Top 7 Apps Like Zip Quadpay in 2023: Alternatives for Instant Financing Solutions

Discover the future of effortless payments with our expertly curated list of the Top 10 Apps Like Zip Quadpay in 2023! Managing your finances and making convenient purchases has never been easier, thanks to cutting-edge instant financing solutions. Just as Zip Quadpay has revolutionized the buy-now-pay-later landscape, these alternatives offer you a range of flexible, user-friendly, and reliable options to meet your budgeting needs. Don’t miss out on the digital payment revolution – dive into our comprehensive guide to find the perfect app for your financial journey in 2023 and beyond!

1.

Affirm

4.5

Experience the power of personal growth and positivity with Affirm, an innovative app designed to deliver daily affirmations and inspiration to enhance your mindset. Unlock the potential of self-improvement and rediscover positivity through the app’s customizable features, empowering guidance, and motivational prompts. Make the most of your individual journey towards mindfulness, confidence, and self-empowerment with Affirm, your personal assistant for building healthy habits and nurturing resilient thinking in your everyday life.

Pros

- Affirm allows users to make purchases without having to put down a large sum of money upfront, which can be helpful for those who don’t have the funds immediately available.

- The app provides clear and transparent information about the interest rates and fees that come with using Affirm, which can help users make informed decisions.

Cons

- Affirm’s interest rates may be higher than those of traditional credit cards, which could lead to users paying more in interest over time.

- If users cannot make their payments on time, they may incur late fees and damage their credit score.

Conclusion: Overall, Affirm can be a helpful tool for those looking to make purchases without having to pay the full amount upfront. However, it’s important for users to be aware of the potential costs and risks involved with using the app, and to make sure they can make their payments on time.

2.

Sezzle

4.6

Sezzle is a cutting-edge app designed to revolutionize the way consumers manage their finances, offering a seamless and interest-free installment payment solution for online shopping. With an intuitive user interface and advanced security features, Sezzle caters to savvy shoppers seeking flexibility and convenience in their purchasing experience. The app’s innovative approach allows users to split the cost of their purchases into four equal installments while enjoying instant approval and no hidden fees. Experience the future of payment solutions with Sezzle – transforming the eCommerce landscape through smart and effortless financial management.

Pros

- Sezzle offers flexible payment options for customers by spreading out the cost of purchases over four installments.

- The application doesn’t require a credit check, making it accessible to a wider range of customers who may not have a strong credit history.

Cons

- Sezzle charges fees for users who miss payments or need to reschedule payment dates, which can add up and lead to financial strain.

- Some retailers may not offer Sezzle as a payment option, limiting its usefulness for customers who prefer to use the service.

Conclusion: Overall, Sezzle can be a helpful application for customers looking for more flexible payment options. However, users should be aware of the fees associated with the service and make sure they’re only using it for purchases they can afford to pay off on time.

3.

Splitit

4.2

Splitit is a cutting-edge payment solution app designed to revolutionize the way individuals and businesses handle transactions. By providing an innovative, interest-free installment payment option, Splitit enables customers to seamlessly divide their purchases into smaller installments without impacting their credit score or incurring additional fees. The app’s user-friendly interface and seamless integration with popular e-commerce platforms make it a must-have for savvy shoppers and businesses looking to attract customers by offering flexible payment options. Discover the future of payment solutions and elevate your shopping experience with Splitit.

Pros

- Allows customers to split the cost of a purchase into smaller, interest-free payments over time, making expensive purchases more accessible

- Integrates with existing credit cards, so customers don’t need to apply for a new line of credit or open a new account

Cons

- May not be available for all merchants or payment types, limiting its usefulness

- Customers may end up paying more overall due to transaction fees and potential interest charges on their existing credit card

Conclusion: Overall, Splitit can be a valuable tool for customers looking to manage their finances and make big purchases more affordable over time. However, it’s important for customers to carefully consider the potential costs and limitations of using the app, and to compare it against other financing options to ensure they’re getting the best deal.

4.

PayBright

4.4

PayBright is a leading app focused on simplifying the financing process and providing accessible payment plans for consumers. With seamless integration, it offers flexible purchasing options, allowing customers to enjoy a better shopping experience. Discover PayBright’s unique features and benefits for both businesses and consumers, making it a must-have financial tool in today’s fast-paced eCommerce world. Explore how PayBright is revolutionizing the way we shop, providing convenience and affordability for users across America.

Pros

- Allows customers to split payments over time, making large purchases more manageable

- Easy to use and integrate with participating retailers

Cons

- Interest rates can be high, leading to additional costs for customers

- Limited number of participating retailers may limit options for consumers

Conclusion: Overall, PayBright is a useful tool for customers looking to make large purchases more affordable. However, the high interest rates and limited retailer options may deter some users.

5.

Quadpay

4.5

Quadpay is a versatile and user-friendly mobile app that offers a seamless payment solution for savvy shoppers. With its interest-free, four-installment payment plan, the app promotes smarter and more manageable spending habits. Catering to a wide range of stores and venues, Quadpay engages users with a hassle-free experience, flexible shopping options, and personalized features, making it the ideal companion for exploring and maximizing the world of retail.

Pros

- Quadpay allows customers to split their purchase into four interest-free payments, making it easier for them to budget and afford larger purchases.

- The app has a user-friendly interface and is easy to use, with quick approval and payment processing times.

Cons

- Quadpay may encourage impulse purchases and overspending, as customers may be more likely to make a purchase if they know they can split it into smaller payments.

- There is a chance that customers may run into issues with missed or late payments, which could result in fees and affect their credit score.

Conclusion: Overall, Quadpay can be a helpful tool for budget-conscious shoppers who want to make larger purchases over time. However, it’s important for users to be responsible and aware of their payment schedules to avoid any potential issues.

6.

FuturePay

3.8

FuturePay is a cutting-edge app designed to simplify your shopping experience by offering a secure, hassle-free payment solution. Explore the innovative way this app enables users to make purchases online or in-store without the need for credit cards or cash. Experience seamless transactions, easy management of payment plans, and the benefit of advanced security measures, making FuturePay the go-to choice for today’s savvy consumers. Unlock the potential of effortless payments with this groundbreaking financial tool and redefine your shopping experience.

Pros

- FuturePay offers a convenient payment option for online shoppers who may not have access to traditional forms of credit.

- The application process for FuturePay is quick and easy, with approvals taking only a few minutes in most cases.

Cons

- FuturePay requires users to link their bank account or credit card information, which may raise concerns about security and privacy.

- The interest rates for FuturePay can be higher than other forms of credit, meaning users may end up paying more in the long run.

Conclusion: FuturePay is a useful tool for online shoppers who need an alternative to traditional credit payments, but users should be aware of the potential drawbacks, such as higher interest rates and the need to share sensitive financial information.

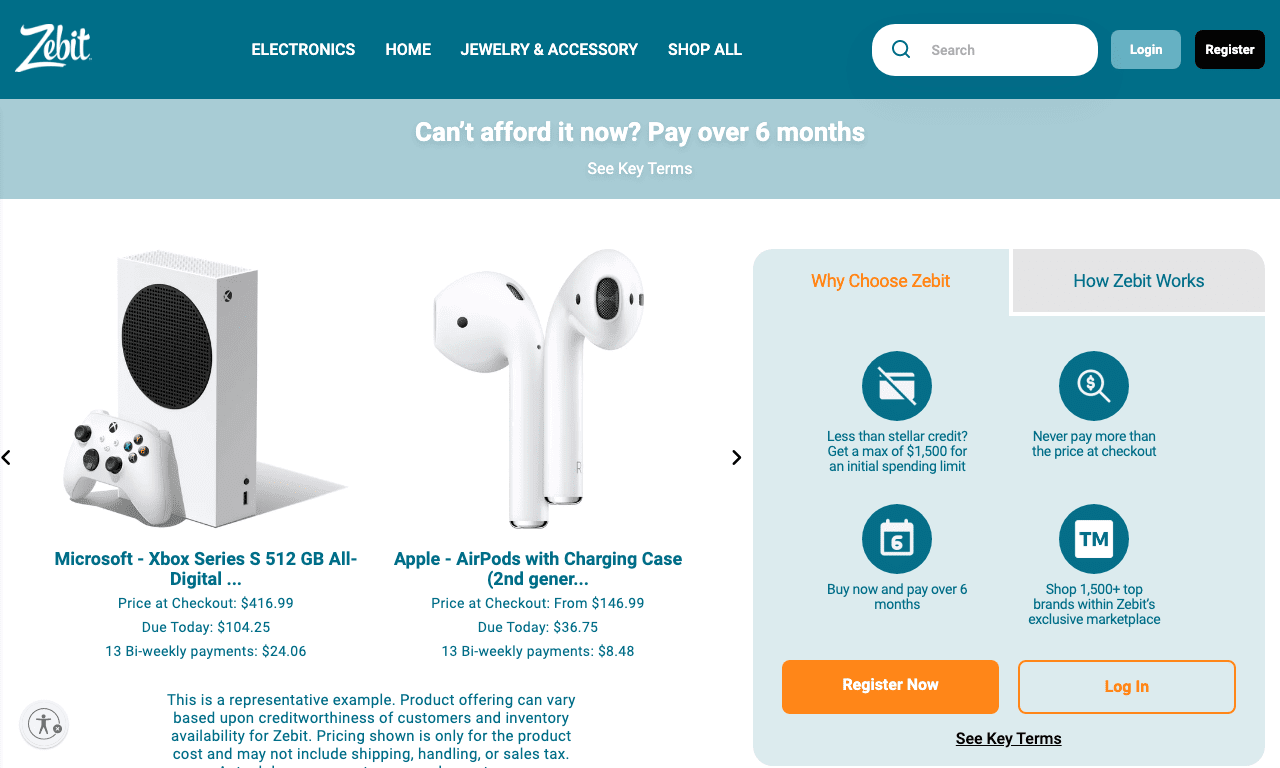

7.

Zebit

3.6

Zebit is a revolutionary financial app designed to provide users with a stress-free shopping experience by offering interest-free credit and flexible payment options. With an extensive product selection, transparent pricing, and no hidden fees, Zebit ensures responsible financial management while catering to various lifestyle needs. Add convenience to your shopping and manage your budget efficiently with Zebit – the smart choice for savvy consumers.

Pros

- Zebit allows users to purchase items and pay for them over time without having to rely on traditional credit options.

- The application has a wide selection of products, from clothing to electronics, making it possible for users to find what they need without having to go to multiple stores.

Cons

- Zebit’s prices are often marked up, which means users could end up paying more than an item is worth if they use the application’s payment plan.

- Late payments can result in fees and interest charges, which could ultimately lead to the user paying more than they would have if they had used a credit card.

Conclusion: Overall, Zebit can be a useful tool for individuals who do not have access to traditional credit options. However, users should be aware of the potential drawbacks, including higher prices and late fees, before they decide to use the application.

Frequently Asked Questions

What is Zip Quadpay and how does it work?

Zip Quadpay is a financial app that enables consumers to split their purchases into four equal, interest-free installments. Users make a down payment at the time of purchase and pay the remaining installments every two weeks, allowing them to spread the cost of their purchases over time.

How do I sign up for a Zip Quadpay account?

To sign up for a Zip Quadpay account, download the Quadpay app on your smartphone or visit their website. Provide your personal information, including your name, address, email, and mobile number. You may also be asked to verify your identity and link a payment method, such as a credit or debit card.

Is there a credit check when using Zip Quadpay or similar apps?

Most buy now, pay later apps like Zip Quadpay, Afterpay, or Klarna perform a soft credit check during the approval process. This type of credit check does not negatively impact your credit score.

Can using Zip Quadpay or other similar apps harm my credit score?

If you use Zip Quadpay or similar apps responsibly and make your payments on time, it should not harm your credit score. However, missed or late payments can lead to fees, interest charges, and potential negative impacts on your credit.

What types of purchases can I make using Zip Quadpay or similar apps?

You can use Zip Quadpay or similar apps like Afterpay and Klarna for various types of purchases, including clothing, electronics, home goods, and more. These apps partner with a wide range of retailers, both online and in-store, providing users with numerous shopping options.

Are there fees associated with using Zip Quadpay or similar apps?

While there are usually no upfront fees or interest charges for using buy-now-pay-later apps like Zip Quadpay, Afterpay, or Klarna, there may be fees for late payments, rescheduling payment dates, or missing payments. Be sure to read the terms and conditions of each app carefully to understand any potential costs.

How do I apply for an installment plan with apps like Zip Quadpay or Afterpay?

Many buy-now-pay-later apps integrate directly into a retailer’s checkout process. Select the desired app (such as Zip Quadpay, Afterpay, or Klarna) as your payment method during checkout and follow the prompts to apply for an installment plan.

Are there any restrictions on who can use Zip Quadpay or similar apps?

While most buy-now-pay-later apps are available to customers over 18 years old, requirements may vary depending on the app and state regulations. Some apps might also have minimum purchase amounts or only allow users with a specific credit score to apply for installment plans.

How do the interest rates with Zip Quadpay and similar apps compare to traditional credit cards?

Apps like Zip Quadpay, Afterpay, and Klarna usually offer interest-free installment plans if you pay on time. However, late payment fees and interest rates might apply if you miss payments. Depending on your credit card’s interest rate, buy-now-pay-later apps could potentially be a more affordable option for some users.

Can I return an item purchased with Zip Quadpay or similar apps?

Returns and refunds for items purchased using buy-now-pay-later apps like Zip Quadpay, Afterpay, or Klarna depend on the individual retailer’s return policy. If you’re eligible for a return, the app will typically process the refund and adjust any remaining installment payments accordingly.

What is the purpose of using apps like Zip Quadpay?

Applications such as Zip Quadpay assist users in managing their finance by allowing them to spread their payments for various products and services across numerous installments. This offering allows users to buy now and pay later, thereby making expensive items more affordable and enhancing purchasing power.

How does Zip Quadpay work?

Zip Quadpay allows consumers to make purchases instantly and then pay for them in four equal installments over six weeks’ period, with zero interest or additional fees as long as payments are made on time. The first payment is made at the time of purchase, with the remaining three payments automatically scheduled for every two weeks.

Is it necessary to have a specific credit score to use Zip Quadpay?

No, Zip Quadpay does not require a specific credit score for anything. However, to protect themselves and their users, they may perform a soft credit check to ensure the customer’s creditworthiness. This does not affect the user’s credit score.

Does Zip Quadpay charge any interest or fees?

No, Zip Quadpay does not charge interest or upfront fees if the payments are made on time. However, there’s a $7 late fee charge if a payment is not made by the due date.

Where can I utilize Zip Quadpay for purchases?

Zip Quadpay can be used at any store that accepts Visa cards. Apart from that, the app has partnerships with many online merchants where Zip Quadpay can be selected as the payment method during checkout.

Is it possible to modify a scheduled payment in Zip Quadpay?

Yes, Zip Quadpay allows users to reschedule their payments. You can do this by accessing your Zip Quadpay customer portal or through the app. However, note that you can only change the date of the next upcoming installment, not subsequent ones.

What happens if I miss a payment with Zip Quadpay?

With Zip Quadpay, if a payment fails to process, users are sent a notification, and the payment is reattempted. If the payment remains unpaid after the due date, a late fee is charged.

Is there a limit to how much I can spend with Zip Quadpay?

Yes, Zip Quadpay has spending limits which can increase or decrease based on your payment history and the length of time using the service. The exact amount can be found in the app under ‘Spending Power.’

Can I return or exchange items purchased with Zip Quadpay?

Yes, you can return or exchange items purchased with Zip Quadpay. However, the return policy of individual retailers will apply and users need to coordinate directly with the retailer for this process. Once a retailer processes a return, Zip Quadpay will refund the amount to your original payment method and cancel or adjust your repayment schedule as necessary.

How can I sign up for Zip Quadpay?

You can sign up for Zip Quadpay via their website or by downloading the Zip Quadpay app from Google Play store or Apple App store. You’ll need to provide basic details including name, address, a valid mobile number, and a payment method to complete sign up.

ping.fm

ping.fm