Top 10 Alternative Apps to Possible Finance for Managing Finances in 2023

Are you on the lookout for the best financial management apps that can rival Possible Finance in 2023? Look no further! In today’s fast-paced and digital world, keeping track of your personal finances has never been more essential. With a plethora of options at your fingertips, figuring out the perfect app for your needs can be quite overwhelming. That’s why we’ve put together a comprehensive list of the top 10 alternative apps to Possible Finance, each offering exceptional features and benefits tailored to your financial goals. Say goodbye to financial blind spots and budgeting mishaps as these impressive apps provide you with the ultimate tools for effective money management. Read on and discover the finest apps to conquer your financial game in 2023!

1.

Dave

4.9

Dave is an innovative financial management app designed to help users take control of their finances and avoid overdraft fees. With features such as budgeting tools, income tracking, and predictive account balance forecasting, Dave provides an intuitive platform ideal for both personal and professional use. Experience financial peace of mind and keep your spending in check with this user-friendly, cutting-edge app. Discover the difference Dave can make in your financial wellbeing today.

Pros

- Dave can help users avoid expensive overdraft fees by providing notifications about upcoming transactions and low balances.

- The app also offers an easy way to access paycheck advances, which can be a helpful resource for low-income individuals.

Cons

- While the app is advertised as free, there are fees associated with the paycheck advance feature, which some users might find misleading.

- Some users have reported technical difficulties with the app, including issues with linking their bank accounts and delays in processing transactions.

Conclusion: Overall, while Dave has some useful features, users should be aware of potential drawbacks such as hidden fees and technical issues. It may be worth exploring alternative options for managing finances and avoiding overdraft fees.

2.

Earnin

4.8

Earnin is a revolutionary financial app designed to empower individuals by providing access to their earned wages before payday. With the Earnin app, users can withdraw a portion of their earnings instantly, avoiding hefty overdraft fees and payday loan interest rates. By promoting financial transparency and community-based support through features like Balance Shield and Lightning Speed, Earnin enables users to gain more control over their finances and break free from traditional paycheck-to-paycheck living. Download the Earnin app today for an innovative solution to your financial needs.

Pros

- Earnin offers free access to up to $100 per day of earned wages without charging interest, fees, or hidden costs.

- The app provides a simple, user-friendly interface that makes it easy to track earnings, request pay advances, and receive payments.

Cons

- Earnin requires users to submit a range of personal and sensitive data, including bank account information, Social Security numbers, and employment data, which could raise security and privacy concerns.

- The app’s functionality is limited to employees who receive direct deposits into checking accounts, excluding a significant portion of the workforce that relies on alternative payment methods.

Conclusion: Earnin is a useful app that offers a valuable service for those who need quick access to earned wages without the hassle of payday loans or high-interest credit cards. However, users should weigh the potential risks, such as data breaches and privacy violations, against the benefits of using the app, especially if they are not eligible for its services.

3.

Branch

4.7

Branch is an innovative mobile app designed to streamline and enhance the way users connect, communicate, and collaborate within professional and personal networks. Featuring a dynamic interface and robust functionality, Branch’s all-in-one platform seamlessly integrates messaging, file sharing, and project management tools, enabling efficient knowledge exchange and fostering enhanced productivity. Whether engaging in team discussions, coordinating events, or managing complex projects, Branch is the premier solution for individuals seeking a more cohesive and intuitive networking experience. Discover the power of seamless connectivity and streamline your workflow with Branch today.

Pros

- Allows for real-time team collaboration on tasks and projects.

- Facilitates communication between team members and managers, improving productivity and increasing the likelihood of successful outcomes.

Cons

- Users may experience difficulty navigating the platform, particularly if they are not familiar with similar project management tools.

- Most features require payment for use, which may make it less accessible to smaller businesses or individuals.

Conclusion: Overall, Branch is a useful tool for team collaboration and project management. However, it may not be the most budget-friendly option and may require additional training for less tech-savvy users.

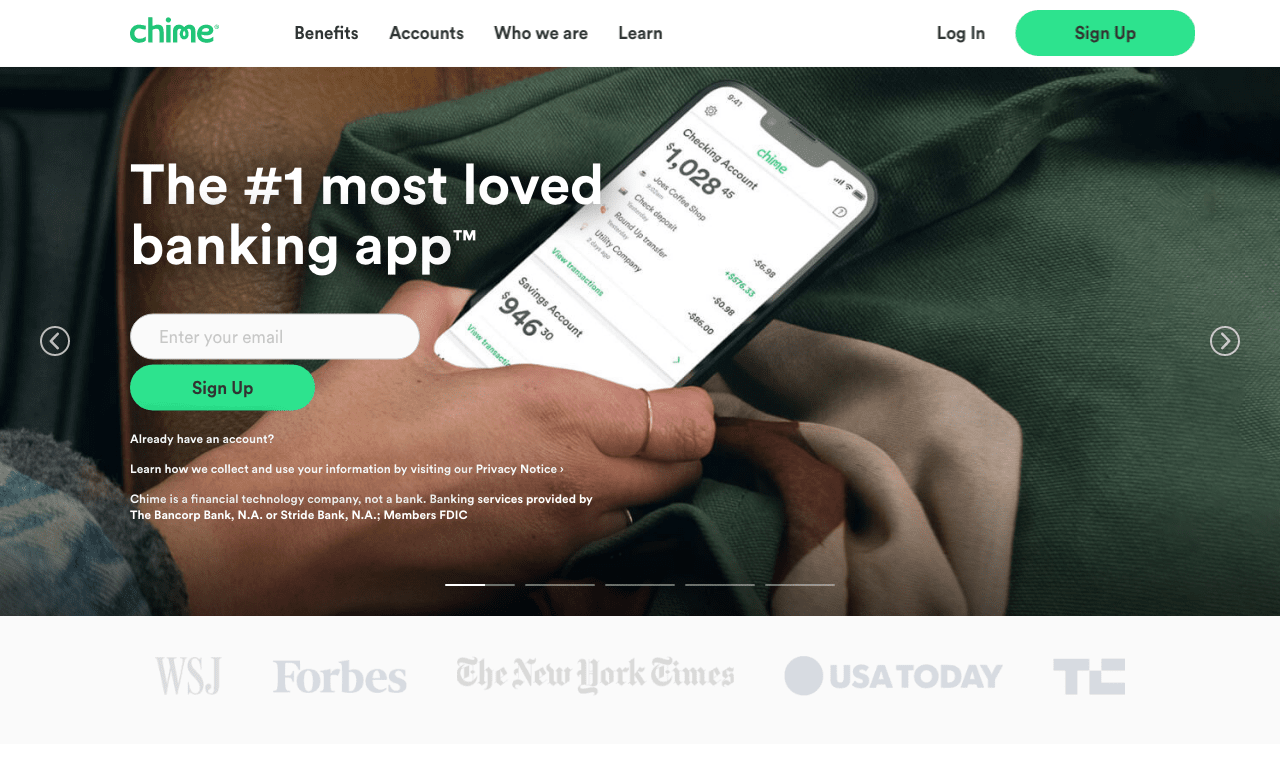

4.

Chime

4.6

Chime is a revolutionary mobile banking app designed to simplify and enhance users’ financial experiences. With features such as instant transaction notifications, automatic savings, fee-free overdraft protection, and user-friendly account management tools, Chime offers a modern approach to personal finance. As a highly rated app, Chime continues to attract users seeking a more convenient, transparent, and hassle-free banking alternative. Discover the benefits of Chime and revolutionize your financial management today.

Pros

- Chime offers fee-free banking services, including no overdraft fees, and no monthly maintenance fees.

- Chime provides early access to direct deposits, allowing users to access their paychecks up to two days earlier than traditional banks.

Cons

- Chime does not have physical branches, which could be a disadvantage for users who prefer face-to-face interactions and access to in-person services.

- Some users have reported issues with customer service and difficulty resolving issues with the app.

Conclusion: Overall, Chime offers a convenient and cost-effective alternative to traditional banking, with the added benefit of early pay access. However, it may not be the best option for users who prefer in-person banking services or require extensive customer support.

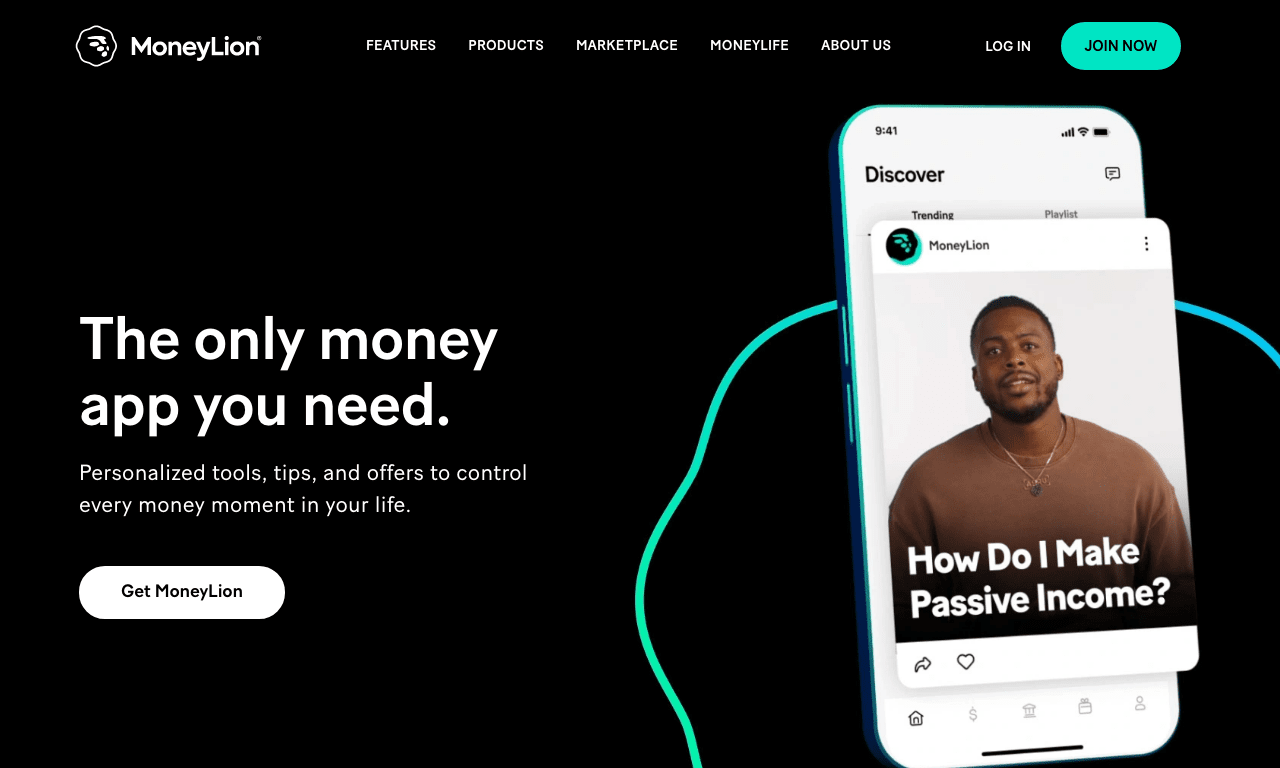

5.

MoneyLion

4.5

MoneyLion is a comprehensive personal finance app designed to empower its users by offering all-inclusive financial solutions, such as credit building, savings, and investment tools, in one convenient platform. With its personalized approach, the app seeks to transform the way individuals navigate their financial journey by offering tailored insights and recommendations. By harnessing the power of data-driven technologies, MoneyLion is democratizing finance for everyone, making financial wellness and smart decision-making more accessible than ever before. Discover the innovative capabilities of MoneyLion and embark on a path towards a healthier financial future.

Pros

- MoneyLion offers a range of financial tools and resources, such as budgeting and credit monitoring, to help users manage their finances effectively.

- The app also provides access to loans and investment opportunities, which can be beneficial for individuals looking to build their credit or grow their wealth.

Cons

- Some users may find the fees associated with certain services, such as loans and investment products, to be higher than what they would pay with other providers.

- The app may not be as user-friendly or intuitive as other personal finance apps on the market, which could make it less appealing to some users.

Conclusion: Overall, MoneyLion can be a useful app for individuals looking to take control of their finances. However, it is important to consider the fees and usability of the app before making a decision to use it as a primary tool for managing your money.

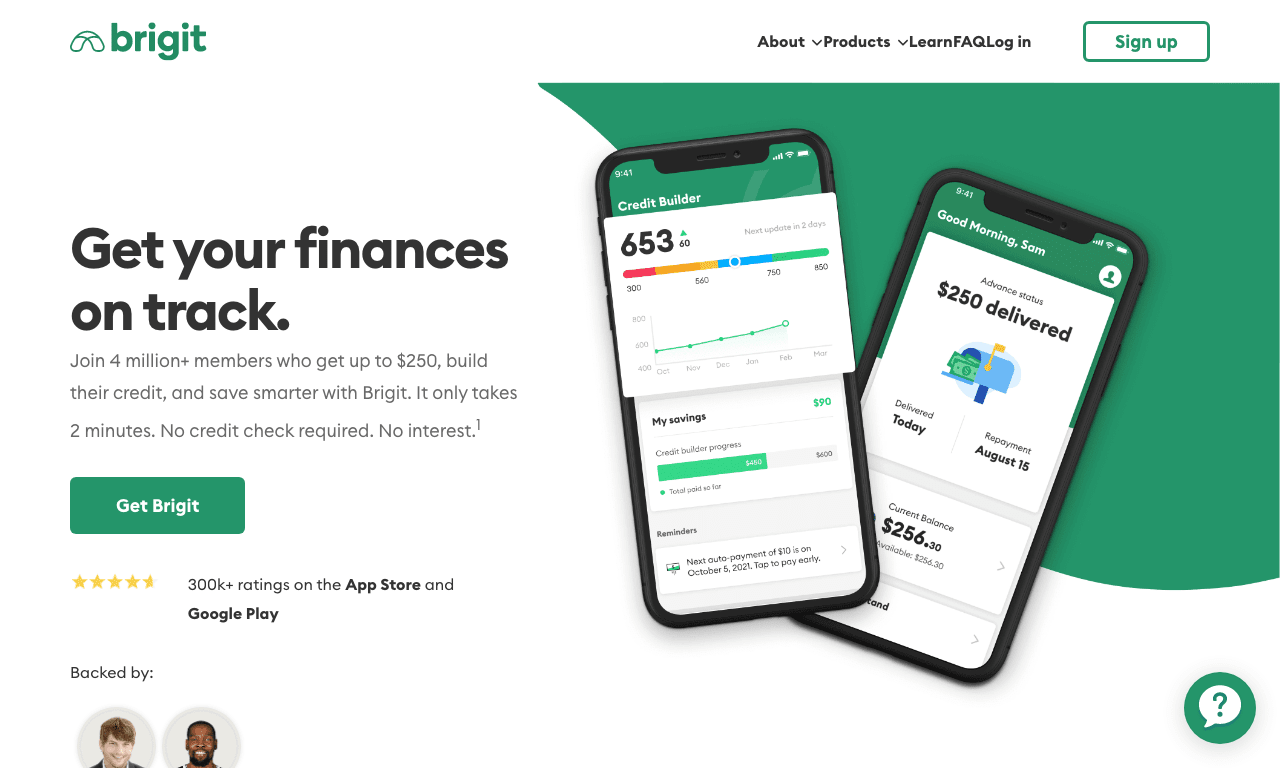

6.

Brigit

4.4

Discover financial freedom and convenience with Brigit, a budgeting and cash advance app designed to empower users by providing transparent, effective, and personalized financial solutions. With advanced features such as instant cash advances, budget tracking, and personalized finance coaching, Brigit aims to alleviate financial stress and simplify money management. The app’s intelligent design and user-friendly interface cater to the needs of a wide range of users, helping them take control of their financial future and make smarter money decisions. Unlock your financial potential with Brigit and start building a solid foundation for a stronger financial future.

Pros

- Brigit offers a great tool for managing finances with a simple and easy-to-use interface.

- The app provides users with helpful financial resources and suggestions, such as offering ways to save money and improve credit scores.

Cons

- Some users may find that the $9.99 monthly fee for Brigit’s premium membership is too expensive.

- The app’s use of automated overdraft protection can result in unexpected withdrawals from a user’s connected checking account.

Conclusion: Overall, Brigit is a helpful financial tool that provides users with useful resources and an easy-to-use interface. However, potential users should be aware of the app’s premium membership fee and use of automated overdraft protection before signing up.

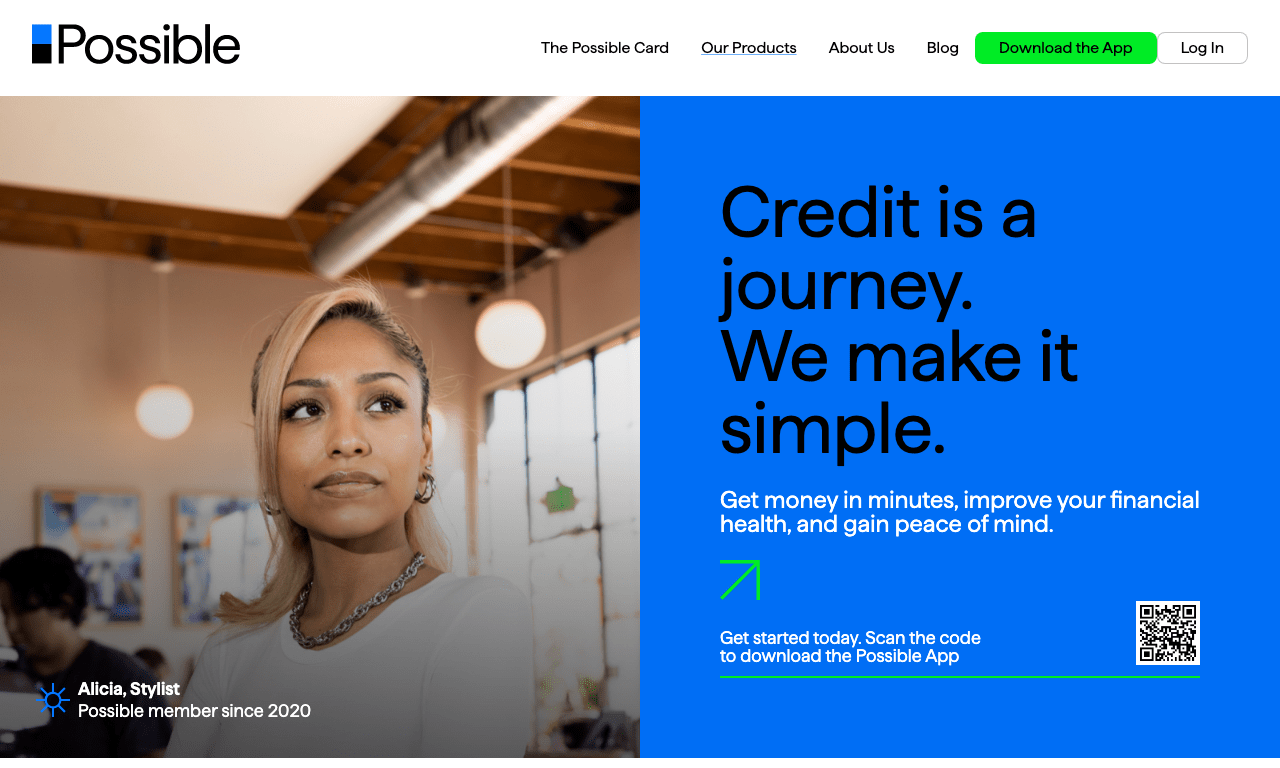

7.

Possible

4.3

Discover the power of Possible, a renowned app designed to streamline your financial management experience. With innovative features and a user-friendly interface, Possible reimagines the way you access loans, monitor credit scores, and navigate finances with ease. Say goodbye to traditional banking hassles and explore the endless possibilities of smart money management at your fingertips. Elevate your financial journey with the revolutionary and reliable app known as Possible.

Pros

- Provides daily motivation and encouragement for self-improvement and goal-setting.

- Offers a variety of tools such as gratitude journaling, habit tracking, and mindfulness exercises.

Cons

- The app has limited customization options for tracking habits and personalizing the experience.

- Some users have reported glitches and technical issues with the app.

Conclusion: Possible is a great application for those seeking to improve their daily habits and mindset. While there are a few drawbacks, the app provides valuable tools and motivation for personal growth and development.

8.

Varo

4.2

Varo, a cutting edge mobile banking app, simplifies personal finance management by offering users a seamless experience to access, control, and optimize their funds. With robust features such as no-fee checking, high-yield savings accounts, and easy money transfers, Varo revolutionizes digital banking by emphasizing financial wellness and convenience. Experience hassle-free personal finance with Varo’s intuitive interface and innovative tools designed to help users achieve better financial outcomes.

Pros

- Varo offers competitive interest rates on savings accounts compared to traditional banks.

- The application provides budgeting tools and spending insights to help users manage their finances better.

Cons

- Varo does not offer physical branches or ATMs, meaning customers cannot deposit cash or withdraw money easily.

- There are some limits on transactions and transfer amounts, which may be inconvenient for customers who need to move larger sums of money.

Conclusion: Overall, Varo can be a great option for those who want to save money and manage their finances effectively through a mobile application. However, it may not be the best fit for those who need access to cash frequently or make large transactions on a regular basis.

9.

Even

4.1

Even is a groundbreaking app designed to empower users in managing and simplifying their financial lives. By seamlessly consolidating budgeting and tracking features, Even ensures users can make informed financial decisions while keeping a close eye on their income and expenses. Its intuitive interface and robust capabilities make it a must-have for anyone seeking improved financial control and stability. This standout app’s innovative features simplify the complexities of finance and help users achieve financial success.

Pros

- Easy to use and navigate, with a clear and intuitive interface.

- Provides a simple way to split expenses and keep everyone on the same page, thereby reducing misunderstandings or conflicts.

Cons

- Limited functionality and features, compared to other similar apps in the market.

- May not be suitable for more complex expense-sharing scenarios, as it lacks robust tools and customization options.

Conclusion: Overall, Even is a decent option for those looking for a basic expense-sharing app. While it may not offer as many advanced features as other apps, it’s easy to understand and use, making it an accessible choice for many. However, for those with more complex needs, it may be worth exploring other options that offer greater customization and flexibility.

10.

Stash

4.0

Stash is an innovative mobile app designed to make investing and personal finance more accessible for users of all skill levels. With its user-friendly interface and extensive learning resources, Stash aims to simplify the investment process and empower individuals to build financial independence. The app offers a diverse range of investment options, including stocks, ETFs, and fractional shares, catering to various risk profiles and financial goals. Additionally, Stash’s financial wellness features, such as budgeting tools and personalized guidance, ensure a holistic approach to personal finance management and investment strategy. Explore the benefits of Stash to revolutionize your financial journey.

Pros

- Easy to use interface

- Offers educational resources to help users make informed investment decisions

Cons

- Limited investment options compared to other platforms

- Fees can be higher for small account balances

Conclusion: Overall, Stash can be a good option for beginner investors who want a user-friendly platform with educational resources. However, more experienced investors may find the investment options and fees to be too limiting.

Frequently Asked Questions

What is the best alternative to Possible Finance for managing finances in 2023?

The top alternative apps to Possible Finance in 2023 include Dave, Earnin, Branch, Chime, MoneyLion, Brigit, Possible, Varo, Even, and Stash.

How can alternative finance apps help me avoid overdraft fees?

Apps like Dave and Brigit provide notifications about upcoming transactions and low balances, helping users prevent costly overdraft fees.

Is it possible to access paycheck advances through financial management apps?

Yes, apps like Earnin and Chime offer features allowing users to access their paychecks early or get paycheck advances.

Do any of the apps offer free banking services without hidden fees?

Chime is known for providing fee-free banking services, such as no overdraft fees and no monthly maintenance fees.

Which alternative financial management app offers the most comprehensive features?

MoneyLion offers a wide range of financial tools, including budgeting, credit monitoring, loans, and investment opportunities for users to better manage their finances.

Are any of these apps suitable for team collaboration and project management?

Branch is specifically designed for team collaboration and project management, incorporating features such as messaging, file sharing, and task coordination.

Can I invest through any of these financial management apps?

Stash is a popular app for novice investors, offering a user-friendly platform and educational resources on stocks, ETFs, and fractional shares.

Which app is best for budgeting and tracking expenses?

Even is known for its easy-to-use interface and clear expense tracking features that allow users to manage their finances effectively.

Are there alternative finance apps that focus on financial wellness and convenience?

Varo emphasizes financial wellness and convenience by offering features like no-fee checking, high-yield savings accounts, and easy money transfers.

Can any of the alternative apps offer personalized guidance for my personal finance management?

Stash and MoneyLion provide personalized financial guidance and recommendations, helping users make informed decisions and achieve financial success.

What is the main function of Possible Finance?

Possible Finance is an online platform that provides its users with short-term, small-dollar loans. It’s aimed at assisting people with low credit scores who need quick access to funds. Mainly, it is designed to help people manage their budgets, improve their credit scores, and achieve financial stability.

How does the application process in Possible Finance work?

The application process at Possible Finance is straightforward and entirely online. Prospective borrowers need to download the app, fill out the application form with their personal and financial details, and submit. After the submission, Possible Finance usually takes a few minutes to a couple of hours to review the application and provide a decision.

Does Possible Finance require a credit check during the application process?

Yes, Possible Finance carries out a ‘soft credit check’ that does not impact the applicant’s credit score as part of the application process. This is done to determine the applicant’s creditworthiness and the likelihood of repayment.

Can I build my credit score while using Possible Finance’s services?

Yes, using Possible Finance’s services can help you build credit. The platform reports repayments to two major credit bureaus, so consistent on-time repayments can improve your credit score over time.

How soon can I get the funds once my application is approved?

Once your application is approved, Possible Finance aims to deliver funds as quickly as possible. The majority of users see the funds in their account within 1 business day, but timing can vary depending on your bank’s deposit speed.

What happens if I can’t repay the loan on the due date?

If you find yourself unable to repay the loan on the scheduled due date, Possible Finance offers a deferment feature. Users can request repayment extension through the app, allowing flexibility. However, it’s recommended to get in touch with the Possible Finance support team if borrowers encounter any payment difficulties.

Are there any fees for late payments?

No, one of the many benefits of Possible Finance is that it doesn’t charge any late fees for missed payments. Nevertheless, borrowing responsibly and making timely repayments remains paramount as consistent late payments can negatively affect your credit score.

Is Possible Finance available in all states?

No, Possible Finance currently only operates in certain states. You can check their state licenses page to find out if the service is available in your state.

Is it necessary to have a job to be approved for a loan from Possible Finance?

While it’s not strictly essential to have a traditional job, Possible Finance does require proof of consistent income. The income could come from a regular job or other sources like government benefits or freelance work. The important aspect is showing the ability to repay the loan.

Is the Possible Finance app secure to use?

Yes, the Possible Finance app uses bank-level security measures to ensure customer information is kept secure and protected. Your personal and financial information are encrypted and stored safely according to the highest safety standards.

ping.fm

ping.fm