Top 8 Albert Alternatives: Best Finance Apps to Manage Your Money in 2023

Discover the ultimate list of the Top 10 Albert Alternatives in 2023! With the ever-evolving landscape of personal finance management, finding the perfect app to help simplify your financial life is crucial. If you’re a fan of the popular Albert app but are eager to explore similar budgeting and money management tools, you’ve come to the right place. In this comprehensive guide, we’ve researched and compiled the 10 best finance apps that offer top-notch features, user-friendly interfaces, and outstanding reviews, making them strong contenders to rival the mighty Albert app. Get ready to take control of your finances and achieve your financial goals with these exceptional alternatives. Dive into the world of digital money management and let these finance apps transform the way you save, spend, and invest.

1.

Dave

4.9

Dave is an innovative financial app designed to empower users in managing their finances and achieving monetary stability. With smart budgeting tools, low balance alerts, and hassle-free cash advances, users can bid farewell to overdraft fees and say hello to a seamless banking experience. Harness the power of AI-driven predictions to monitor your expenses, track your spending habits, and gain insights tailored to your financial goals. Access a supportive community and personalized tips for a smarter financial future with the groundbreaking Dave app.

Pros

- Dave’s app provides cash advances of up to $100 at no interest, which is a great option for people who need quick cash but don’t want to pay high fees or interest rates.

- Dave’s app can help users budget and manage their finances by tracking their spending, predicting their upcoming expenses, and offering personalized tips and advice.

Cons

- Dave’s app requires users to link their bank account to the app, which may raise privacy and security concerns for some users.

- Dave’s app charges a subscription fee of $1 a month, which may not be worth it for users who don’t use the cash advance feature frequently or who already have other money management tools.

Conclusion: Overall, Dave’s app can be a useful tool for people who need occasional cash advances and want to stay on top of their finances. However, users should weigh the benefits and drawbacks carefully before deciding whether to use the app and whether to pay the subscription fee.

2.

Mint

4.7

Mint is a leading personal finance app that seamlessly consolidates all your accounts in one user-friendly platform, empowering users to effectively manage their budgets, track spending, and stay financially organized. Using state-of-the-art security, Mint offers real-time insights, personalized financial advice, and customizable features designed to fulfill the unique needs of each individual. Elevate your money management game and achieve your financial goals with Mint, the ultimate solution for all your personal finance needs.

Pros

- Free to use and easily accessible on smartphones and desktops.

- Provides a comprehensive overview of all financial accounts in one place, making it easier to manage finances.

Cons

- The automatic categorization of transactions is not always accurate, requiring manual adjustments.

- The app may sometimes suggest unnecessary or irrelevant financial products or services.

Conclusion: Mint can be a helpful tool for individuals looking to manage their finances in one place, but users should exercise caution when relying on the automatic categorization feature and avoid accepting unnecessary suggestions for financial products or services.

3.

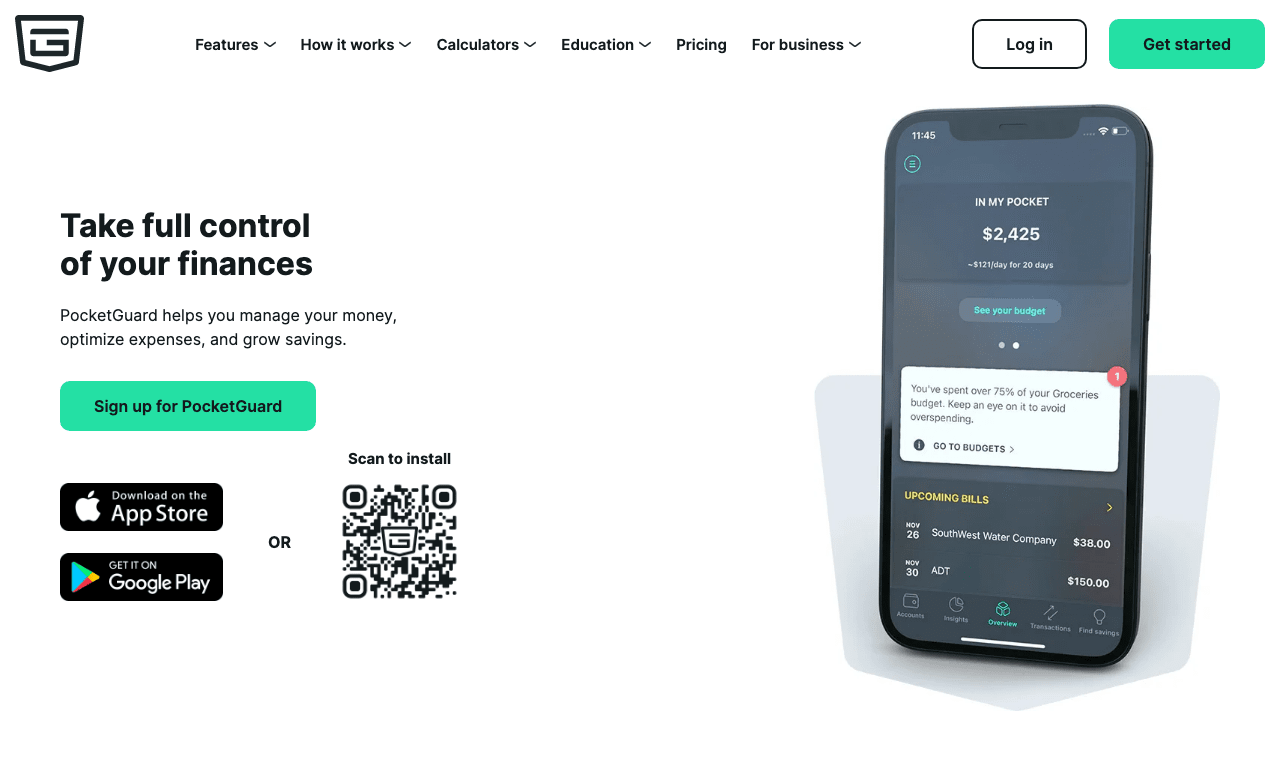

PocketGuard

4.5

PocketGuard is a top-rated personal finance app designed to help users manage their money effortlessly and stay in control of their finances. With features such as budgeting tools, bill reminders, and expense tracking, the app simplifies money management while providing insightful tips to save more and spend wisely. Download the PocketGuard app today to experience a seamless way to manage your financial life and achieve financial peace of mind.

Pros

- Easy to use and intuitive interface

- Provides a comprehensive overview of financial situation

Cons

- Limited customization options

- Some users may prefer more advanced features

Conclusion: PocketGuard is a great option for those who want a simple and easy-to-use financial management tool. While it may lack some of the advanced features of more robust apps, its straightforward approach is perfect for those just starting to take control of their finances.

4.

YNAB

4.4

YNAB, or You Need A Budget, is a powerful personal finance app designed to help users take control of their spending, savings, and debt management. This user-friendly app offers innovative budgeting features, real-time tracking of transactions, and expert advice for effective money management. With its intuitive interface and intelligent planning tools, YNAB empowers users to create a customized financial plan, eliminate debt, and achieve long-term financial goals. Experience a smarter approach to budgeting with YNAB’s versatile and highly acclaimed financial solutions.

Pros

- Easy budget tracking: YNAB makes it simple to track all of your expenses and allows you to quickly identify areas where you can cut back on spending.

- Mobile accessibility: The app is available on both iOS and Android devices, making it convenient for users to access their budgets and track their expenses on the go.

Cons

- Learning curve: The software can be difficult to learn, especially for users who are not familiar with budgeting software.

- Cost: YNAB requires a monthly or annual subscription fee, which can be expensive for some users.

Conclusion: YNAB is a powerful budgeting tool that offers a range of features to help users track their spending, save money, and manage their finances. While the learning curve and subscription fee may be a drawback for some users, those who are willing to invest in the platform will find it to be a valuable resource for achieving their financial goals.

5.

Personal

4.2

Discover the power of a streamlined digital organizer with the “Personal” app – a comprehensive solution designed to effectively manage your everyday tasks and events. Effortlessly track and synchronize your to-do lists, appointments, and reminders, keeping your productivity and time management in perfect harmony. Explore the intuitive interface and customizable features of the “Personal” app, making daily organization a breeze. Maximize your efficiency and revolutionize your daily routine with the “Personal” app – the ultimate tool for optimizing work-life balance.

Pros

- The Personal app allows users to easily manage and organize their daily tasks and schedule in one place, helping them to be more productive and efficient.

- The app includes additional features such as note-taking and goal setting, which can aid in personal development and achievement.

Cons

- The app requires users to input personal information and preferences, which may raise privacy concerns.

- Some users may find the app overwhelming or confusing to navigate, particularly if they are not accustomed to using organizational tools.

Conclusion: Overall, the Personal app offers a range of useful features for anyone looking to manage their time and prioritize their daily tasks. However, users should be aware of potential privacy concerns and may need some time to adjust to using the app effectively.

6.

Clarity

4.1

Discover the dynamic and innovative Clarity app, designed to revolutionize personal finance management. Effortlessly track expenses, create budgets, and gain valuable insights into your financial habits with this user-friendly and highly versatile application. Elevate your money management game with Clarity, and experience the satisfaction of financial freedom and stress-free living. Explore the advantages of Clarity today and unlock the key to taking control of your financial future.

Pros

- Clarity offers real-time tracking of your finances, allowing you to stay on top of your spending and budgeting.

- The app provides personalized insights and recommendations based on your spending habits to help you make better financial decisions.

Cons

- Some users have reported difficulty syncing their accounts with the app, which can lead to inaccurate or incomplete financial data.

- Clarity may not be suitable for users who prefer a more hands-on approach to tracking their finances, as it relies heavily on automation.

Conclusion: Overall, Clarity can be a valuable tool for those seeking to improve their financial literacy and management. However, it may not be the best fit for everyone, and users should be aware of its limitations and potential drawbacks before committing to using the app.

7.

Goodbudget

4.0

Goodbudget is an intuitive app designed to simplify your financial management experience by employing the envelope budgeting method. With features such as seamless expense tracking, insightful reports, and the ability to sync across devices, this app offers users a comprehensive solution to manage their finances effectively. Enhance your budgeting skills, achieve your financial goals, and gain peace of mind with the easy-to-use and efficient Goodbudget app.

Pros

- Goodbudget allows you to set up and track budget categories easily, making it simple to see where your money is going.

- It also syncs across multiple devices, making it easy to access and update your budget at any time.

Cons

- The free version of Goodbudget has limited features and only allows for 10 budget categories.

- It requires a lot of manual entry, which may be tedious for some users.

Conclusion: Overall, Goodbudget is a great budgeting app for those who want a simple and user-friendly way to track their spending. While the free version may not have all the features you need, the paid version offers more robust functionality that may be worth the investment.

8.

Qapital

3.8

Qapital, an innovative personal finance app, helps users conveniently and efficiently manage their finances. Designed with a customer-centric approach, Qapital simplifies budgeting, goal-setting, and tracking of expenses, ensuring a seamless experience in achieving financial goals. By using AI-driven algorithms, this intuitive app takes the hassle out of saving, investing, and planning, making it a preferred choice for individuals looking to enhance their financial literacy and maintain financial stability in their lives. With robust features, user-friendly interface, and secure banking, Qapital is the ultimate tool for improving financial health.

Pros

- Easy to use and navigate

- Customizable savings goals and rules

Cons

- Some features require a paid subscription

- Limited investment options

Conclusion: Qapital is a solid app for helping users save money in a personalized way, but those looking for extensive investment options may need to look elsewhere. The paid subscription may also be a deterrent for some users.

Frequently Asked Questions

What is the Albert app, and why might someone want to know about its alternatives?

The Albert app is a popular personal finance management tool that helps users budget, save, invest, and manage their financial lives. People might be interested in alternatives if they’re seeking different tools, additional features, price options, or interface experiences to enhance their money management.

Are all Albert alternatives free to use?

Not all Albert alternatives are free to use. Some apps have a basic free version with limited features, while others may charge monthly or annual subscription fees to access advanced features, such as syncing abilities or specialized budgeting methods.

Which finance app is the best for budgeting?

Different budgeting apps cater to specific needs. YNAB (You Need A Budget) and Goodbudget are well-known apps that focus primarily on budgeting, but other tools like Mint and Clarity also offer comprehensive budgeting and tracking features.

How secure are these money management apps?

Most finance apps prioritize security, using encryption and strong authentication methods to protect users’ data. However, it is important to read each app’s privacy policy and take note of the security measures they implement.

Can these apps help me with debt management?

Some Albert alternatives, such as YNAB and Mvelopes, offer integrated debt management features that help users create debt payoff plans and track their progress.

Which app is best for couples managing joint finances?

Honeyfi is specifically designed for couples to manage their joint expenses, budgets, and savings goals, making it an ideal choice for those in partnerships.

Which finance app can fulfill multiple financial management needs?

Mint is a popular personal finance app that consolidates all your financial accounts, helping users track spending, budget and manage their finances in one platform.

Do these apps require linking bank accounts and other financial information?

Most personal finance apps require users to sync their bank accounts, credit cards, and other financial data for comprehensive tracking and management features. Users should review each app’s privacy and security policies to address any concerns.

Are all these finance apps available for both Android and iOS devices?

Most of the listed finance apps have versions available for both Android and iOS devices, ensuring compatibility with various smartphones and tablets.

Can these apps help me save and invest money as well as manage my budget?

Some apps, such as Qapital, focus on helping users save money and even invest in a limited capacity. Other apps like Dave and Mint provide personalized financial advice, helping users identify areas for saving and investment.

What kind of educational topics does Albert cover?

Albert covers a broad range of educational topics. These include, but are not limited to, Advanced Placement subjects, SAT and ACT test preparation, Common Core aligned subjects for middle and high school, and even specific topics for college readiness and beyond. These range from mathematics to science, English and history, among other subjects.

How does Albert help in SAT and ACT preparation?

Albert provides dedicated practice modules for both the SAT and ACT. These modules contain numerous practice questions that simulate the actual tests. This enables students to familiarize themselves with the format and types of questions they will encounter. Additionally, Albert gives instant feedback and detailed explanations to help students understand their mistakes and improve their skills more effectively.

What features does Albert provide for teachers?

Albert offers numerous features to make teaching more effective and efficient. Teachers can assign tasks to students, track progress in real-time, and analyze performance through comprehensive reports. Furthermore, teachers can integrate Albert with their existing learning management systems, making it a versatile educational tool.

How does Albert support student learning?

Albert supports student learning in various ways. It allows students to practice skills at their own pace, providing immediate feedback and explanation for questions. This self-paced learning enables students to understand their strengths and weaknesses, and focus on areas that need improvement. Albert also presents learning content in an engaging and interactive way to enhance student motivation and actively involve them in their studies.

Does Albert offer any teacher training or professional development resources?

Yes, Albert does offer professional development resources for teachers. These include webinars, tutorials, and articles that provide insights on how to use Albert effectively for teaching. Moreover, teachers can access a comprehensive knowledge base which is designed to empower them with tips, best practices, and resources to maximize their use of Albert.

What is the pricing model for Albert?

Albert’s pricing varies depending on the type of subscription and the quantity needed. They offer different plans for individuals, schools, and districts. For accurate information on pricing, users are advised to visit the Albert Pricing page on the official website.

Does Albert provide any resources for parents?

Yes, Albert does offer resources for parents. They can monitor their child’s progress, view comprehensive reports, and keep track of their child’s learning and performance. Alongside, Albert provides guides and articles to help parents understand how they can support their child’s learning process more effectively.

Does Albert offer resources for college readiness?

Yes, Albert offers resources designed to prepare students for college. They offer subjects such as Advanced Placement (AP), which can give students a head start in their college education. There’s also a college life section that features topics about managing college life and transitioning from high school.

Is Albert compliant with student data privacy laws?

Yes, Albert is compliant with major student data privacy laws. They follow the Family Educational Rights and Privacy Act (FERPA) and the Children’s Online Privacy Protection Act (COPPA) to ensure the security and privacy of student data.

What subjects does Albert cover for middle school?

For middle school, Albert covers a wide range of subjects in line with the Common Core standards. These include, but are not limited to, English (ELA), Mathematics, Science, and Social Science.

ping.fm

ping.fm