Discover the Top 9 MoneyLion Alternatives: Best Finance Apps of 2023 for Better Money Management

Are you looking for the perfect financial app to streamline your money management in 2023? Look no further! In this era of digitalization, MoneyLion has proved itself to be a leading player in the world of finance apps. However, it’s always wise to explore other options that may cater to your specific needs even better. That’s why we’ve assembled a comprehensive list of top 10 MoneyLion alternatives that will not only enlighten you with in-depth insights but also help you make smarter financial decisions. Say goodbye to cumbersome financial management and stay ahead of the curve with these robust and future-ready apps designed for the savvy investor in you! Join us as we dive into the world of seamless digital finance and uncover the best alternatives to MoneyLion available in 2023.

1.

Mint

4.8

Mint is an all-in-one personal finance app designed to help users effortlessly manage their money and gain financial insights. With intuitive budgeting tools, real-time expense tracking, and personalized financial advice, Mint simplifies the process of staying on top of your finances. The app securely connects to your financial accounts, providing an overview of your spending, savings goals, credit score, and more, all in one convenient dashboard. Whether you are looking to create a budget, track your bills, or improve your credit score, Mint is the ultimate financial companion to help you stay on track and take control of your financial future. Experience financial freedom and peace of mind with Mint’s powerful features and user-friendly interface.

Pros

- Mint provides a comprehensive overview of your finances, including your bank accounts, credit cards, investments, and bills, all in one place.

- Mint offers personalized budgeting tools and alerts to help you stay on top of your spending and save money.

Cons

- Mint requires access to your financial accounts in order to function, which can be a security risk if your data is not handled properly.

- Mint’s advertisements and promotional offers can be overwhelming and distracting for some users.

Conclusion: Overall, Mint is a useful tool for managing your personal finances, but it’s important to be aware of the potential risks and drawbacks of using the app. As with any financial tool, it’s important to use your own judgment and do your own research before making decisions about how to manage your money.

2.

Personal

4.7

Discover enhanced organization and productivity with Personal App, a cutting-edge solution designed to streamline your daily tasks, events, and goals. With its seamless UX, this app consolidates your essential reminders, calendar events, and personal notes in one spot, allowing for effortless time management. Revolutionize the way you approach personal success with Personal App’s state-of-the-art features and exceptional functionality, ensuring you stay on top of your game in today’s dynamic world. Experience the future of personal organization and revel in the satisfaction of achieving your full potential with Personal App.

Pros

- The Personal application provides a convenient and organized way to track personal information, such as contacts, tasks, and notes.

- The application also allows users to set reminders and notifications to stay on top of important appointments and deadlines.

Cons

- The app may require a significant amount of time and effort to set up initially, as users must input all of their personal data and preferences.

- The app may also be limited in its functionality, as it is primarily designed for personal use and may not be suitable for more complex organizational or professional needs.

Conclusion: Overall, the Personal application can be a useful tool for managing personal information and staying organized. However, users should be aware of the potential limitations and consider whether the app will meet their specific needs before committing to using it.

3.

Acorns

4.5

Acorns is a finance management app that effortlessly assists users in managing their wealth by offering automated micro-investing solutions. The app’s innovative technology facilitates round-up investing, allowing users to invest spare change into diversified portfolios, simplifying the process of long-term savings and investments. Acorns’ intuitive interface and custom investment strategies cater to varying risk tolerances and financial goals, ensuring an accessible and personalized investment experience for all users. In addition to micro-investing, Acorns provides educational resources and expert insights aimed at fostering financial literacy and empowering users to make informed decisions about their finances. With Acorns, harness the power of smart investing to enhance your wealth-building journey and achieve financial wellness.

Pros

- One of the main advantages of using Acorns is that it is very user-friendly and easy to navigate. Even individuals who have never invested before can use the app to start investing their money.

- Another benefit of Acorns is that it offers a wide range of investment options including exchange-traded funds (ETFs) portfolios that are managed by professional investors. This provides users with diversification and reduces overall risk.

Cons

- One disadvantage of Acorns is that it charges a monthly fee which can eat into small accounts. Although the fee is relatively low, it may reduce the overall earnings of an account that has a low balance.

- Another potential disadvantage of Acorns is that the investment returns may not be as high as users can get from other investment platforms since the app is designed to be a micro-investment platform.

Conclusion: Overall, Acorns is a great option for individuals who are new to investing and want a simple and easy way to get started. However, users should be aware of the fees and the relatively low-return rates. It may be worth considering other investment platforms if investing larger sums of money.

4.

Stash

4.3

Stash is an innovative finance management app designed to simplify investing, budgeting, and saving, with user-friendly features that cater to both beginners and experts. Ideal for those seeking to take control of their financial future, Stash offers customized guidance, a diverse range of investment options, and seamless user experience. Explore Stash’s array of tools, including customizable portfolios, automatic savings, educational resources, and robust analytics, for effective and personalized money management. Unlock your financial potential with Stash, the all-in-one finance app trusted by millions.

Pros

- Stash allows users to easily invest in individual stocks and exchange-traded funds (ETFs) with low fees.

- The app offers educational resources and personalized investment recommendations based on users’ risk tolerance and financial goals.

Cons

- Stash charges a monthly fee for its investment services, which may not be cost-effective for users with lower account balances.

- The app’s investment options are limited compared to other investment platforms, which may not suit more advanced investors.

Conclusion: Stash can be a beneficial investment platform for novice investors looking to begin investing in the stock market with personalized guidance and low fees. However, the monthly fee and limited investment options may not appeal to more experienced investors or those with larger account balances.

5.

MoneyLover

4.2

MoneyLover is a comprehensive personal finance management app designed to simplify your budget-tracking experience. Efficiently manage and categorize your income, expenses, and savings with seamless integration of multi-currency and cloud synchronization features. Stay on top of your financial goals with customizable reports, intuitive visualizations, and customizable budget planning tools. Experience financial peace of mind with MoneyLover’s robust security measures and reliable data backup options. Embrace smart money management and achieve long-term financial success with MoneyLover, your all-in-one budgeting solution.

Pros

- MoneyLover app offers a wide range of features, including expense tracking, budget planning, investment tracking, and bill reminders.

- The app has a user-friendly interface that makes it easy to navigate and understand, even for beginners.

Cons

- Some essential features, such as syncing with bank accounts, are only available in the paid version of the app.

- The design of the app can be a bit outdated, making it less appealing to some users.

Conclusion: Overall, MoneyLover is an excellent choice for anyone looking for a comprehensive personal finance app. While some features require a paid subscription, the app’s functionality and ease of use make it worth the investment for those serious about managing their finances.

6.

Wally

4.1

Experience seamless personal finance management with Wally, an innovative and feature-rich app tailored to simplify budgeting, expense tracking, and financial planning. Tap into insightful financial overviews and detailed spending analytics to craft a customized spending plan that works for you. With Wally, discover the freedom and confidence that comes with effortlessly balancing your income, expenses, and savings – all in one user-friendly platform. Built for discerning users, Wally prioritizes security and privacy, ensuring your financial data remains protected at all times. Elevate your financial game and redefine your relationship with money using Wally, the ultimate personal finance app.

Pros

- User-friendly interface that makes budget tracking intuitive and easily accessible.

- Wally includes features like automatic categorization and receipt scanning that streamline the expense tracking process.

Cons

- Users have reported occasional bugs and glitches, particularly with syncing data across different devices.

- Wally’s free version has some limitations compared to its paid subscription, such as only being able to track one budget at a time.

Conclusion: Overall, Wally is a great option for individuals looking to track their spending and stay on top of their finances. While it may not be perfect for everyone, the app’s intuitive design and helpful features make it a strong contender in the budgeting app space.

7.

YNAB

4.0

YNAB, short for You Need A Budget, is a cutting-edge budgeting app that revolutionizes the way users approach personal finance. Designed with user-friendliness in mind, YNAB promotes financial mindfulness by empowering users to allocate funds and track expenses efficiently. Features like real-time syncing with bank accounts, customizable categories, and goal-setting tools make it a compelling choice for individuals and families seeking to achieve financial stability. The intuitive interface and supportive online community further enhance the YNAB experience, making it one of the most popular and trusted budgeting apps available today. Experience financial freedom with the innovative app that puts you in complete control of your budget.

Pros

- YNAB’s budgeting system is based on the principle of giving every dollar a job, which makes it easier for users to prioritize their spending and achieve their financial goals.

- YNAB offers real-time sync of transactions across multiple devices, making it convenient for users to track their spending on-the-go.

Cons

- YNAB requires a monthly subscription fee, which may not be feasible for some users who are looking for a free budgeting app.

- The app’s user interface can be overwhelming for beginners, as it involves a lot of data entry and requires a certain level of financial literacy.

Conclusion: Overall, YNAB is a great option for users who are willing to invest in a budgeting app and have a basic understanding of personal finance. However, those who are looking for a simpler and more intuitive budgeting solution may want to consider other options.

8.

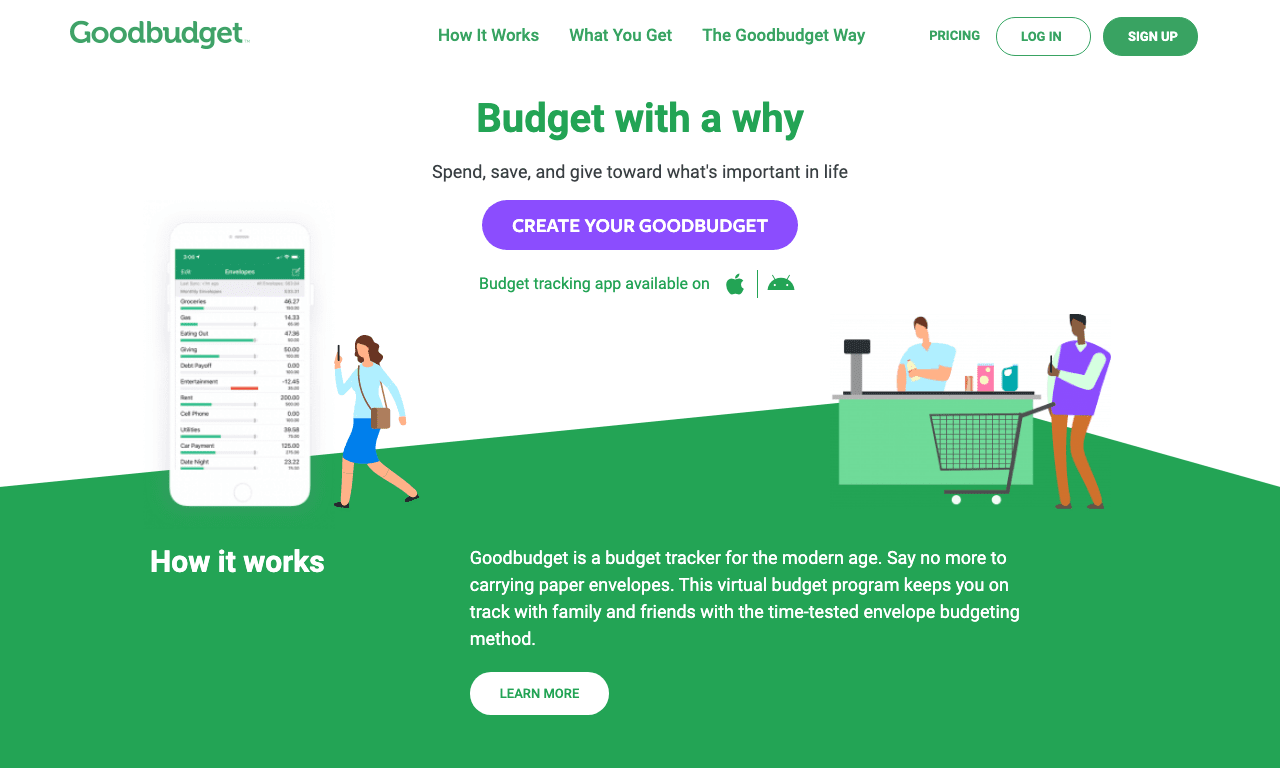

Goodbudget

3.9

Goodbudget: Transform your financial management with this intuitive, user-friendly app designed for individuals and households. Effortlessly track your expenses, set custom budget categories, and visualize your financial progress with easy-to-understand graphs and reports. Experience personalized financial management and watch your savings grow as you achieve your money goals with Goodbudget. Say goodbye to financial stress and hello to financial success!

Pros

- Goodbudget allows users to track their expenses and budgeting in real-time, with a clear overview of their spending categories.

- The app also allows for multiple users to share a budget, making it a great tool for couples or families who want to work together to save money.

Cons

- Goodbudget’s free version only allows for a limited number of expense categories and accounts to be tracked, so some users may find it lacking in features.

- While the app is user-friendly, it can take some time to set up and input all of your expenses.

Conclusion: Overall, Goodbudget is a great option for those looking to get a better handle on their finances and track their expenses. While the free version may not have all the features some users need, the paid version offers a variety of advanced budgeting tools. The ability to have multiple users sharing a budget makes it a great tool for families or couples that are working towards shared financial goals.

9.

Spendee

3.8

Spendee is a cutting-edge personal finance application designed to simplify your money management experience, providing you with advanced tools for budgeting and expense tracking. With its user-friendly interface, customizable categories, and seamless syncing across multiple devices, Spendee allows you to gain control over your finances like never before. Discover unique insights through visual reports that can help you save smarter and spend wisely. Experience financial organization and success with the innovative Spendee app, the perfect solution for all your budgeting needs.

Pros

- Spendee has a user-friendly interface that allows easy tracking of expenses and incomes by connecting to bank accounts or manually inputting data.

- It offers comprehensive reports that provide valuable insights into spending habits and financial trends.

Cons

- The free version of Spendee has limited features and only allows for tracking up to 3 wallets.

- Customer support can be slow and unresponsive at times.

Conclusion: Spendee is a useful app for people who want to better manage their finances and track their expenses. While it has some limitations, the app’s user-friendly design and comprehensive reports make it a valuable tool for budgeting. However, those who need more advanced features or extensive customer support may want to consider alternative options.

Frequently Asked Questions

What are some of the top alternatives to MoneyLion for personal finance management in 2023?

Some of the top alternatives include Mint, Personal App, Acorns, Robinhood, Stash, MoneyLover, Wally, YNAB, Goodbudget, and Spendee.

Can I trust these finance apps with my personal financial data?

Most finance apps prioritize data security and use advanced encryption techniques to protect your information. However, it’s essential to do your own research on each app’s security policies and stick with reputable apps.

Are the alternatives listed free to use?

Some of the alternatives mentioned, such as Mint and Wally, offer free versions with limited features. Others, like YNAB and Goodbudget, require monthly subscriptions for full access. It’s essential to review each app’s pricing model to determine which one best suits your needs and budget.

Are these finance apps suitable for beginners or experienced investors?

These finance apps cater to users with varying experience levels, from beginners who need guidance in budgeting and investing to more experienced investors seeking advanced tools. Review each app’s features and interface to determine the best fit for your level of financial expertise.

Can I use these apps to improve my credit score?

Some apps, like Mint, offer credit score tracking and personalized advice on improving your credit. However, it’s crucial to research each app’s specific features to determine which one best aligns with your credit improvement goals.

Which finance apps are best for investing?

Acorns, Robinhood, and Stash are among the top alternatives to MoneyLion for investing. Each app offers various investment options and features to cater to different preferences and risk tolerances.

Are these finance apps available for both iOS and Android devices?

Yes, the finance apps mentioned in this article are generally available for both iOS and Android devices. However, before committing to any app, it’s crucial to check compatibility with your device.

Can I use these apps for collaborating with my partner or family on budgeting?

Apps like Goodbudget allow multiple users to share a budget, making it an excellent choice for couples or families working towards shared financial goals. Check each app’s features to determine whether it supports collaborative budgeting.

How do these finance apps help with budgeting and expense tracking?

Most finance apps offer features such as customizable expense categories, real-time syncing with bank accounts, and visual reports to aid in effective budgeting and expense tracking. Explore each app’s unique features to determine the best fit for your personal finance management needs.

Can these apps help me save money and achieve financial goals?

By providing tools for budgeting, expense tracking, and investing, these finance apps empower users to make informed financial decisions, save money, and work towards their financial goals. Choose the app that best aligns with your individual financial needs and objectives.

What is the purpose of the Moneylion app?

Moneylion is a personal finance app designed to provide simple, accessible financial services for everyone. It encompasses various features such as a zero-fee checking account, high-yield savings account, as well as investment advice, which users can leverage to manage and improve their financial health effectively. It’s like an all-in-one bank right in your pocket.

How can I open an account with Moneylion?

Signing up for a MoneyLion account is quite simple. You just need to download the MoneyLion app from the Google Play Store or Apple App Store, and follow the prompts to create your account. You’ll have to provide some basic information including your email address and social security number for verification purposes.

What are the benefits of MoneyLion Plus membership?

With a MoneyLion Plus membership, users get unlimited access to 0% APR Instacash advances, competitive-rate MoneyLion loans, automated investing, and cashback rewards. Essentially, it gives you a full-package financial solution to ease your day-to-day monetary management.

How does the credit builder loan by Moneylion work?

The credit builder loan is an installment loan aimed at helping you improve your credit. This feature allows you to borrow money while it automatically contributes to your credit report, hence boosting credit when repaid on time. It’s a powerful tool for those needing an assisting hand to build a healthier credit history.

Is the MoneyLion app safe to use?

Yes, the MoneyLion app uses 256-bit SSL encryption and multi-factor authentication to protect your data. It is registered with the Financial Industry Regulatory Authority and the Securities Investor Protection Corporation, thereby substantiating its credibility and security compliances.

Can I get a loan from MoneyLion without a Plus membership?

Absolutely, MoneyLion does offer loan features to non-Plus members as well. You might be eligible for a loan as a regular user, but the terms can vary and might not be as favorable compared to those granted for Plus members.

Does MoneyLion report to credit bureaus?

Indeed, MoneyLion reports to all three major credit bureaus – Experian, Equifax, and TransUnion. Therefore, timely repayments of the Credit Builder Loan can assist you in enhancing your credit score effectively.

What is Instacash with banking on the Moneylion app?

Instacash with banking is a feature that allows you to access a 0% APR cash advance on your upcoming paycheck. This feature facilitates getting additional funds when needed, without incurring any conventional hefty payday loan charges.

Are there any fees associated with using the Moneylion app?

The basic MoneyLion account is free, but for premium services like MoneyLion Plus, there is a monthly fee. However, there are no overdraft fees, minimum balance fees, or transfer fees, thus presenting a pretty accessible and user-friendly banking experience.

Can I deposit checks with the Moneylion app?

Yes, the MoneyLion app provides the feature of mobile check deposit, where you can deposit checks directly from your phone by taking a photo of the front and back of your endorsed check. It’s a convenient feature, eliminating the need to visit a bank branch for check deposits.

ping.fm

ping.fm