Top 9 Earnin Alternative Apps for 2023: Boost Your Financial Freedom Today!

Are you on the hunt for the ultimate financial empowerment tool? Look no further! In this comprehensive guide, we’ve uncovered the top 10 Earnin alternative apps for 2023 that will redefine your approach to managing your money. As the demand for instant access to funds continues to surge, innovative technology solutions offering rapid financial aid have become increasingly popular.

With a plethora of apps like Earnin popping up in the marketplace, our list of high-performing options will lead you to your perfect match for custom-tailored financial freedom. So dive right in and transform your digital wallet experience today with these top-notch financial apps!

1.

Dave

4.9

Meet Dave, an innovative financial app revolutionizing the way you manage your money. With its intuitive interface, robust budgeting features, and proactive overdraft protection, Dave has become an essential tool for individuals striving for better financial management. Master your finances effortlessly with Dave’s personalized insights, while enjoying quick access to fee-free cash advances and automatic savings for a seamless and stress-free financial experience. Experience the future of personal finance with Dave, your ultimate companion for smart financial planning and optimization.

Pros

- Provides cash advances of up to $100 to help users avoid overdraft fees or make ends meet before their next paycheck

- Offers a low-cost banking account with no minimum balance requirement or monthly fees

Cons

- Requires users to link their bank account, which could raise security concerns for some individuals

- Not available in all states, limiting access for some potential users

Conclusion: Overall, Dave can be a helpful tool for those seeking a low-cost banking option and occasional cash advances. However, some users may be hesitant to link their bank account, and its limited availability could be a drawback for those living outside of the states where it operates.

2.

Brigit

4.8

Brigit is a user-friendly app designed to help busy individuals stay on top of their personal finances. This innovative app offers powerful features such as automatic balance updates, personalized notifications on upcoming bills and potential overdrafts, and access to interest-free cash advances. With its seamless integration with major banks and intuitive interface, Brigit is the perfect financial companion for those looking to manage their money responsibly. Experience a new level of financial control and peace of mind with the Brigit app today.

Pros

- Brigit offers a helpful service by providing cash advances to users who may be experiencing financial difficulty. This can be a much-needed lifeline for those who may not have many other options available to them.

- The app is very easy to use and navigate, with a simple and straightforward interface. This makes it very accessible to a wide range of users, including those who may not be very tech-savvy.

Cons

- Brigit’s fees can be quite high, particularly for users who need to borrow larger amounts of money. This means that some users may end up paying much more than they borrowed, which could exacerbate their financial difficulties in the long run.

- The app may not be suitable for everyone. Users need to have a regular income and a checking account to be eligible for a cash advance, which could exclude some people who may need help the most.

Conclusion: Brigit can be a helpful tool for those who need cash advances in times of financial difficulty. However, it is important to consider the potential costs and eligibility requirements before using this app. It may be useful to explore other options, such as borrowing from family or friends or seeking financial counseling, before relying on a service like Brigit.

3.

MoneyLion

4.7

MoneyLion is the comprehensive personal finance app designed to revolutionize the way you handle your financial life. Offering seamless management of your spending, saving, and investment needs, this top-notch platform boasts state-of-the-art features such as personalized financial advice, credit score monitoring, no-fee banking, and a wide range of investment options tailored to your unique preferences. Embrace a smarter approach to managing your money, and unleash your financial potential with MoneyLion’s innovative and intuitive solutions.

Pros

- MoneyLion offers a free checking account with no overdraft fees, which could save users money in the long run.

- The app also offers personalized financial advice and tools to help users improve their credit score and manage their finances more effectively.

Cons

- Some users have reported issues with customer service, including difficulty getting in touch with representatives and long wait times.

- The app has some limitations, such as not offering joint accounts or the ability to deposit physical checks.

Conclusion: Overall, MoneyLion may be a good option for users who want to improve their financial literacy and track their spending, but may not be the best fit for those who need more traditional banking services or who prioritize strong customer service.

4.Even

4.5

Even is an exceptional app designed to streamline personal finance and budgeting for users, offering unique features and an intuitive interface. With its innovative money management tools, Even enables users to effortlessly track expenses, identify saving opportunities, and make well-informed financial decisions. Leveraging advanced algorithms, the app provides personalized financial insights, empowering individuals to achieve financial stability and meet their long-term financial goals. Discover the benefits of seamless budgeting and financial planning with the groundbreaking Even app.

Pros

- Even helps users with budgeting and managing their finances by tracking their income and expenses.

- The app offers personalized insights based on users’ spending habits to help them identify areas where they can cut back and save money.

Cons

- Even’s subscription model may not be suitable for everyone, as some users may prefer free budgeting tools instead.

- The app’s user interface can be overwhelming for some users, especially those who are not familiar with financial terminology.

Conclusion: Overall, Even can be a useful app for those who need help with budgeting and managing their finances. However, its subscription model and complex user interface may not be ideal for everyone.

5.

Branch

4.4

Discover the power of seamless collaboration and organization with the innovative Branch app. Harnessing advanced features such as real-time messaging, file sharing, and task management, this all-in-one solution is perfect for businesses and teams looking to streamline their workflow and enhance productivity. Explore the potential of personalized channels, intuitive navigation, and data privacy for an unparalleled user experience. Embrace a more efficient future with the game-changing capabilities offered by the Branch app.

Pros

- Branch facilitates collaboration and communication between team members, helping them stay connected and aligned on project work.

- The app enables users to streamline their workflow, reducing inefficiencies and delays while increasing productivity.

Cons

- Branch can be overwhelming for new users, who may find the interface complicated and difficult to navigate.

- The app requires a stable internet connection to function properly, which can be a challenge for remote workers or those with limited connectivity.

Conclusion: Overall, Branch is an effective tool for teams looking to improve their collaboration and workflow. While the app may have a bit of a learning curve, its benefits make it well worth the investment. However, users should be aware of the potential connectivity issues and take steps to mitigate these in order to ensure optimal performance.

6.Chime

4.3

Chime, a user-friendly banking app, is designed to revolutionize the way users manage their finances with a plethora of unique features. Offering seamless integration of banking needs such as online checking and savings accounts, Chime ensures a hassle-free experience devoid of hidden fees or unnecessary charges. The app is well-known for its intuitive dashboard that simplifies budgeting and expense tracking, empowering users to make informed decisions about their financial future. Additionally, Chime is highly regarded for its secure transactions, instant payment notifications, and effective fraud protection measures. With an easily accessible customer support team and availability across multiple platforms, Chime is the ultimate financial tool in the digital age for users seeking convenience and control over their financial endeavors.

Pros

- Chime has no monthly fees and offers free overdraft up to $100, which could be helpful for those on a tighter budget or needing occasional financial assistance

- The app has an automatic savings feature that allows users to round up their purchases and save the difference, helping them easily build up their savings without much effort

Cons

- Chime doesn’t offer as many services as traditional banks, such as joint accounts or small business accounts, which may limit its usefulness for certain customers

- There have been some complaints about Chime’s customer service, with some users experiencing long wait times or difficulty resolving issues

Conclusion: Overall, Chime may be a good option for individuals looking for a fee-free banking option with helpful savings features. However, those in need of more traditional banking services or strong customer support may want to consider other options.

7.

PayActiv

4.2

PayActiv is a revolutionary financial wellness app designed to cater to the diverse needs of modern users, focusing on providing easy access to earned wages, bill payment assistance, and financial management services. This innovative solution is specifically designed for those looking to enhance their financial well-being and unlock the full potential of their hard-earned money. Highlighting crucial app features such as real-time wage access, savings program, and budgeting tools, PayActiv is the ultimate financial ally for those seeking to take control of their finances and achieve their monetary goals. Discover how PayActiv is redefining the way people manage and engage with their finances through its unique and user-friendly platform.

Pros

- Gives employees access to earned wages before payday, reducing financial stress and allowing for better financial planning

- Helps employers to boost employee retention and productivity by offering a valuable benefit

Cons

- Users may become reliant on accessing earned wages early, potentially leading to financial instability if not managed responsibly

- Some employers may be hesitant to implement this type of program due to concerns about administrative and regulatory complications

Conclusion: Overall, PayActiv offers a unique advantage to both employees and employers by providing early access to earned wages and fostering a positive workplace culture. However, it is important to carefully consider the potential drawbacks and limitations of this type of program before deciding to implement it in a given workplace.

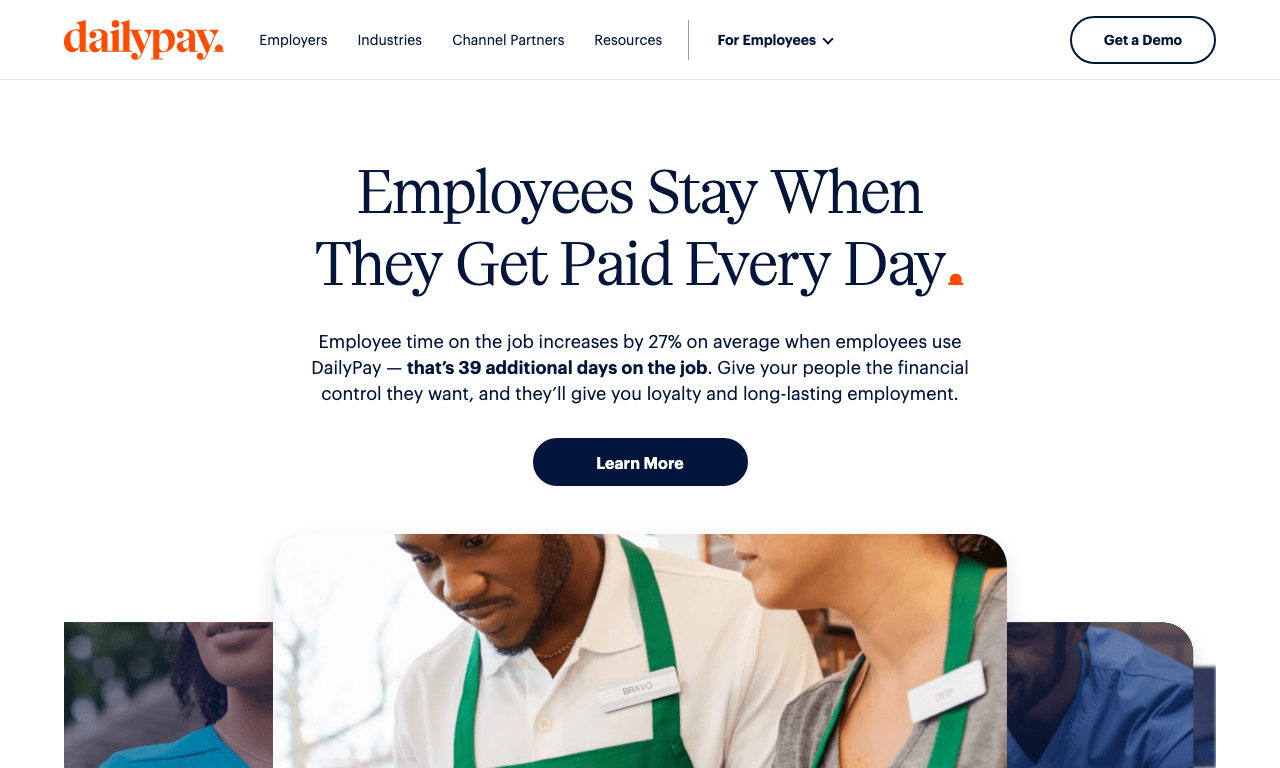

8.DailyPay

4.1

DailyPay is a cutting-edge mobile app that revolutionizes the way you manage your finances, offering unparalleled flexibility and control. Gain instant access to your hard-earned wages with the app’s innovative on-demand pay feature, while enjoying seamless budgeting tools and personalized savings plans. Experience financial freedom and say goodbye to payday stress with DailyPay’s advanced technology, top-notch security, and user-friendly interface. Elevate your financial game today with DailyPay, the ultimate solution for smarter money management.

Pros

- Provides flexibility for employees to access their earned wages before payday, which can help with unexpected expenses or emergencies.

- Can potentially increase employee motivation and satisfaction by improving their financial well-being.

Cons

- May encourage employees to rely on early access to their wages instead of properly budgeting and managing their finances.

- Can be expensive for employers, who may need to pay a fee for each transaction made through the app.

Conclusion: Overall, while DailyPay offers benefits such as increased flexibility and employee satisfaction, it is important to consider the potential downsides and costs before implementing the app in a workplace setting. Employers and employees should carefully weigh the pros and cons and make informed decisions about its use.

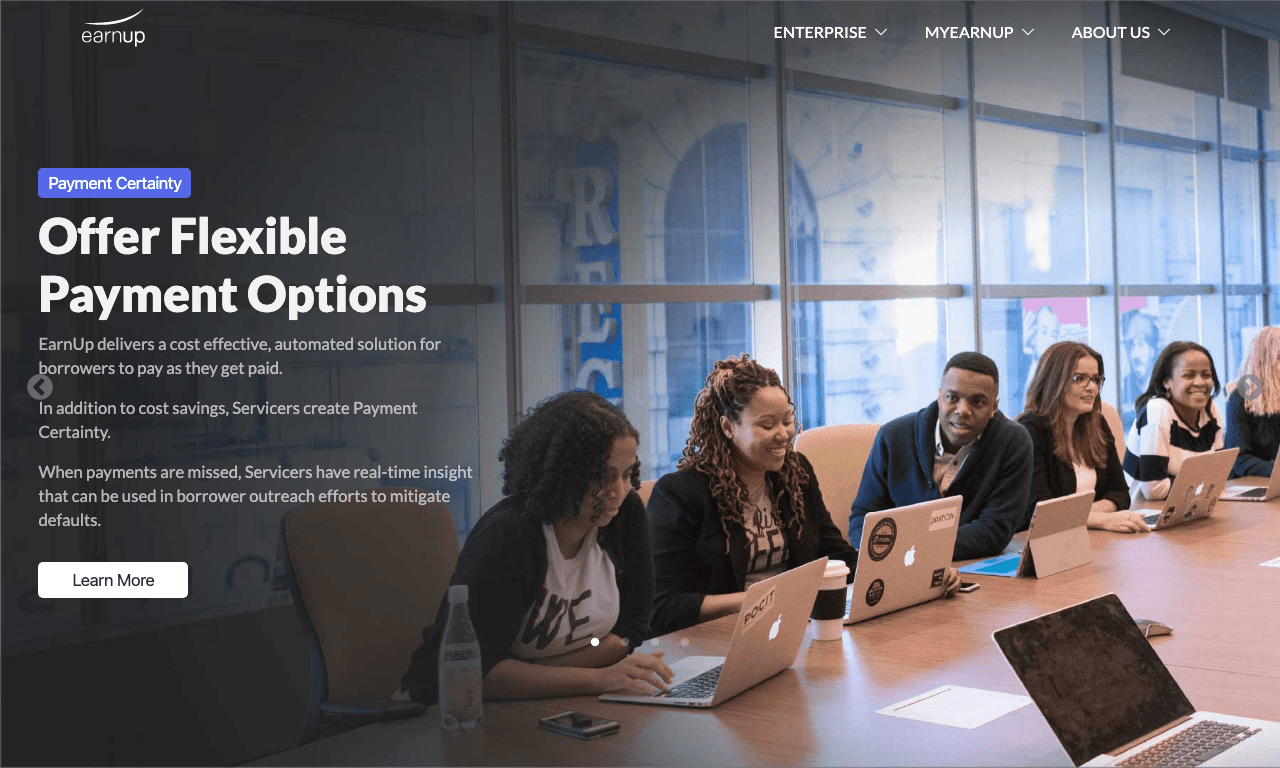

9.

EarnUp

3.9

EarnUp, a powerful financial management app, is designed to revolutionize the way users approach debt repayment. With its state-of-the-art features, EarnUp strategically analyzes income, expenses, and loans to create customized payment plans for faster debt relief. The app offers unparalleled convenience and efficiency by automatically setting aside and allocating funds for loan repayments. Utilize EarnUp for seamless budgeting and a financially secure future as the app expertly tracks loan status, payment history, and progress. Escape the debt cycle with EarnUp, your ultimate partner in mindful money management.

Pros

- EarnUp helps users make consistent and timely payments towards their debts and loans, leading to better financial management and potentially improved credit scores.

- The app offers personalized advice and recommendations based on the user’s financial profile, which can help them save money and make better decisions with their finances.

Cons

- The service requires users to link their bank accounts and provide sensitive financial information, which may not appeal to those who are hesitant to share such data online.

- While the service can help users manage their debts, it does come with a monthly subscription fee, which may not be feasible for those on a tight budget.

Conclusion: EarnUp offers many useful tools for managing debts and loans, and can be especially beneficial for those who struggle with making timely payments or keeping track of their finances. However, users should carefully consider the costs and privacy implications associated with the service before signing up.

Frequently Asked Questions

What are the top 10 Earnin alternative apps for 2023?

The top 10 Earnin alternative apps for 2023 are Dave, Brigit, MoneyLion, Even, Branch, Chime, PayActiv, DailyPay, FlexWage, and EarnUp.

Are these apps like Earnin safe to use?

These apps generally prioritize user safety and security; however, sharing sensitive financial information does come with risks. Users should carefully research each app and check user reviews before linking their bank accounts or sharing personal data.

Are there any fees associated with using these apps?

Some of these Earnin alternatives may charge fees, such as monthly subscriptions or transaction fees. Users should closely review each app’s pricing structure and determine if the potential benefits outweigh the costs.

Do these apps provide access to earned wages before payday?

Some Earnin alternative apps, such as DailyPay, PayActiv, FlexWage, and Brigit, offer access to earned wages before payday, helping users avoid financial stress and improve cash flow.

Are these apps suitable for budgeting and managing finances?

Most of the Earnin alternative apps offer budgeting tools and financial management features to help users gain control over their finances and make informed decisions. However, some apps may be more user-friendly or comprehensive than others, so it’s essential to choose the app that best fits your needs.

Can these apps help improve credit scores?

Some Earnin alternatives, such as MoneyLion and EarnUp, provide tools and personalized financial advice to help users improve their credit scores. By following recommendations, making consistent debt payments, and managing finances more effectively, users may see a positive impact on their credit.

Are these Earnin alternative apps available for both Android and iOS devices?

Most of these financial apps are available on both Android and iOS platforms. Users should check the availability of their chosen app on their device’s respective app store before downloading or signing up.

Is customer support available for these alternative Earnin apps?

Most of these Earnin alternative apps provide customer support in various forms, ranging from in-app support chat, FAQs, or email. However, user experiences with customer support may vary, so it’s worth reading reviews or reaching out directly to the app’s support team with any questions.

Can these apps help users save money?

Many Earnin alternatives assist users in saving money through features such as automatic savings, budgeting tools, and personalized financial advice. By utilizing these features, users may find new ways to save and manage their finances more efficiently.

Do employers need to participate in offering these apps to their employees?

Some apps, such as PayActiv, DailyPay, and FlexWage, require employer participation to offer access to earned wages before payday. Employers should consider the potential benefits and costs of these services and make informed decisions on whether to implement them in their company or organization. Other apps, such as budgeting tools and personal finance management apps, do not require employer participation and can be used individually by employees.

What exactly does the app Earnin do?

Earnin is a financial tool developed to assist users in managing their income more effectively. This app allows employed individuals to access their earned pay before their usual paycheck arrives. To clarify, it’s not a loan service; rather, it provides an advance on wages you’ve already earned, therefore avoiding interest fees.

What kind of fees does Earnin charge?

Interestingly, Earnin does not charge standard fees or interest. Instead, they operate on a voluntary tip system, allowing users to tip whatever amount they believe is fair in appreciation for their service. However, tipping is entirely optional, and users can still use the service at no cost.

What are the eligibility requirements to use Earnin?

There are several requirements for using Earnin: users must be over 18 years old, gainfully employed or receiving direct deposit unemployment benefits, and use a checking account as their primary bank account. Users must also receive at least 50% of their paychecks via direct deposit and maintain a regular pay schedule, such as bi-weekly or monthly.

Is Earnin safe to use?

Yes, Earnin employs bank-level encryption to ensure the security of all user data. In addition, they do not store any personal information, such as usernames or passwords. So you can rest assured knowing your information is safe and secure when utilizing the Earnin app.

Does every bank cooperate with Earnin?

No, not every bank is compatible with the Earnin service. However, most US banks have been officially partnered with the Earnin app, allowing workers from various institutions to access their earned wages before their scheduled payday. You can verify if your bank is among the eligible financial institutions on the Earnin website.

Does Earnin support any other types of income other than direct deposit from employment?

Yes, in addition to standard employment income, Earnin also supports users receiving direct deposit unemployment benefits. However, the app currently does not support other income types such as contract work, or income from self-employment.

How do I repay the Earnin cash advance?

The repayment of your cash advance from Earnin is automated. When your next paycheck is deposited into your bank account, Earnin will automatically withdraw the amount you advanced. There’s no need for manual repayment or worrying about missing a due date.

Is there a limit to the amount I can borrow from Earnin?

Yes, Earnin imposes borrowing limits as a measure of responsible lending. The borrowing limit is set between $100 and $500 per pay period, depending on the user’s spending habits, earnings, and usage of the app. Requirements ensure that users borrow within their means and facilitate healthy financial practices.

What happens if I don’t have enough money in my account when Earnin tries to withdraw the amount I borrowed?

If you don’t have sufficient funds in your account at the time of the scheduled withdrawal, Earnin will reattempt the process up to three times. If the repayment still fails, Earnin may pause your ability to cash out until the outstanding balance is settled. The app does not charge overdraft fees.

Can I access Earnin’s services if I am not in the United States?

Currently, Earnin’s services are only available to individuals with a US-based bank account. Their services are not yet accessible to those living and earning wages outside of the United States.

ping.fm

ping.fm