest loans or credit cards.

- Integrates with existing payroll systems, making it easy for employers to offer this benefit without disrupting their current workflows.

Cons

- Charges employees a fee for each early payment, which can be costly over time and may create an additional financial burden for workers who are already struggling financially.

- May encourage people to rely on their wages before they actually receive them, which can lead to financial instability and difficulty budgeting.

Conclusion: DailyPay can be a useful tool for employees who need more financial flexibility, but it’s important to weigh the costs and benefits before deciding whether to use it. Employers should also consider the impact of offering this benefit on employee morale and retention, as well as their own administrative costs.

Frequently Asked Questions

What is the best alternative to MoneyLion Instacash for cash advances?

There are several great alternatives such as Earnin, Brigit, Dave, and MoneyLion. Each app has different features and fees, so it’s essential to research and choose the one that best fits your financial needs.

Can I access cash advances from multiple apps simultaneously?

Yes, but it’s crucial to carefully manage your finances and ensure you’re not creating a more significant financial burden on yourself by using multiple cash advance apps.

Are there any fees associated with using cash advance apps?

Some apps, like Earnin, do not charge fees but may accept voluntary tips, while others, such as Brigit and Dave, may charge a monthly subscription fee. It’s essential to understand each app’s fee structure before using it.

How do cash advance app limits work?

Each app sets its own borrowing limits, often based on factors such as your income and work schedule. Ensure you are aware of these limits before relying on the app for financial assistance.

Can cash advance apps affect my credit score?

Generally, these apps do not report to credit bureaus, so they should not impact your credit score. However, it’s essential to manage your finances responsibly and repay any cash advances to avoid potential negative consequences.

Do I need a bank account to use a cash advance app?

Most cash advance apps require you to have a checking account at a compatible bank to access their services. Additionally, some apps require you to link your bank account to monitor your financial activity.

Can I use a cash advance app if I’m self-employed?

Some apps, like Earnin, require users to work for companies that use specific time-tracking and payroll systems. As a result, not all self-employed individuals will be eligible for these services. It’s essential to research each app’s eligibility criteria before using it.

Are cash advance apps secure?

App security can vary, but well-established, reputable apps typically have secure systems in place to protect user data. Always research and read user reviews to ensure the app you choose takes security seriously.

What is the average repayment term for cash advances from these apps?

Repayment terms can vary depending on the app, but generally, users are expected to repay the cash advance by their next payday or within a specified number of days.

Can I use cash advance apps to help build credit?

While some financial management apps, like MoneyLion, offer credit-building services, cash advance apps generally do not report to credit bureaus. As a result, using these apps alone will not help you build credit.

What is the central function of the Moneylion Instacash feature?

The key function of the MoneyLion Instacash feature is to offer its users a short-term solution for unexpected financial emergencies by granting cash advances. Essentially, it’s a financial safety net provided by MoneyLion to its users.

How can I avail the Instacash service by MoneyLion?

To avail of the Instacash service from MoneyLion, you first need to have a MoneyLion account. Then, you’ll have to link your checking account and verify your recurring income to become eligible for the service. This allows MoneyLion to calculate your Instacash advance limit.

Is there any interest or fee involved with the Instacash feature?

One of the notable benefits of Instacash is that it does not charge any interests or require hidden fees for the cash advance, making it a reliable and affordable solution for urgent financial needs.

How can I repay my Instacash advance?

Instacash advances will need to be repaid by the due date you set during the application process. Payment will be automatically withdrawn from the checking account you linked to your MoneyLion account.

What is the usual limit for the Instacash advance?

The default limit for Instacash advances is often $250, but this can vary depending on factors like income and banking behavior.

Can I get an Instacash advance if there is no direct deposit into my MoneyLion account?

Yes. While having direct deposits can increase your Instacash limit, you can still qualify for an Instacash advance if you have a recurring income stream and a linked checking account.

Is there a specific income requirement to qualify for Instacash?

No, there’s no specific income threshold required to qualify for Instacash. As long as you have a recurring income and a linkable checking account, you can apply for an Instacash advance.

How frequent can I request for an Instacash advance?

While there is no specified limit to how many times you can request an Instacash advance, you must repay your previous advance before you can apply for another one.

Can I cancel my Instacash advance after requesting it?

If you’ve made an error or changed your mind, you generally have a short window to cancel your Instacash advance. Should you need to cancel, it’s recommended that you contact MoneyLion’s Customer Service immediately.

Are there any user requirements to use MoneyLion and the Instacash feature?

To use MoneyLion and its Instacash feature, users must be at least 18 years old, and have a checking account in good standing that can be linked to the MoneyLion app. They must also be a U.S. resident with a valid U.S. mailing address.

ping.fm

ping.fm