Discover the Top 10 Dave Alternatives: Best Budgeting Apps of 2023 for Financial Success

Are you tired of struggling with your finances and looking for a better way to manage your money? Look no further! We’ve got you covered with our selection of the top 10 budgeting apps like Dave to revolutionize your financial journey in 2023. With a range of features suitable for any budget, you can find the perfect match to meet your personal financial goals – making these apps your ultimate allies for achieving financial success. From saving for that dream vacation to staying on track with bill payments, explore this carefully curated list and discover how these powerful alternatives to Dave can transform your finances in no time. So sit back, relax, and get ready to elevate your budgeting game with these exceptional apps!

1.

Earnin

4.8

Earnin is a revolutionary financial app designed to simplify the payday experience, offering users easy access to their hard-earned money when they need it the most. This hassle-free app allows working individuals to tap into their earned pay before their scheduled payday, ensuring financial peace of mind and reducing reliance on expensive loans or credit cards. With a secure and user-friendly interface, Earnin empowers users to stay on track with their budget, improve financial health, and avoid costly late fees. Discover the freedom and flexibility provided by Earnin’s innovative services and take control of your finances with this groundbreaking app today.

Pros

- Earnin allows users to access their earned income before payday, providing much-needed financial flexibility and relief to those living paycheck to paycheck.

- The app offers additional features such as automated savings and budgeting tools, helping users manage their finances beyond just advancing their paychecks.

Cons

- Users must have a consistent income and a time tracking system in place at their job in order to use the app, limiting accessibility for some individuals.

- The app relies on users tipping what they believe is fair for the service, which can be seen as subjective and potentially unfair compensation for the company.

Conclusion: Overall, Earnin offers a useful service for those in need of access to their earned income before payday and additional financial tools. However, the app’s limitations and reliance on tips as compensation should be considered by potential users.

2.

MoneyLion

4.7

MoneyLion is a revolutionary financial management app that offers users access to a wide range of personalized financial tools and services in one convenient platform. With features that include credit monitoring, personalized financial advice, budgeting, investing options, and cash advances, MoneyLion empowers users to achieve their financial goals with ease. The app offers intuitive financial analytics that helps users to make informed decisions and manage their finances in a smart and efficient manner. By seamlessly consolidating all vital financial information and services under one roof, MoneyLion streamlines users’ financial experience and ultimately promotes financial wellness. Download MoneyLion today to experience the future of intelligent personal finance management.

Pros

- Offers free credit monitoring and personal finance management tools

- Provides access to loans and cashback rewards for using the app’s debit card

Cons

- Charges a monthly membership fee for access to some features

- Higher interest rates and fees for loans compared to traditional banks or credit unions

Conclusion: Overall, MoneyLion could be a useful app for those looking to improve their credit and manage their finances. However, the monthly membership fee and higher interest rates for loans should be considered before signing up. It may be worth comparing rates and fees with other financial institutions before committing to this app.

3.

Chime

4.7

Chime is a revolutionary mobile banking app that simplifies personal finance for users while offering a multitude of standout features. With Chime’s fee-free approach, users benefit from no monthly maintenance, minimum account balance requirements, or foreign transaction charges. The app also excels in providing real-time transaction notifications, automatic savings options, and a seamless mobile experience, making it the ultimate choice for today’s modern banking needs. Experience unrivaled convenience and take control of your finances with Chime – the quintessential app for hassle-free, secure, and efficient digital banking.

Pros

- Chime has no monthly maintenance fees or overdraft fees, making it a cost-effective alternative to traditional banking.

- Chime also offers early direct deposits, allowing users to receive their paychecks up to two days early.

Cons

- Chime’s ATM network is limited and users may incur third-party ATM fees when withdrawing cash.

- Chime’s customer service options are limited, with no phone support available on weekends.

Conclusion: Overall, Chime is a great option for individuals looking for a cost-effective and convenient banking alternative. However, users should be aware of the limited ATM network and customer service options.

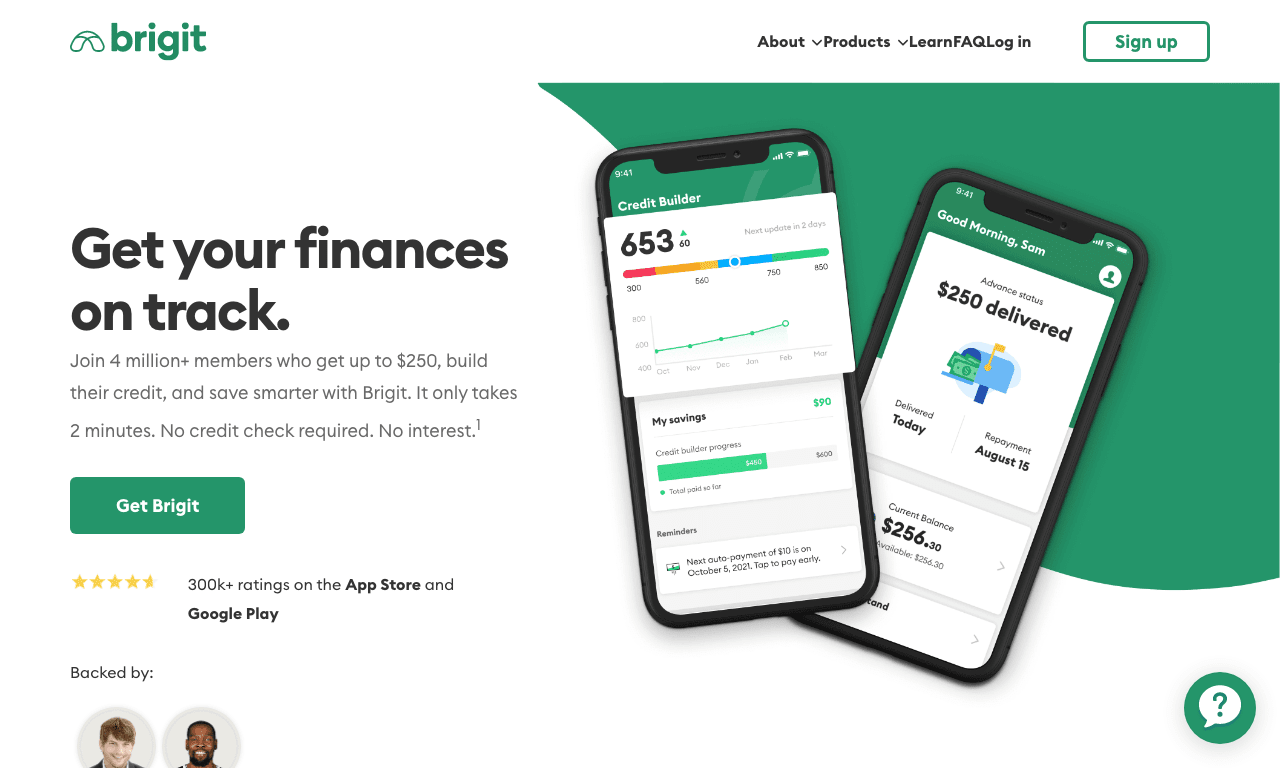

4.

Brigit

4.6

Brigit is a revolutionary financial app designed to help individuals manage their finances seamlessly and effortlessly. With features such as real-time account balance monitoring, instant cash advances, credit score tracking, and personalized budgeting tools, users can take control of their financial health with ease and confidence. The app’s no-overdraft guarantee ensures that users can avoid expensive overdraft fees while accessing quick financial assistance. Moreover, Brigit’s AI-powered algorithm provides customized insights to optimize users’ financial habits while prioritizing security with bank-grade encryption. Experience financial peace of mind with Brigit – your smart and reliable money management partner.

Pros

- Provides advances of up to $250 to help cover unexpected expenses before the next paycheck

- Offers financial insights and tips to help users better manage their money

Cons

- Charges a monthly subscription fee of $9.99

- May not be a viable option for those who consistently struggle to make ends meet

Conclusion: Brigit can be a useful tool for those who occasionally need a little extra financial help, but the monthly subscription fee and limited loan amounts may not make it cost-effective for individuals who are consistently struggling to make ends meet.

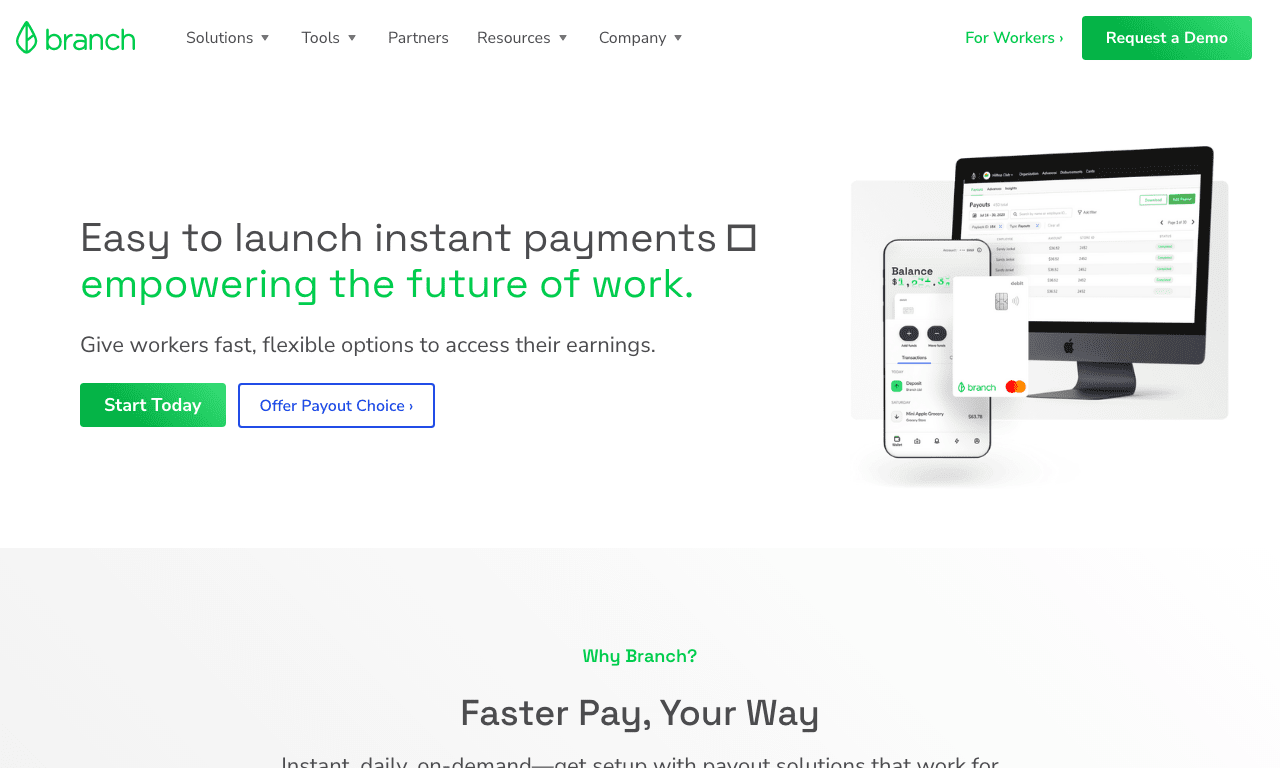

5.

Branch

4.5

Branch is a cutting-edge app that revolutionizes the way people connect and engage with one another. Experience seamless communication, efficient team collaboration, and enhanced productivity with this feature-rich platform. Utilize advanced tools such as smart scheduling, interactive boards, and customizable channels, all designed to take your professional and personal interactions to new heights. Discover the unparalleled flexibility and potential of Branch, the ultimate app for transforming your connectivity experience.

Pros

- Branch allows for seamless collaboration and communication among team members, keeping everyone on the same page and increasing productivity.

- The app offers a variety of integrations with other workplace tools, providing a central hub for all necessary resources.

Cons

- The cost can be a significant barrier for smaller teams or freelancers looking for a collaboration app.

- Some users have reported glitches or difficulty navigating the app’s interface, leading to frustration and decreased efficiency.

Conclusion: Overall, Branch can be a powerful tool for larger teams looking to streamline their communication and workflow. However, the high price point and potential for technical issues may make it less accessible or practical for smaller operations.

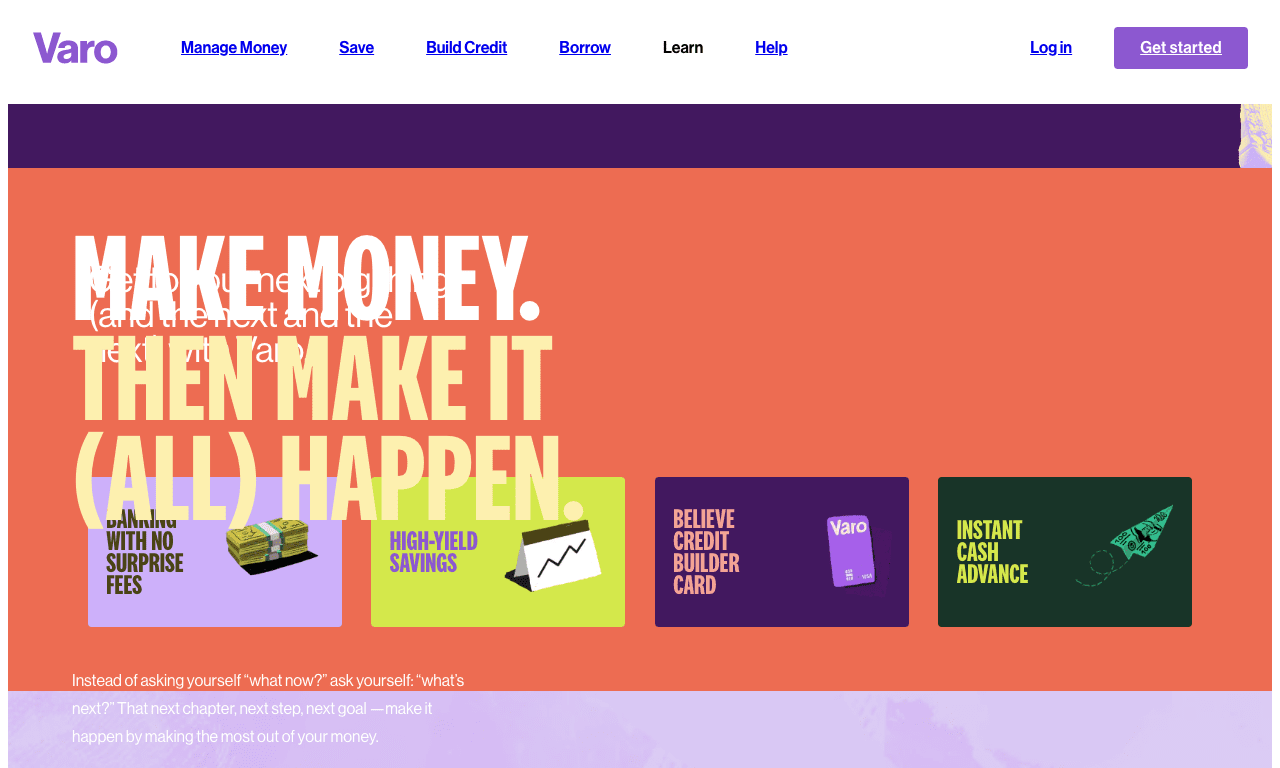

6.

Varo

4.5

Discover the benefits of Varo, an innovative finance and banking app that elevates your personal financial management experience. Explore its advanced features such as fee-free banking, early direct deposit access, and an intuitive budgeting tool. Experience seamless integration with popular apps for streamlined money management and robust security measures ensuring safe transactions. Enhance your financial journey with Varo’s versatile and user-friendly design, tailored to fit the needs of the modern, financially-savvy individual.

Pros

- No monthly fees: The Varo app doesn’t charge any monthly fees, so users can save more of their money.

- High-yield savings account: The app offers a high-yield savings account with an APY of up to 2.8%, which helps users earn more on their savings.

Cons

- No physical branches: As Varo is an online-only bank, it has no physical branches. This can be a disadvantage for people who prefer face-to-face interactions.

- Limited features: Varo offers basic banking services, but it doesn’t offer more complex services like investments, loans, or joint accounts.

Conclusion: Overall, Varo can be a great option for people who prioritize no monthly fees and a high-yield savings account. However, those who prefer in-person banking or need more advanced financial services may want to look elsewhere.

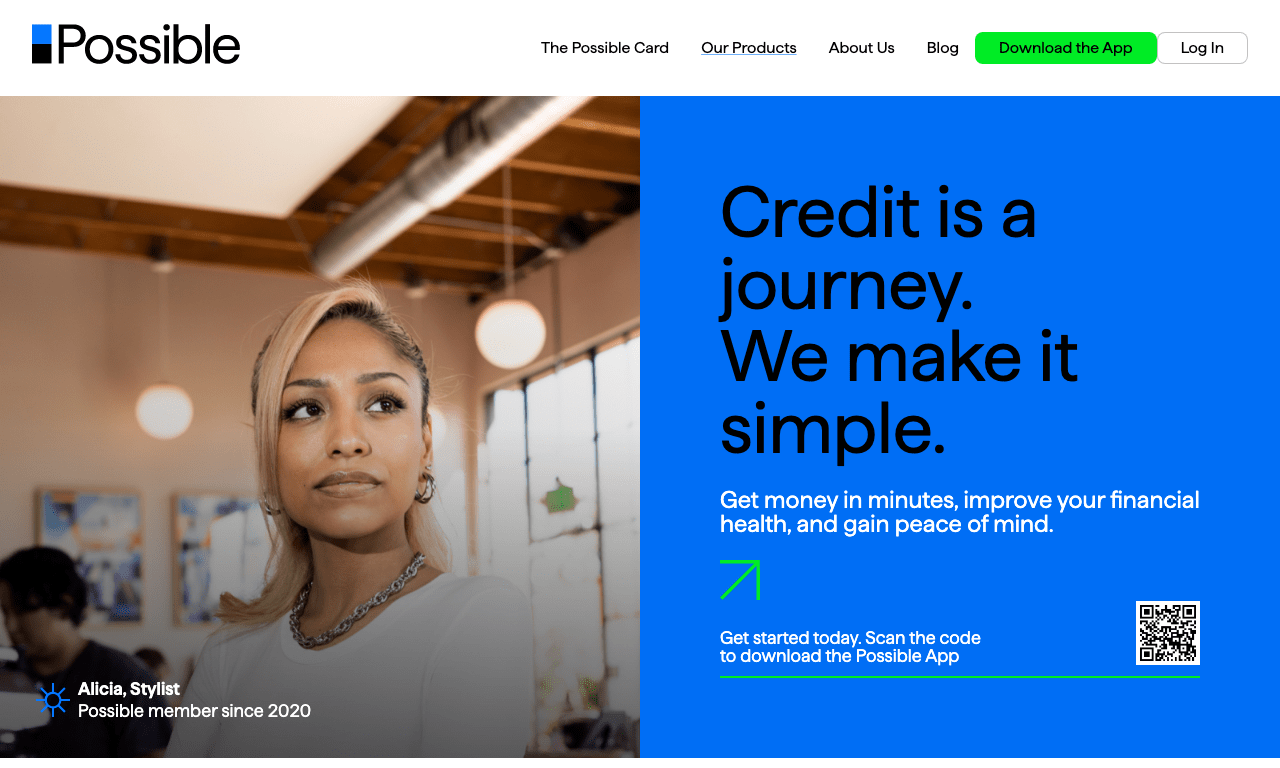

7.

Possible

4.4

Possible is an innovative mobile app designed to empower users with seamless task management and goal tracking. Leveraging advanced technology, Possible streamlines everyday activities by enabling intuitive planning and offering customizable solutions. The app boasts a range of unique features such as intelligent scheduling, real-time progress monitoring, and priority-based organization, ensuring optimal productivity and a sense of accomplishment. Download Possible today to unlock the power of efficient time management and take charge of your personal and professional endeavors.

Pros

- Possible allows users to track daily habits and set goals, which can be helpful for self-improvement and overall well-being.

- The app offers a community feature, allowing users to connect with others who share the same goals and interests.

Cons

- Some users have reported technical issues with the app, such as crashes or difficulty syncing with other devices.

- The premium version of the app comes with a monthly subscription fee, which may not be affordable for some users.

Conclusion: Possible can be a useful tool for those looking to improve their habits and connect with like-minded individuals. However, its technical issues and subscription fee may be drawbacks for some users.

8.

PayActiv

4.3

PayActiv is a revolutionary financial wellness app that enables users to effectively manage their personal finances while alleviating financial stress. With its innovative features, such as earned wage access, bill payment options, and savings tools, PayActiv offers a comprehensive solution for achieving financial stability. Experience the convenience and empowerment of smarter money management with the user-friendly PayActiv app.

Pros

- PayActiv offers on-demand access to earned wages, allowing employees to receive pay before their scheduled payday. This can be a valuable resource for individuals facing unexpected expenses or financial emergencies.

- The app also provides various financial wellness tools and resources, such as budgeting and savings features, which can help individuals better manage their finances.

Cons

- While PayActiv does offer access to earned wages, there may be fees associated with using this service that could cut into an employee’s overall earnings.

- The app’s effectiveness is largely dependent on an employer’s participation in the program. If an employer does not offer PayActiv as a benefit, then employees would not be able to use the service.

Conclusion: Overall, PayActiv can be a useful tool for employees looking to access earned wages and improve their financial wellness. However, it is important for individuals to carefully weigh the potential costs and benefits of using the app, and for employers to fully understand the implications of offering it as a benefit.

9.

Even

4.2

Introducing Even, the ingenious app designed to streamline your financial management while optimizing your savings journey! Seamlessly navigate your expenses and save money effortlessly with Even’s splendid array of features including automatic savings, instant cash advances, and insightful budgeting tools. Experience the joy of achieving your financial goals and a stress-free life with Even’s top-notch personalized finance app at your fingertips.

Pros

- Even is a great tool for budgeting and tracking expenses on a regular basis, as it allows users to sync their bank accounts and automatically categorize transactions.

- The app also offers helpful features such as the ability to set savings goals and notifications to remind users of upcoming bills or expenses.

Cons

- While the app is free to download, some users may be turned off by the subscription-based pricing model necessary to unlock certain premium features.

- There may be concerns related to the security of linking bank account information to the app, as this presents a potential risk of unauthorized access to sensitive financial data.

Conclusion: Overall, Even is a solid option for those looking to better manage their finances and stay on track with expenses and savings goals. However, potential users should weigh the benefit of the app’s convenience against potential concerns around data security and cost.

10.

Cleo

4.1

Cleo is an innovative personal finance app designed to simplify budgeting and money management for users seeking financial clarity. Boasting an intuitive interface and a powerful AI assistant, Cleo offers in-depth analysis of spending patterns, personalized budget suggestions, and real-time account monitoring to ensure users stay on top of their finances with ease. The app further distinguishes itself with unique features such as bill tracking, goal setting, and automatic savings, positioning itself as an essential tool in today’s digital financial landscape. Experience financial control and peace of mind like never before with the Cleo app.

Pros

- Cleo provides a convenient, user-friendly interface for users to manage their finances and track their spending.

- Users can connect their bank accounts to Cleo, allowing for automatic updates and categorization of transactions.

Cons

- The app requires users to give access to their bank account information, which may raise security concerns.

- Some users have reported issues with the accuracy of Cleo’s categorization and budgeting features.

Conclusion: Overall, Cleo can be a helpful tool for individuals seeking to better manage their finances. However, users should be aware of potential security risks and inaccuracies in the app’s features.

Frequently Asked Questions

What are the top alternatives to Dave for budgeting and financial management in 2023?

The top 10 Dave alternatives are Earnin, MoneyLion, Chime, Brigit, Branch, Varo, Possible, PayActiv, Even, and Cleo.

Which Dave alternatives offer early access to earned income?

Earnin, Chime, Brigit, and PayActiv are apps that provide early access to earned income before payday.

Do all Dave alternatives charge monthly fees for their services?

No, not all Dave alternatives charge monthly fees. Chime and Varo, for example, offer fee-free banking. However, some apps, like Brigit and MoneyLion, charge monthly subscription fees for access to certain features.

Are there security concerns when using budgeting apps like Dave alternatives?

Security is a valid concern when using any budgeting app, as you may need to provide sensitive financial information. Most apps in this list prioritize security by using bank-grade encryption and taking necessary measures to protect user data. It’s important to carefully review each app’s security policies before signing up.

Which Dave alternative is best for individuals looking for a cost-effective banking option?

Chime and Varo stand out as cost-effective alternatives, as they both offer fee-free banking services without monthly maintenance fees or minimum account balance requirements.

Do any of the Dave alternatives offer high-yield savings accounts?

Yes, Varo offers a high-yield savings account with an APY of up to 2.8%, enabling users to earn more money from their savings.

Are there any Dave alternatives that focus specifically on spending analysis and budget recommendations?

Cleo is an app that primarily focuses on spending analysis and personalized budget recommendations, using AI to assist users in their financial management.

Can I set savings goals with the Dave alternatives listed in this article?

Several Dave alternatives, such as Even and Cleo, allow users to set and track financial goals, including savings targets.

Do the Dave alternatives offer adequate customer support for potential issues?

While most of the Dave alternatives offer some form of customer support, some apps may have limitations, like Chime, which doesn’t offer phone support on weekends. It’s crucial to research each app’s customer support options and read user reviews before committing.

Are Dave alternatives suitable for all types of users and financial situations?

While the top 10 Dave alternatives listed in this article cater to a wide range of financial goals and situations, it’s essential to closely assess each app’s features and potential limitations to ensure they align with your specific financial needs and preferences.

What exactly is the app Dave?

Dave is a financial app that offers various services such as helping users avoid overdraft fees by providing small loans. The app also includes budgeting tools, automatic savings features, and job-finding assistance, making it a comprehensive tool for personal money management.

Can Dave help me to establish a personal budget?

Yes, certainly. Dave provides a detailed budgeting tool that allows users to track their income and expenses, helping them better understand their financial habits and establish a personal budget that suits their needs and goals.

Can the Dave app help me avoid overdraft fees?

Yes, Dave assists you in preventing overdraft costs by providing small advances on your upcoming paycheck. It helps in managing your finances by alerting you if your balance is low or if there’s a risk of incurring an overdraft fee, thus enabling you to take preventive action.

Is there a fee to use the Dave app?

Dave operates on a subscription model requiring a monthly fee of $1. While the app provides some services for free, other features such as paycheck advances may carry additional fees. However, it’s important to understand the app’s cost structure prior to usage.

What are some other features of Dave?

Apart from providing paycheck advances and helping you budget, Dave also has a feature known as Side Hustle that can assist you in finding part-time employment. Additionally, the app has a built-in savings tool that automatically sets aside a small amount of money every week.

How much can I borrow with the Dave app?

With Dave, you can get advances on your paycheck of up to $100. This can be extremely useful if you find yourself short of cash days before your next payday. The borrowing limit is designed to provide temporary relief rather than for large expenses.

How does Dave automatically save money for me?

Dave’s automatic savings feature, known as Dave Saves, sets aside a small amount of your money every week. By doing this consistently, it helps you build up savings slowly and steadily without you having to manually transfer money.

Can everybody apply for a Dave app?

The Dave app is available to anyone with a stable income and a bank account. However, the availability of some features such as paycheck advances may depend on whether your income is regularly deposited into your linked bank account. Ensure to review the app’s terms and conditions for more information.

What is the turnaround time for paycheck advances on Dave?

Typically, the turnaround time for paycheck advances on the Dave app can be as fast as the same day, but it may also take up to three business days depending on your bank’s processing times and if you have opted for the express fee or not.

How secure is the Dave app?

Dave takes the security of its users very seriously. It uses 2048-bit encryption to secure its connections, conducts regular security audits, and ensures that no personal data is stored on devices or servers. Therefore, you can use the app with confidence.

ping.fm

ping.fm