Discover the Top 9 Deferit Alternatives: Best Budget Apps of 2023 for Seamless Bill Management

Are you searching for the perfect financial companion to keep your bills in check and your budget on track? Look no further than our comprehensive guide to the top 10 Deferit alternatives of 2023! With the ever-growing demand for efficient and user-friendly budget apps, you’re sure to find the ideal solution that caters to your unique needs. In this article, we’ll explore the best bill management apps that rival the popular Deferit platform. From advanced features to seamless user experiences, these top-rated apps will help you stay organized and stress-free in your financial journey. So, let’s dive in and uncover the ultimate financial tools to take control of your expenses and achieve your money goals.

1.

Mint

4.7

Mint is a comprehensive personal finance app designed to help individuals effortlessly manage their financial life. With the ability to sync multiple bank accounts, track expenses, set budgets, and monitor credit scores, Mint offers users an all-in-one platform for efficient financial planning and organization. Through its intuitive interface and powerful analytics, Mint simplifies the process of optimizing one’s financial well-being, making the app an essential resource for money-savvy individuals seeking a streamlined approach to managing their personal finances.

Pros

- Mint is a comprehensive financial management app that consolidates all of your financial accounts, transactions, and data in one place for easy tracking and analysis.

- It offers a range of useful features, such as budget tracking, bill reminders, alerts, and personalized financial insights, that can help you better manage your money and make more informed decisions.

Cons

- Mint asks you to connect your bank account and credit cards to the app, which some users may find intrusive or insecure, even though the app uses bank-level encryption and security protocols to protect your data.

- Mint may overload you with too much information or overwhelm you with ads, offers, or promotions that you don’t want or need, especially if you haven’t customized your settings or preferences.

Conclusion: While Mint can be a helpful tool for managing your finances, it’s important to weigh the pros and cons of using the app and what information you’re comfortable sharing with it. If you’re comfortable with linking your accounts, Mint can provide valuable insights and tools to help you save money and stay on top of your budget. However, if you’re concerned about privacy, security, or customization, there are other apps or methods you can try to manage your finances.

2.

PocketGuard

4.5

PocketGuard is a feature-rich personal finance app designed to simplify money management and budgeting. Ideal for tracking expenses, identifying bill patterns, and monitoring account balances, the intuitive app provides insightful financial analysis and assists users in optimizing their spending habits. Stay in control of your finances and achieve financial freedom with this reliable and user-friendly tool.

Pros

- PocketGuard offers an easy-to-use interface that allows users to quickly and easily track their expenses and see where their money is going.

- The app also offers personalized insights and advice, which can help users improve their finances and build better spending habits.

Cons

- PocketGuard’s budgeting feature may be limited for some users, as it does not allow for manual entry of expenses or the ability to set custom categories.

- The app requires access to users’ banking information, which may raise concerns about privacy and security.

Conclusion: Overall, PocketGuard is a useful financial management tool that can benefit users who want to track their spending and improve their finances. However, users should be aware of the limitations of the budgeting feature and consider the potential privacy and security risks before using the app.

3.

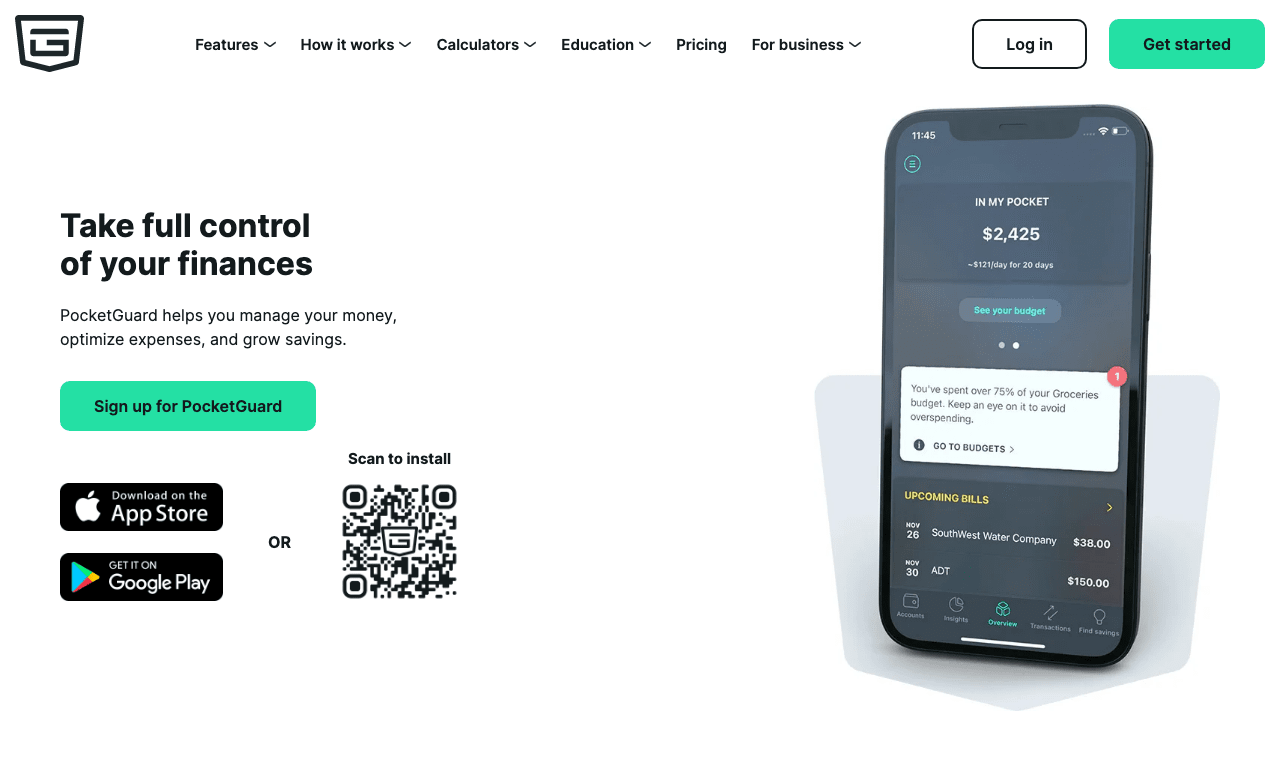

Wally

4.3

Discover the innovative world of Wally, a cutting-edge personal finance app designed to simplify budgeting and expense tracking. With its intuitive interface and advanced features, Wally revolutionizes the way users manage their finances, empowering them to make informed decisions and achieve financial stability. Experience the seamless integration of this all-in-one financial tool, renowned for its user-friendly design, robust analytics, and tailor-made solutions, catering to individuals across a wide range of financial needs. Say hello to smarter money management with Wally by your side.

Pros

- Easy to use interface for tracking expenses and budgeting.

- Ability to scan receipts and input them into the app for easy expense tracking.

Cons

- Limited integration with other financial apps and platforms.

- Lack of customization options for tracking categories or budgeting goals.

Conclusion: While Wally is a user-friendly expense tracking app with some helpful features, it may not be the best fit for everyone’s financial needs.

4.

Clarity

4.1

Clarity is an innovative app designed to streamline and enhance the user experience by simplifying communication and fostering collaboration within teams. With a user-friendly interface, Clarity offers powerful project management tools and seamless integration with popular platforms, ultimately increasing productivity and efficiency in the workplace. Emphasizing both form and function, Clarity provides a top-notch solution for teams looking to transform their workflow and achieve optimal results.

Pros

- Clarity offers a variety of features for project management and team collaboration, including task tracking, time tracking, and project workflows.

- The interface is user-friendly and customizable, allowing users to adjust the layout to suit their needs.

Cons

- While Clarity offers a free trial, the full version can be quite expensive, especially for small businesses or individuals.

- Some users have reported issues with the stability of the software, including crashes and slow performance.

Conclusion: Clarity can be a valuable tool for businesses and teams looking for a comprehensive project management solution. However, the cost and potential stability issues should be taken into consideration before committing to the software.

5.

You

4.0

Discover the innovative “You” app – a cutting-edge platform that offers seamless connectivity and personalized solutions tailored to meet your unique needs. Explore the powerful features that streamline your digital experience, foster productive communication, and enhance your daily activities. Designed with an intuitive interface and state-of-the-art technology, the “You” app is the go-to choice for efficient and seamless digital living. Optimize your lifestyle with this revolutionary app today.

Pros

- The You app allows users to track their daily activities, such as exercise, sleep, and nutrition, which can help them improve their health and well-being. Users can set goals and receive personalized recommendations based on their data, making it easy to stay on track and achieve their desired results.

- The You app offers a user-friendly interface that is easy to navigate and customize. Users can choose from a variety of themes and layouts, and can customize their dashboard to showcase the information they find most relevant. The app also provides helpful tips and tutorials to help users get the most out of their experience.

Cons

- The You app requires users to have a compatible device, such as a Fitbit tracker or Apple Watch, in order to track their activities. This may limit the app’s usefulness for those who do not own one of these devices, or who prefer to use a different type of tracker.

- The You app may be overwhelming for some users, as it provides a large amount of data and information that can be difficult to process and interpret. Some users may find it difficult to keep up with their daily tracking and may become discouraged if they do not see immediate results.

Conclusion: Overall, the You app offers a range of helpful tools and features that can support users in their pursuit of better health and wellness. However, it may not be suitable for everyone, especially those who do not own a compatible device or who find the app overly complex. As with any health and fitness app, it is important to consult with a healthcare provider before making any lifestyle changes or starting a new exercise program.

6.

Personal

3.9

Discover the convenience and efficiency of the Personal app, designed to simplify your life by organizing and securing important information in one easy-to-navigate platform. Experience the seamless integration of essential features that allow users to manage finances, passwords, important documents, and more—all in one place! With the Personal app, enjoy enhanced privacy and security ensuring your valuable data stays protected, elevating your daily digital experience to new heights. Unlock the ultimate in smart organization with the Personal app, the perfect companion for a well-coordinated and secure lifestyle.

Pros

- Helps individuals keep track of their schedules, tasks, and goals in one central place

- Can provide reminders and notifications to help individuals stay on track and manage their time effectively

Cons

- May be difficult for individuals who prefer pen-and-paper or more traditional methods of organization

- Some individuals may find it overwhelming or difficult to navigate the app’s features and settings

Conclusion: Overall, the Personal app can be a useful tool for those looking to improve their organization and productivity. However, it may not be the best fit for everyone, and users should consider their own preferences and needs when deciding whether or not to use the app.

7.

Truebill

3.8

Truebill is a comprehensive financial management app designed to simplify personal finance tracking and budgeting. With its intuitive interface, users can effortlessly monitor their spending habits, analyze subscription costs, and uncover hidden fees. Truebill’s robust features include automatic bill negotiation, custom budget creation, and real-time transaction alerts. This powerful app empowers users to take control of their finances and achieve a more secure financial future.

Pros

- Truebill allows users to easily monitor and manage their subscriptions and recurring payments in one place, helping them to save money and avoid unwanted charges.

- The app’s bill negotiation feature can potentially help users secure lower rates for certain bills, such as cable or internet, which could result in significant savings over time.

Cons

- While the basic version of the app is free, some features, such as bill negotiation and premium support, come at an additional cost.

- The app’s interface can be overwhelming and confusing for some users, particularly those who are not tech-savvy or have limited experience managing their finances online.

Conclusion: Overall, Truebill offers some useful tools and features for anyone looking to take control of their finances and reduce unnecessary spending. However, users should be aware of the app’s limitations and additional costs before signing up.

8.

Prism

3.7

Prism is a groundbreaking financial management app designed to simplify your personal finances, offering a comprehensive solution for tracking, monitoring, and organizing all your bills in one seamless platform. Stay on top of your financial health with real-time updates, customizable budgets, spending insights, and detailed bill due date reminders. Experience peace of mind and take control of your finances with the innovative Prism app.

Pros

- Allows users to aggregate and view all their social media feeds in one place, making it easier to stay on top of their various platforms.

- Provides users with personalized news recommendations based on their interests and reading habits.

Cons

- Has been criticized for potentially enabling government surveillance, as Prism’s parent company Palantir has contracts with various government agencies.

- May expose users to biased or limited news sources, as the app’s algorithms are proprietary and not transparently disclosed.

Conclusion: Prism can be a useful tool for managing social media and keeping up with the news, but users should be aware of potential privacy and information bias concerns before using the app.

9.

Honeydue

3.6

Honeydue is a top-rated finance app designed for couples seeking an effortless way to manage their shared finances. The platform offers a comprehensive suite of tools for tracking expenses, allocating budgets, and monitoring bill payments, all in one user-friendly interface. Prioritize financial wellness and strengthen relationships by effectively communicating about your money goals using Honeydue’s seamless features. Enjoy transparency and simplicity in managing your shared finances with the app that thousands have already welcomed into their financial lives. Experience the benefits of Honeydue and elevate the way you handle money matters as a couple.

Pros

- Honeydue allows couples to easily manage their finances in one place. They can track their bills, accounts, and expenses together.

- The app provides real-time notifications for shared expenses, which reduces the risk of missed payments or overdrafts.

Cons

- There is a lack of customization options for budgeting and categorizing expenses.

- Honeydue only supports a limited number of banks and financial institutions, which may not be convenient for some users.

Conclusion: Overall, Honeydue is a useful application for couples who want to simplify their finances and manage their expenses together. However, the app may not be suitable for everyone, particularly those who require more customization or support for additional financial institutions.

Frequently Asked Questions

How do I choose the best bill management app for my needs?

First, consider the features that are important to you, such as budget tracking, expense categorization, reminder capabilities, and integration with your bank accounts. Next, read reviews and gather insights on the app’s usability, intuitiveness, and overall performance. Finally, test out the app with a free trial or basic version to determine if it meets your expectations and suits your needs.

Are these bill management and budget apps secure?

Most reputable bill management apps use bank-level encryption and security protocols to protect your data. However, it’s essential to read the app’s privacy policy and consider any potential security risks before sharing your banking information.

Can I manage multiple bank accounts and credit cards in one app?

Many of these apps, such as Mint, PocketGuard, and Truebill, allow you to sync multiple bank accounts and credit cards, making it easier to manage your finances in one place. Make sure to check the app’s features to ensure it supports the number of accounts you wish to connect.

Are these apps suitable for couples or joint finances?

Some of these apps, such as Honeydue, are explicitly designed for couples or those who share finances. Other apps may allow you to add multiple users to an account, so it’s crucial to explore each app’s features and capabilities for joint financial management.

Do these bill management apps have a free version?

Many budget and bill management apps offer free versions or trials with limited features. Some apps, such as Albert and Truebill, have additional features available through a premium subscription for an additional cost. Make sure to research the pricing model for each app and consider if the available features align with your financial needs.

How can bill management apps help me save money?

Bill management apps can help you save money by tracking your expenses, identifying unnecessary spending, monitoring subscriptions, and providing personalized financial insights. Some apps offer features like bill negotiation, helping customers secure lower rates on specific bills.

Can these apps be used on both Android and iOS devices?

Most of the top bill management and budgeting apps are available for both Android and iOS devices. Make sure to check each app’s compatibility with your specific device before downloading it.

Are there any apps for tracking cash expenses?

Many budgeting apps, such as Wally, allow you to manually input and track cash expenses to help you keep track of all your spending. Look for apps that support manual transaction input and offer customization options for expense categories.

How do bill management apps help with budgeting?

These apps typically offer features like budget creation, expense categorization, automatic expense tracking, and real-time notifications to help you stay on top of your spending. By monitoring your financial activity over time, these apps can help you better understand your spending habits and identify areas where you may be overspending.

Can these apps improve my credit score?

While using a bill management app can help you stay organized and on top of your finances, it’s important to remember that no single app can directly increase your credit score. However, consistently paying your bills on time, managing your spending, and reducing debt can contribute to an improved credit score over time.

What is the purpose of the Deferit app?

The main objective of the Deferit app is to assist users with managing their bill payments. Users can schedule their bills through the app, and Deferit will pay the bills on time on users’ behalf. The users, in turn, repay Deferit in four equal installments without any interest. It essentially reduces the burden of large, one-time payments.

Does Deferit charge its users any interest?

No, Deferit does not charge any interest on the money it pays for your bills. However, there is a small monthly fee for using the service, which allows you to defer as many bills as you want throughout the month.

Can Deferit help improve my credit score?

Yes, using Deferit could potentially help improve your credit score. By ensuring your bills are paid on time consistently, late payments or defaults are less likely to be reported to credit bureaus, thereby having a positive effect on your credit rating.

Which types of bills can be paid using Deferit?

Deferit allows its users to pay almost all types of bills including utilities like electricity, water, and gas, insurance premiums, telecommunications services, and even rent. However, always check with the service before scheduling a payment to ensure your bill type is supported.

What are the limits to how much I can defer with Deferit?

Users of the Deferit app have a default limit of $500, which can be increased up to $2000 based on their repayment history. The increase in limit is at the sole discretion of Deferit after reviewing the user’s repayment behavior and overall financial situation.

Is Deferit available outside the United States?

Currently, the Deferit service is available in Australia only. Look out for updates on their website or app regarding their expansion to other regions.

How can I contact Deferit’s customer service?

You can get in touch with Deferit’s customer service team either through their mobile app with the in-built chat option, or by sending an email to their official email address mentioned on their website.

Can I cancel a Deferrit payment once it’s been scheduled?

While the Deferit service strives to provide flexibility, once a payment has been initiated and your bill has been paid on your behalf, it cannot be cancelled.

Can I use Deferit if I have a bad credit history?

Yes, even if you have a bad credit history,you might be able to use Deferit. Deferit does not conduct traditional credit checks. Their main concern is your ability to repay the amounts in a timely manner according to your agreement with them.

Does Deferit work with any specific banks?

Deferit can work with any bank account that a user has. Their system of payment collection is not limited to specific banks. As long as you have a valid and active bank account, you can use Deferit’s services.

ping.fm

ping.fm