Top 7 Quadpay Alternatives in 2023: Buy Now, Pay Later App Showdown

Are you looking for the best buy now, pay later apps to revolutionize your shopping experience in 2023? Look no further! In this article, we uncover the top 10 Quadpay alternatives to enhance your purchasing power and introduce more flexibility in your financial decisions. With the ongoing shift towards a cashless society, these apps are perfect for breaking down big-ticket items into manageable installments, making them must-haves in your digital wallet. So buckle up as we dive into the world of convenient and budget-friendly payment options that might just transform the way you shop!

1.

Affirm

4.7

“Affirm” is a revolutionary financial app designed to provide users with a streamlined, hassle-free experience for making purchases and managing their expenses. Offering transparent, customizable payment plans and competitive rates, this innovative app is reshaping modern personal finance by prioritizing user convenience, financial flexibility, and trustworthiness. With Affirm, experience a revolution in the world of online payments, empowering smart financial decision-making for a better tomorrow.

Pros

- Affirm offers a transparent and flexible financing option for online purchases, allowing customers to split payments over time and easily see the interest rates and fees involved.

- The application process for Affirm is generally quick and easy, and customers can get approved for financing without affecting their credit scores.

Cons

- Some customers may not qualify for financing through Affirm, either due to creditworthiness or other factors, limiting its usefulness as a payment option.

- Affirm’s interest rates can be relatively high compared to other financing options, leading to higher overall costs for customers who use it.

Conclusion: Overall, Affirm can be a useful tool for customers seeking flexible financing options, but it may not be the best fit for everyone’s needs. Its transparency and ease of use are key advantages, but customers should carefully consider the interest rates and fees involved before deciding to use it.

2.

Sezzle

4.5

Sezzle is a cutting-edge app designed to revolutionize the way consumers approach online shopping, offering a seamless and stress-free payment method. With its innovative Buy Now, Pay Later system, Sezzle empowers customers to break down purchases into four equal, interest-free installments, promoting financial responsibility while enhancing the overall shopping experience. As a transparent, user-friendly platform, Sezzle is quickly becoming a popular choice for savvy shoppers seeking flexible payment options and effortless budget management. Experience the freedom to buy what you want when you want with Sezzle, transforming the e-commerce landscape one purchase at a time.

Pros

- Sezzle allows users to pay for purchases in interest-free installments, making it a more affordable option for those who can’t afford to pay the full amount upfront.

- The application has a simple and user-friendly interface, making it easy to navigate and use.

Cons

- Sezzle has a limited number of partner merchants, which may make it difficult to use for those who shop at smaller or less well-known retailers.

- Users who miss a payment may be subject to late fees or penalties, which can be costly and negate the benefits of the interest-free installment option.

Conclusion: Overall, Sezzle can be a useful tool for those looking to make purchases in installments, but it is important to carefully consider the potential downsides before using the application. As with any financial product, it is important to read the fine print and understand the terms and conditions before signing up.

3.

Splitit

4.4

Splitit is a groundbreaking app designed to revolutionize the way consumers manage their payments and purchases. Offering an innovative solution, Splitit enables users to effortlessly divide their payments into interest-free installments by utilizing their existing credit card. Experience the ease of flexible payments, gain improved financial control, and unlock a world of smart shopping—all with the seamless, secure integration offered by Splitit. Empower your purchasing decisions and simplify your spending with this cutting-edge app.

Pros

- Splitit allows users to split the cost of purchases into smaller, interest-free payments, making it easier to manage larger purchases and budgets.

- The application is widely accepted by merchants around the world, allowing users to use it for a variety of different purchases and services.

Cons

- Splitit is not available for all types of purchases, as it is mainly intended for larger purchases rather than everyday expenses.

- Users may need to have a high enough credit limit in order to use Splitit, which could limit access for some users.

Conclusion: Overall, Splitit can be a useful tool for managing larger purchases and budgets, especially if users have a high enough credit limit to be able to use the application. However, it may not be the best choice for everyday expenses or smaller purchases, and could potentially limit access for some users.

4.

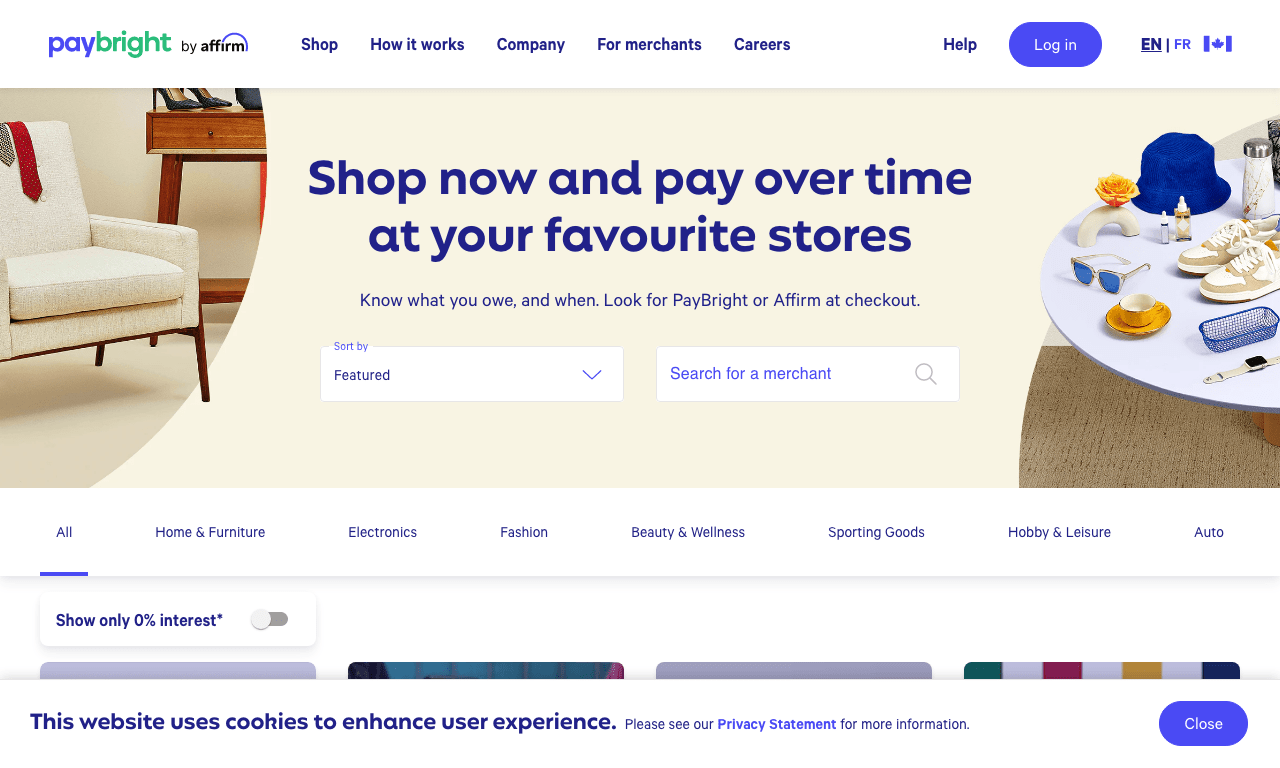

PayBright

4.3

PayBright is a leading financial technology app designed to facilitate swift, secure, and seamless payment solutions for users across various platforms. With its innovative approach, this revolutionary app offers a user-friendly interface, allowing easy integration with multiple online merchants and instant approval for financing plans. Experience unparalleled convenience and flexibility in managing your finances with PayBright’s dynamic features and unleash the potential of smart spending and budgeting today.

Pros

- PayBright allows customers to make purchases that they may not have been able to afford outright, by spreading the cost over several installments that they can choose to pay over time. This can be especially helpful for larger purchases like appliances or electronics.

- PayBright provides a user-friendly platform that is easy to use, with clear instructions and a straightforward signup process. This makes it more accessible to customers who might not be familiar with using financing tools.

Cons

- PayBright charges interest on the amount borrowed, which can make purchases more expensive in the long run. This means that ultimately, customers will pay more than if they had bought the item outright.

- PayBright may not be available for all purchases or retailers, depending on the terms and conditions of the agreement between the financing provider and the retailer. This may limit the usefulness of the platform for some customers.

Conclusion: PayBright can be a useful tool for customers who need to make purchases but can’t afford them outright. However, it’s important to carefully consider the cost of financing and whether it makes financial sense to use it. Additionally, it’s important to ensure that PayBright is available for the specific purchase you want to make before getting too invested in the idea of using it.

5.

Zip

4.2

Discover the innovative features of the Zip app, designed to simplify your life by streamlining various daily tasks. With its user-friendly interface and cutting-edge technology, Zip provides seamless navigation, enabling quick access to essential tools, including file management, seamless integrations, secure data storage, and enhanced collaboration. Experience unparalleled convenience and efficiency with the game-changing Zip app.

Pros

- Zip allows users to compress large files or folders, making them easier to share or store.

- The software is widely used and compatible with most operating systems, making it a versatile tool for sharing and organizing files.

Cons

- Some versions of Zip may be vulnerable to security risks, such as malware or password cracking.

- The compressed files created by Zip may not always be compatible with other compression software, leading to issues when sharing or transferring files.

Conclusion: Overall, Zip is a useful application for compressing and organizing files, but users should exercise caution when using it to protect against potential security risks. It is also important to consider compatibility issues when using the software with other compression tools or sharing files with others.

6.

Zilch

4.0

Zilch is a comprehensive budgeting and finance management app designed to empower users with full control over their financial lives. With an intuitive interface, Zilch offers tools to track expenses, monitor savings goals, and create personalized budgets, making it an essential financial companion for individuals striving for financial success. The app’s smart analytics and insights ensure users stay informed and make sound financial decisions while adhering to their budget. Experience peace of mind and take control of your personal finances with the innovative, user-friendly Zilch app.

Pros

- Zilch allows users to split payments with friends and family easily, which can help eliminate awkwardness or confusion when dealing with money among loved ones.

- The application offers interest-free credit, which can be a helpful alternative to high-interest credit cards for certain individuals.

Cons

- Zilch has a limited user base and may not be widely accepted by all retailers or vendors, which could limit its overall usefulness.

- The application requires users to connect their social media accounts, which could be a privacy concern for some individuals.

Conclusion: Zilch offers a unique approach to money management that could be useful for those who frequently split expenses with others and want an alternative to traditional credit cards. However, potential users should be aware of the application’s limitations and considerations around privacy.

7.

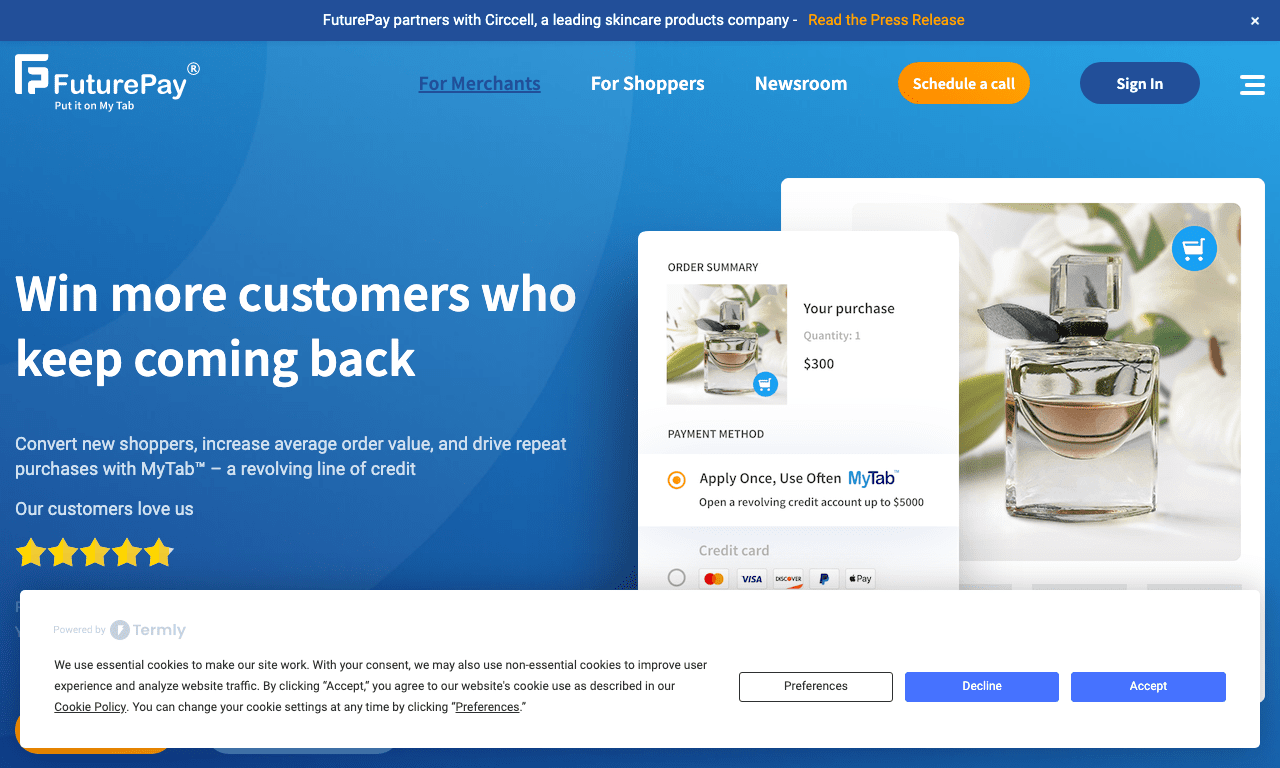

FuturePay

3.9

FuturePay is a cutting-edge app designed to revolutionize the digital payment landscape by offering a secure, efficient, and user-friendly platform. Experience seamless transactions, innovative features, and advanced security measures, all integrated to provide the ultimate payment solution for today’s fast-paced world. Simplify your financial management with FuturePay, the future of online payments.

Pros

- convenient way to shop without immediate payment

- easy and quick application process

Cons

- high interest rates and fees

- may encourage overspending and accumulation of debt

Conclusion: Using FuturePay can be a useful tool for those who want to defer payment and make online shopping more convenient. However, it is important to be aware of the potential downsides such as high interest rates and fees, and to use the app responsibly to avoid accumulating debt.

Frequently Asked Questions

What is a buy now, pay later app?

A buy now, pay later app allows users to make purchases and pay for them in installments over a predetermined period of time. These apps offer increased financial flexibility by allowing customers to spread the cost of an item or service, often without incurring interest charges if payments are made on time.

How do buy now, pay later apps work?

Buy now, pay later apps partner with online merchants to offer flexible payment options at checkout. When making a purchase, users can choose to pay in installments, rather than paying the full amount upfront. The app then divides the total cost into smaller payments, which are due over a specific timeframe, often interest-free if paid on time.

Are buy now, pay later apps safe to use?

Most buy now, pay later apps offer secure payment processing and work with trusted merchants. However, it is essential to research the app’s privacy and security policies and read user reviews before using them. Like any financial tool, users should be cautious when sharing personal and financial information.

Can buy now, pay later apps help improve my credit score?

Some buy now, pay later apps report on-time payments to credit bureaus, which can help improve credit scores. However, late or missed payments can have a negative effect on credit. Users should ensure they are aware of an app’s credit reporting policies and make timely payments to maintain a healthy credit score.

Is there a cost associated with using buy now, pay later apps?

Many buy now, pay later apps offer interest-free installments if payments are made on time. However, some apps charge interest, fees, or late payment penalties. Users should carefully review the terms and conditions of each app to understand any potential costs before using the service.

Are buy now, pay later apps available to everyone?

Eligibility for buy now, pay later apps varies per app and depends on factors such as creditworthiness and financial history. Some apps may not require a credit check, while others may have minimum credit score requirements. Research each app’s eligibility criteria to determine whether it is a suitable option.

Can I use multiple buy now, pay later apps simultaneously?

Users can potentially use multiple buy now, pay later apps, but it is essential to track and manage payments carefully to avoid late fees and damage to one’s credit score. Overusing these services may lead to overspending and difficulty managing finances.

Are buy now, pay later apps only for online shopping?

While many buy now, pay later apps primarily cater to online shopping, some have expanded to offer their services in physical retail stores as well. This availability depends on each app’s partnerships with merchants and can vary.

How do I use a buy now, pay later app at checkout?

During the online checkout process, select the buy now, pay later app as your payment method. The app will usually display the total purchase amount broken down into installments and provide information on payment due dates. Confirm the purchase, and the app will handle the rest, sending reminders when payments are due.

Do buy now, pay later apps have any drawbacks?

While buy now, pay later apps offer financial flexibility, they can also encourage overspending and accumulation of debt if not used responsibly. High interest rates and fees, as well as late payment penalties, can be drawbacks for some users. It is crucial to manage app usage carefully and to prioritize responsible financial decision-making.

What exactly is the app Quadpay?

Quadpay is a mobile app that allows customers to split their purchases into four equal payments over a six-week period with no interest or fees, assuming payments are made on time. The app operates both online and in-store through a digital wallet.

How does the Quadpay app function?

Customers using Quadpay make purchases either online or in-store and then pay for them in four installments over six weeks. The first payment is made at the time of the purchase and the remaining three payments are automatically withdrawn every two weeks. Customers receive reminders prior to each payment to ensure they have adequate funds.

Is there a credit check required to use Quadpay?

Quadpay does not perform hard credit checks on its customers. However, it does perform soft checks, which do not impact a user’s credit score, in order to determine an individual’s eligibility for their service.

Is it possible to manage my Quadpay account from a desktop?

No, at present Quadpay services are only accessible through the mobile app which is available for both iOS and Android devices.

What happens if I miss a payment with Quadpay?

If a customer misses a payment, Quadpay charges a $7 fee on the missed payment. After seven days, if the payment is still not made, an additional $7 fee is incurred. However, customers are notified ahead of time when payments are due to help avoid these fees.

Can Quadpay be used at any store?

Quadpay can be used at any store that accepts Visa cards. In the online checkout, users choose Quadpay as their payment method or they can use the app’s built-in browser to shop. In-store, users present a Quadpay virtual card at checkout.

Are there limits on how much I can spend with Quadpay?

Yes, there are limits. The actual limit is determined on an individual basis and is influenced by a range of factors including the user’s Quadpay history, current order amount, and how long the user has been a Quadpay customer.

Can I imburse an early payment through Quadpay?

Yes, users can pay off their Quadpay balance ahead of the scheduled payment deadlines without penalty.

What if I want to return an item I purchased with Quadpay?

Returns on items purchased with Quadpay are subject to the individual return policy of the store where the purchase was made. Once the return is processed and the refund issued, the refunded amount will be taken off the outstanding Quadpay balance.

Is Quadpay available internationally?

No, currently Quadpay is only available to customers in the United States.

ping.fm

ping.fm