Discover the Top 7 Trending Sezzle Alternatives: Best Buy Now, Pay Later Apps for 2023

Are you searching for the perfect Sezzle alternative to enhance your online shopping experience? Look no further! In this comprehensive guide, we’ve curated a list of the top 10 buy now, pay later apps just like Sezzle that will revolutionize your shopping game in 2023. These leading alternatives offer flexible payment plans, diverse partner stores, and a seamless checkout process. Unlock a world of unparalleled convenience and affordability with our handpicked recommendations, and shop on the go with confidence – knowing that you’re utilizing the best Sezzle alternatives the market has to offer. So buckle up, and let’s dive into the dynamic world of buy now, pay later apps that will transform your 2023 shopping experience!

1.

PayBright

4.5

PayBright is a cutting-edge mobile app designed to revolutionize personal finance management, offering users a seamless way to spread, track, and optimize their expenses. With its user-friendly interface, customizable budgeting options, and real-time transaction monitoring, PayBright empowers individuals to take control of their finances and make smarter spending decisions, ultimately leading to improved financial well-being. Experience the convenience, security, and efficiency of PayBright, a next-generation solution for personal finance management.

Pros

- Convenient way to break down larger purchases into manageable installments

- Quick and easy application process with instant approval

Cons

- Can result in total cost of purchase being higher due to interest and fees

- Limited availability to certain retailers and merchants

Conclusion: PayBright can be a useful tool for individuals looking to manage their expenses and make larger purchases without breaking the bank. However, it is important to consider the potential extra costs and limitations before committing to using the service.

2.

Affirm

4.4

Discover the Affirm app, designed to help users make informed financial decisions and achieve a stress-free shopping experience. With features like transparent payment plans and personalized credit options, users can conveniently manage their finances while avoiding surprise fees. Explore Affirm and pave the way for smart purchasing and improved money management.

Pros

- Affirm offers loans with no hidden fees or late payment penalties, making it a transparent and predictable option for financing.

- Affirm’s mobile app makes it easy for customers to track their payments, adjust their payment schedule, and manage their loan account from their phones.

Cons

- Affirm’s interest rates might be higher than those of traditional lenders, which can make loans more expensive over time.

- Affirm requires a credit check to determine eligibility, which could negatively affect the credit score of applicants who are not approved.

Conclusion: Overall, Affirm can be a helpful financing option for customers who prioritize transparency and flexibility in their loans. However, it’s important for customers to be aware of the potential downsides, such as higher interest rates and credit checks, before applying.

3.

QuadPay

4.3

QuadPay is a cutting-edge app that enables users to make purchases with a convenient, interest-free payment system. Simplifying transactions by dividing them into four equal, automatic installments, QuadPay allows for better budget management while still providing access to a wide range of products and services. With its seamless checkout process and merchant partnerships, the app ensures secure payments and hassle-free shopping experiences. Explore the benefits of QuadPay to enhance your financial flexibility today.

Pros

- QuadPay allows customers to split their purchases into four equal payments, which can make larger purchases more manageable and affordable.

- The application is easy to use and integrates with many popular online retailers, allowing customers to shop at their favorite stores.

Cons

- QuadPay charges fees for late payments and missed payments, which can add up and make purchases more expensive overall.

- The application may not be available for all retailers or for all types of purchases, which can limit its usefulness for some customers.

Conclusion: Overall, QuadPay can be a useful tool for customers looking to split their purchases into smaller, more manageable payments. However, customers should be aware of the potential fees and limitations of the application before using it to make purchases.

4.

Splitit

4.2

Splitit is a cutting-edge app that offers a convenient and flexible solution for seamless payment management, transforming the way you shop online. With its innovative approach to installment payments, Splitit allows users to effortlessly spread their purchases over time, without incurring interest or fees. Enhance your buying experience with the user-friendly interface and wide range of supported retailers provided by the Splitit app, as it revolutionizes eCommerce and simplifies the payment process. Discover the unparalleled benefits of Splitit and redefine your shopping experience today.

Pros

- Offers interest-free installment payment plans for customers

- Can be used with existing credit cards without any additional applications or credit checks

Cons

- Limited availability in terms of partnering merchants

- Some customers have reported issues with payment processing and customer support

Conclusion: Overall, Splitit offers a convenient payment option for customers looking to make purchases in installments without accruing interest. However, potential partners should carefully evaluate the platform’s capabilities and reliability before integrating it into their business. Additionally, customers should be aware of some reported issues and investigate the process for resolving any potential problems.

5.

Zip

4.1

Zip is a cutting-edge app designed to transform the way users experience file management and sharing. Leveraging advanced compression technology, this intuitive app allows individuals to streamline their workflow, save valuable storage space, and enhance productivity. Zip’s remarkable multi-platform compatibility and seamless integration with popular cloud services make it the ultimate file management solution for personal and professional use. With its powerful features, user-friendly interface, and robust security, Zip is revolutionizing the digital landscape and setting new standards in efficient file management.

Pros

- Zip enables users to compress large files and folders, which saves disk space and makes it easier to transfer or send files over the internet.

- The application can also encrypt archived files, providing an extra layer of security for sensitive data.

Cons

- Some users may find Zip’s interface to be less user-friendly compared to other compression tools.

- The application may not always be able to handle certain file types or file structures, which can cause issues during the compression or extraction process.

Conclusion: Overall, Zip is a useful application for compressing and securing files, particularly for those dealing with large files or sending files over the internet. However, it may not be the best fit for everyone, especially those who prioritize a highly intuitive user interface or who need to work with specialized file formats.

6.

Laybuy

4.0

Laybuy is a user-friendly, installment-based payment solution app designed to revolutionize the way people shop. Offering a pay-later option with interest-free installments, Laybuy allows customers to manage their personal finances more efficiently while enjoying the flexibility and convenience of purchasing products in a hassle-free manner. The app empowers both shoppers and retailers by simplifying the payment process, ultimately driving increased sales and customer satisfaction. Embracing innovation and financial freedom, Laybuy is redefining the online and in-store purchasing experience.

Pros

- Provides an affordable payment option for customers who may not have the funds to make a full payment upfront.

- Easy to use and manage, with the ability to schedule payments and receive reminders.

Cons

- Interest and fees are charged for the service, which can add to the overall cost.

- Late fees may also be applied if payments are missed, which can be quite high.

Conclusion: Overall, Laybuy can be a useful tool for customers looking to spread the cost of their purchases over time. However, it’s important to consider the additional fees and interest that come with the service, and to ensure that payments are made on time to avoid late fees.

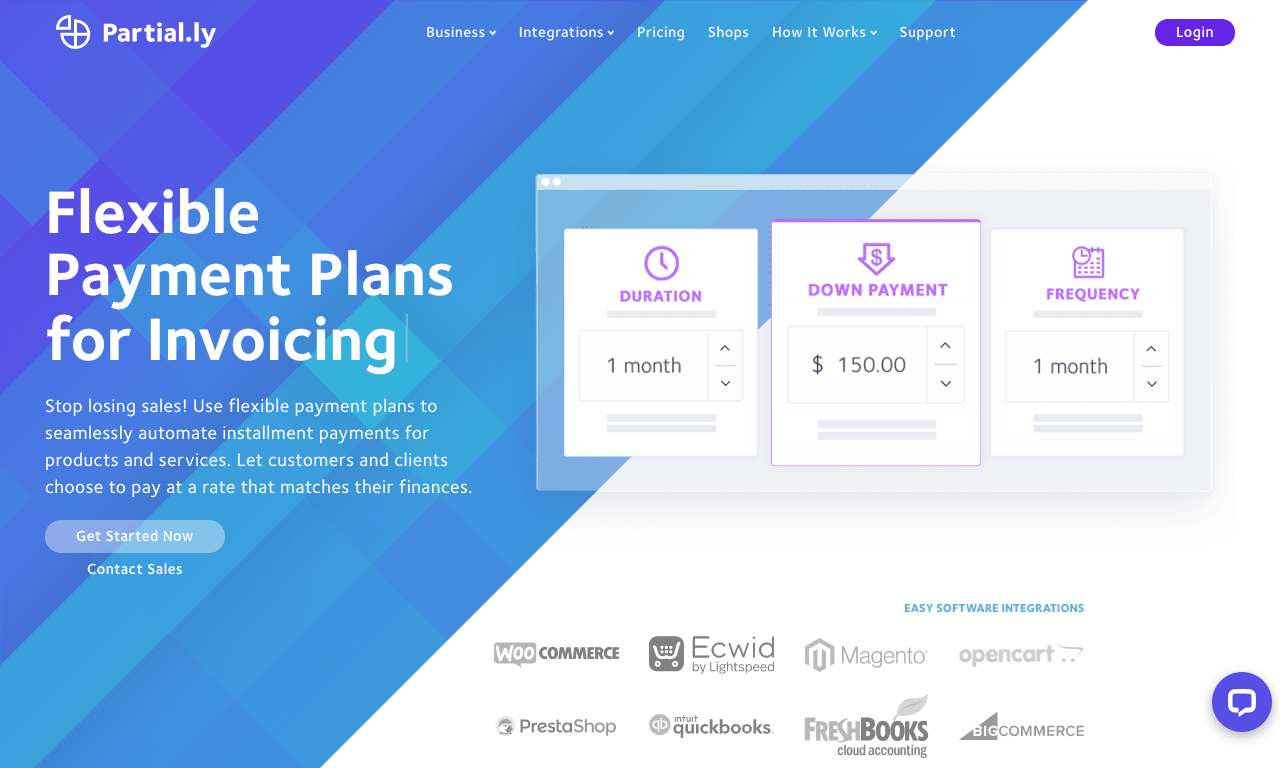

7.

Partial.ly

3.9

Partial.ly is a cutting-edge app designed to revolutionize the payment experience for both businesses and consumers. Streamlining the process of setting up customizable payment plans, Partial.ly offers flexibility, convenience, and simplicity in managing online transactions. This innovative solution seamlessly integrates with various e-commerce platforms, fostering enhanced customer engagement and loyalty. Discover the benefits of Partial.ly, a game-changing app elevating the user experience in modern payment management.

Pros

- Partial.ly provides a flexible payment option for customers who may not have enough money upfront to make a purchase. This can increase sales and customer satisfaction.

- The platform also allows businesses to automate payment plans and reminders, saving time and effort in managing payment schedules.

Cons

- There is a fee for using Partial.ly, which may deter some businesses who are looking for a more cost-effective solution.

- If a customer defaults on their payment plan, it can be difficult for businesses to recover the lost funds.

Conclusion: Overall, Partial.ly can be a useful tool for businesses looking to offer flexible payment options, but it is important to weigh the pros and cons to determine if it is the right fit for your specific needs and goals.

Frequently Asked Questions

What is Sezzle?

Sezzle is a buy now, pay later app that allows customers to make purchases and pay for them in interest-free installments. It aims to provide a more flexible and convenient shopping experience for users.

How does Sezzle compare to its alternatives?

Sezzle is just one of many buy now, pay later apps available today. Its alternatives, such as Afterpay, Klarna, and QuadPay, offer similar features and functionalities, but vary in terms of fees, merchant partnerships, and customer experiences.

Are buy now, pay later apps a good choice for managing my finances?

Buy now, pay later apps can be helpful for individuals looking to break down larger purchases into manageable installments without incurring additional costs. However, it’s essential to use these apps responsibly and avoid overspending, which could lead to financial stress and debt.

Do these apps charge interest or fees for late payments?

Interest and fees can vary depending on the app. Some apps offer interest-free installment plans, while others may charge interest or fees for late payments. It’s essential to understand these details before using these services.

Can using buy now, pay later apps negatively impact my credit score?

Late payments on some apps, such as Afterpay, can negatively impact your credit score. Therefore, it’s crucial to pay close attention to payment due dates and prioritize timely payments to avoid potential issues.

Are these apps available for use with all retailers and merchants?

The availability of buy now, pay later apps depends on their partnerships with retailers and merchants. Some apps have extensive networks, while others may have limited availability. It’s crucial to check which retailers accept your chosen app before making purchases.

Can using buy now, pay later apps lead to overspending or accumulating debt?

The convenience of buy now, pay later apps can potentially encourage some users to overspend or make impulsive purchases. It’s essential to use these apps responsibly and be mindful of your spending habits to avoid debt.

Do I need a credit check to use buy now, pay later apps?

The requirement for credit checks varies among apps. Some, like Afterpay, do not require credit checks or upfront payments, while others like Affirm might require a credit check to determine eligibility.

Are buy now, pay later apps secure for making online purchases?

Most buy now, pay later apps prioritize user security and employ advanced fraud protection measures to ensure safe and secure transactions. However, it’s essential to choose a reputable app and be cautious when entering personal and financial information.

Can I use buy now, pay later apps for international transactions?

The ability to use apps for international transactions depends on the app and its network. Some apps, like PayPal, support multiple currencies and can be used for international payments. However, availability and fees may vary, and users should investigate the specifics before using an app for international transactions.

What is the primary function of the Sezzle app?

Sezzle is a payment solution that allows users to purchase now and pay for it later by dividing the entire order value into four interest-free payments spread over six weeks. Customers can shop online at a partner store, and pay via Sezzle at checkout. Funding for these transactions is provided by the Sezzle platform.

What are the fees associated with using the Sezzle app?

Sezzle does not charge any interest or upfront fees for customers. However, for every order, there is a small processing fee that is charged to the store. Late payment fees apply if a user is unable to make their scheduled payments on time, though Sezzle does extend a grace period first.

Where can Sezzle be used for purchases?

Sezzle can be used at any retailer that has partnered with and integrated Sezzle’s payment platform on their website. The Sezzle Store Directory on the Sezzle website provides a comprehensive list of all partnered retailers.

Is Sezzle a good fit for all types of shoppers?

Sezzle is a particularly excellent choice for budget-conscious shoppers who prefer to break down their purchases into smaller, more manageable payments over time. However, it is crucial for users to ensure they can meet the scheduled payments to avoid late fees.

Are there any eligibility requirements to use Sezzle?

Yes, to use Sezzle you must be 18 years of age or older, have a valid and verifiable mobile number, as well as a U.S. or Canadian billing address. Additionally, a payment method must be linked to your account. Sezzle does not conduct a hard credit check, making the signup process easy and quick for new users.

What happens if I miss a payment with Sezzle?

If you miss a scheduled payment, Sezzle may charge a late fee. However, they do provide a grace period to make the payment before these fees apply. To avoid this, it’s crucial to ensure you have sufficient funds available in your linked payment method on the scheduled payment dates.

How can I sign up for Sezzle?

Signup for Sezzle can be done on the Sezzle website or during checkout at any Sezzle partner store. You will need to provide personal details including your name, date of birth, mobile phone number, and payment method information. Once registered, you can instantly make purchases using Sezzle.

Is it a safe and secure payment option?

Yes, Sezzle maintains high standards of data security and complies with all Payment Card Industry Data Security Standards (PCI DSS) to ensure that your data and privacy are protected. It uses secure server technology to ensure the safety of online transactions.

Can one make returns or exchanges on items purchased with Sezzle?

Yes, the return or exchange of items purchased using Sezzle is handled exactly the same way it would be using any other mode of payment. To process a return or exchange, you should contact the retailer from whom the item was purchased. The retailer will then handle the refund process, and once completed, Sezzle will adjust your payment schedule accordingly.

Does using Sezzle impact my credit score?

No, using Sezzle does not affect your credit score. Sezzle does not perform a hard check on your credit, which means your credit rating won’t be impacted when you choose to shop with Sezzle. However, Sezzle does report your payment information to major credit bureaus, allowing you to build credit over time as you make your payments.

ping.fm

ping.fm