Top 9 Brigit Alternatives: Best Budgeting & Cash Advance Apps in 2023

Are you in search of the perfect budgeting and cash advance app like Brigit to manage your finances efficiently in 2023? Look no further, as we have compiled a list of the Top 10 Brigit Alternatives for you to explore. These apps will empower you with financial tools, resources, and features that are designed to help you make informed decisions, save money, and attain financial stability. From instant payday advances to personalized budgeting solutions, these exceptional Brigit alternatives offer something for everyone. So, buckle up and dive into our carefully curated selection of the best budgeting and cash advance apps available in 2023!

1.

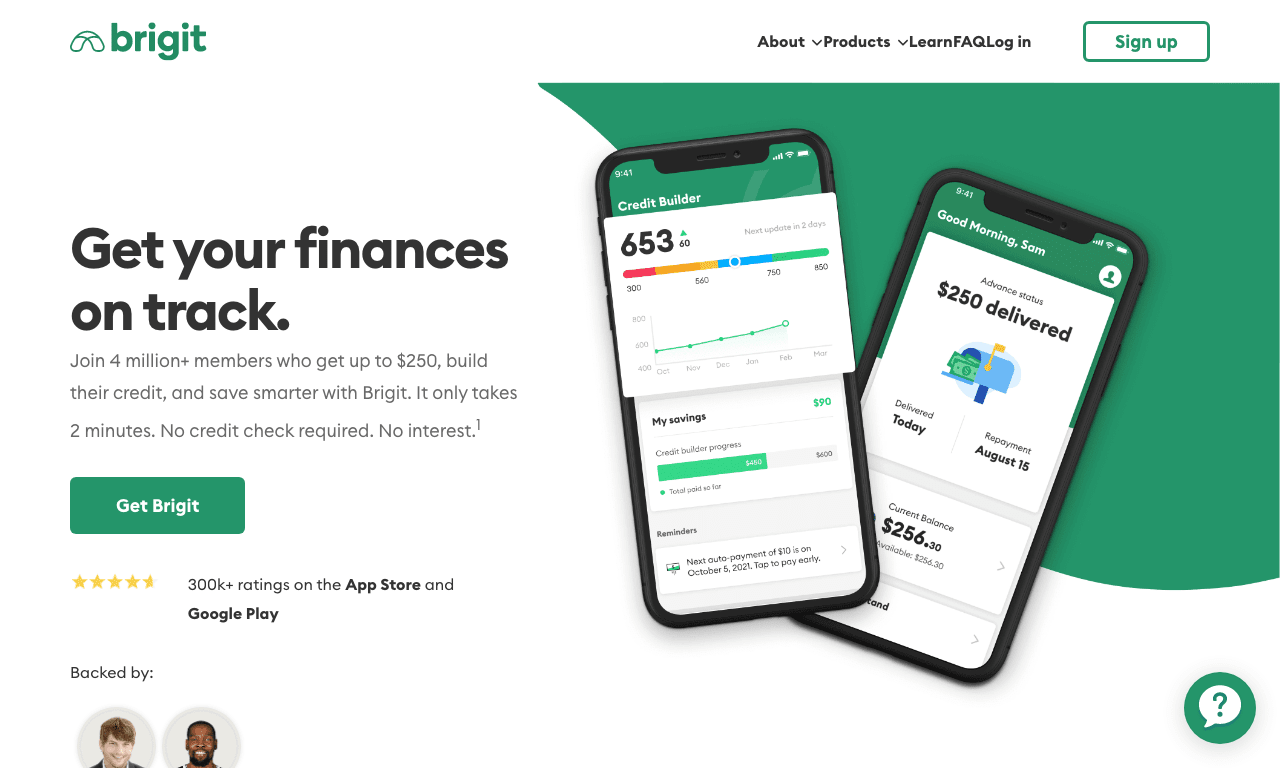

MoneyLion

4.7

MoneyLion is a revolutionary financial app designed to simplify personal finance management and maximize your financial potential. With an impressive range of features, MoneyLion allows users to effortlessly manage expenses, save money, and invest wisely. Track your financial health with personalized credit monitoring and build your credit score with on-time payments and responsible borrowing. Enjoy a user-centric interface and expert financial advice, ushering in the future of personal finance. Enhance your financial wellness with MoneyLion and optimize your financial future today.

Pros

- MoneyLion offers a variety of financial tools, including budget tracking, investment options, and access to low-interest loans.

- The app also provides regular credit score updates, which can be helpful for users looking to improve their credit.

Cons

- While many of the basic features of MoneyLion are free, some of the more advanced tools (like investing) require a paid membership.

- Some users have reported technical issues with the app, which can be frustrating for those trying to manage their finances on the go.

Conclusion: Overall, MoneyLion can be a useful tool for those looking to get a better handle on their finances and improve their credit. However, the app’s reliance on a paid membership and potential technical issues may be drawbacks for some users.

2.

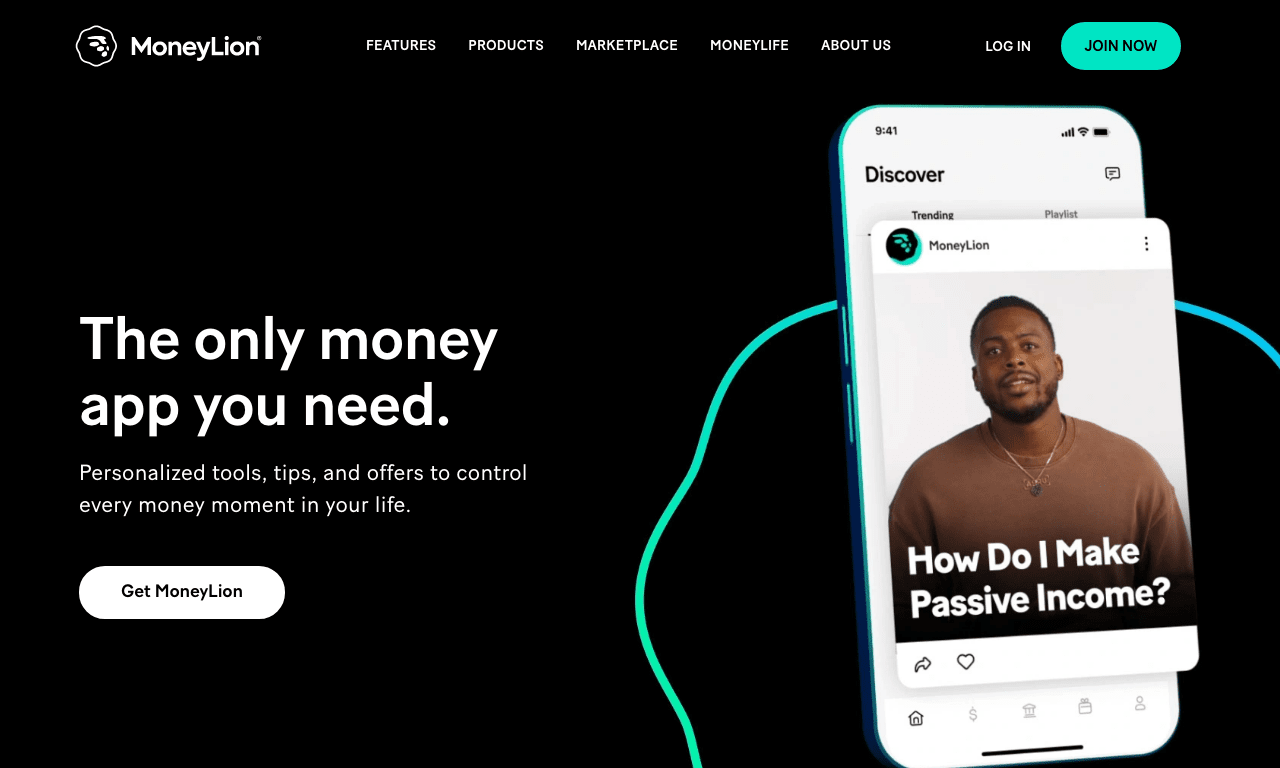

Chime

4.6

Chime is a cutting-edge mobile banking app designed to simplify your financial life. With its intuitive interface and user-friendly features, Chime ensures seamless access to essential financial tools that empower you to take control of your finances. Experience the convenience of fee-free banking, instant transaction notifications, and automatic savings plans that make managing your money easier than ever before. Discover Chime’s innovative approach and dive into a new world of financial freedom tailored to your modern lifestyle.

Pros

- Chime offers no-fee banking with a checking account and savings account.

- The app has a user-friendly interface with features like mobile check deposit and automatic savings.

Cons

- Some users report occasional technical issues with the app, such as deposit errors.

- Chime does not offer physical branches for in-person banking services.

Conclusion: Chime can be a great option for those looking for a no-fee banking experience with convenient digital features. However, its lack of physical branches and occasional technical issues may not be suitable for all users.

3.

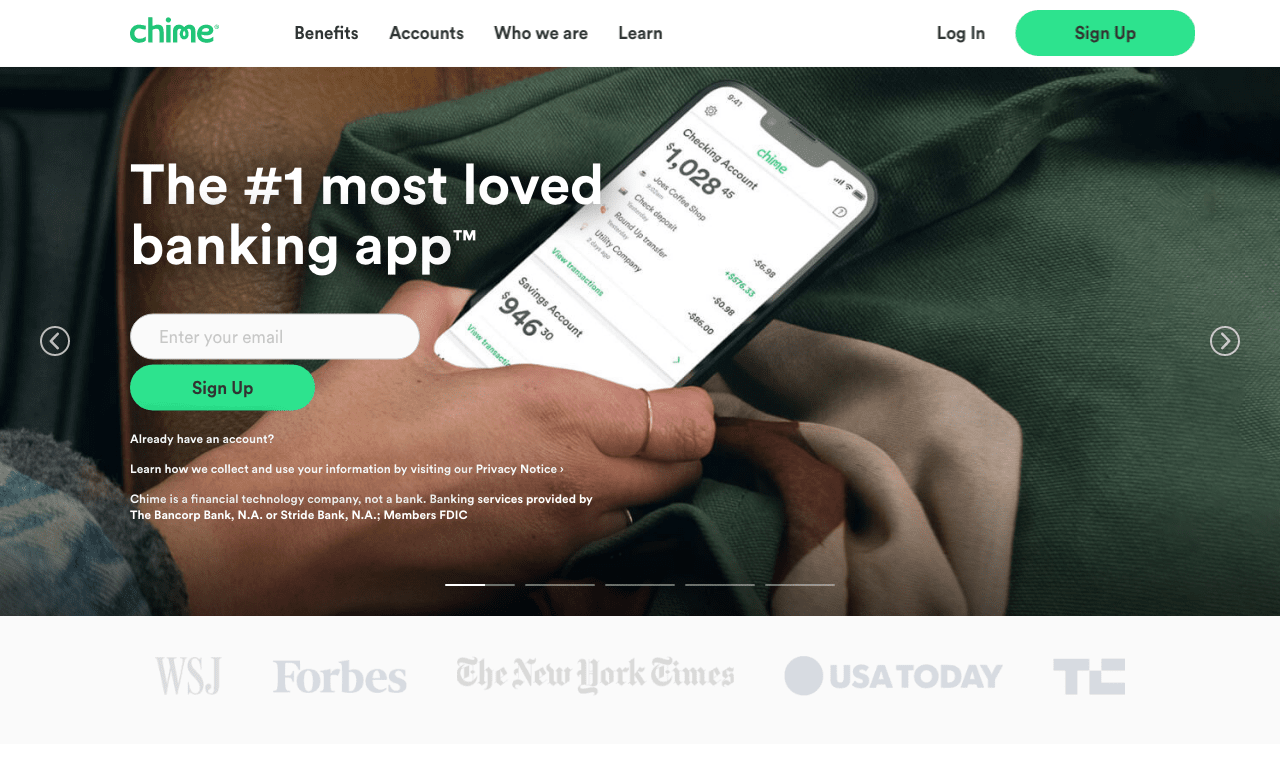

Earnin

4.5

Earnin is a revolutionary financial app designed to help hard-working individuals access their paychecks anytime, without waiting for the traditional payday. With its streamlined interface, users gain the freedom to manage their cash flow effortlessly, eliminating the stress typically associated with unexpected expenses or emergency situations. Key features of this innovative app include overdraft prevention, real-time balance updates, and Lightning Speed. Furthermore, Earnin’s user-friendly platform ensures data security and privacy, fostering trust and reliability among its growing community of satisfied users. Experience the future of paycheck management today with the Earnin app.

Pros

- Earnin lets you access your paycheck early, which can be helpful if unexpected expenses arise before payday.

- The app doesn’t charge you any interest or fees for using its basic features.

Cons

- In order to use Earnin, you need to be paid via direct deposit and have a consistent work schedule, which may not be feasible for everyone.

- Some users have reported issues with the app’s syncing and verification process, which can lead to delays in getting paid.

Conclusion: Overall, Earnin can be a helpful tool for those who need access to some of their paycheck early, but it’s not without its drawbacks. Before signing up, it’s important to understand the app’s requirements and potential limitations.

4.

Branch

4.4

Explore endless opportunities with the innovative Branch app, a groundbreaking tool designed to revolutionize your communication, collaboration, and productivity. Boasting a suite of robust features such as seamless project management, real-time file sharing, and intuitive team discussions, this dynamic platform ensures a hassle-free workflow. With its user-friendly interface, exceptional security measures, and cross-platform compatibility, Branch stands out as the essential asset for modern businesses seeking unparalleled efficiency and success. Experience the future of teamwork, empowering you to thrive in today’s fast-paced digital landscape.

Pros

- Branch allows for easy and efficient communication between team members, even across different locations or time zones.

- The app provides helpful tools for project management, such as assigning tasks and setting deadlines.

Cons

- Some users have reported difficulty navigating the app or finding certain features.

- While the basic version of Branch is free, additional features and options require a paid subscription.

Conclusion: Overall, Branch can be a helpful tool for teams looking to streamline their communication and project management processes. However, users may want to consider the potential difficulties they may encounter when using the app, as well as the cost of a subscription, before fully committing to it.

5.

Empower

4.2

Empower is a cutting-edge personal finance app that simplifies managing your money and elevates your financial well-being. With effective budgeting tools, real-time expense tracking, and insightful analytics, Empower puts you in control of your financial decisions, while seamlessly integrating with your bank accounts and credit cards. The app’s AI-driven recommendations and automatic savings features ensure smart money management, making it an essential addition to the modern individual’s digital toolkit for financial success. Experience financial empowerment with the Empower app and unlock the potential to reach your financial goals.

Pros

- Empower offers personalized budget and savings plans based on individual financial goals and habits. This can help users stay on track with their finances and achieve their goals faster.

- The app offers tools for tracking expenses and creating budgets, with helpful notifications to keep users accountable and aware of their spending.

Cons

- Empower is a paid service, with fees ranging from $6 to $12 per month. This can be a deterrent for users who are looking for a free budgeting app.

- Some users have reported issues with the app syncing with their bank accounts, leading to inaccuracies in their financial data.

Conclusion: Empower seems to be a helpful budgeting app for those willing to pay a monthly fee for personalized financial advice and budget plans. However, users should be aware of potential syncing issues and the cost of the service before signing up.

6.

Varo

4.1

Varo is an all-in-one mobile banking app designed to cater to all your financial needs. Tailor-made for the digital age, Varo offers fee-free banking, high-yield savings, and automatic budgeting tools, revolutionizing the way you manage your finances. With real-time transactions, advanced security measures, and FDIC insurance up to $250,000, Varo seamlessly integrates with other financial platforms while prioritizing your convenience and peace of mind. Experience streamlined banking like never before with Varo’s state-of-the-art interface and user-friendly features that put you in control of your financial well-being.

Pros

- No fees: Varo doesn’t charge any fees for ATM use, maintenance, or foreign transactions.

- Money management tools: The app comes with several tools for budgeting, saving, and tracking expenses, which can help users improve their financial health.

Cons

- No physical branches: Varo is an entirely online bank, which means customers can’t visit a physical location for help or services.

- Limited account types: Currently, Varo only offers checking and savings accounts. There are no options for CDs, money market accounts, or other investment vehicles.

Conclusion: While Varo is an excellent choice for savvy consumers who want to save money and access some robust features in their banking experience, it may not be the right choice for customers who value traditional in-person banking services or need complex account options.

7.

Cleo

4.0

Cleo is an innovative mobile app designed to simplify the complexities of personal finance management. With its streamlined interface, users can effortlessly track spending habits, create practical budgets, and identify ways to save money. The app is boosted by cutting-edge AI technology, which allows for personalized recommendations and insights to help users reach their financial goals. Say goodbye to outdated spreadsheets and experience a smarter way to manage money with Cleo, the all-in-one personal finance solution.

Pros

- Cleo offers a user-friendly and interactive interface that is easy to use and navigate.

- The app provides useful financial insights and tools that help users to better manage their money.

Cons

- Some users have reported issues with the accuracy of Cleo’s transaction tracking, which can cause confusion and lead to discrepancies in a user’s financial records.

- While Cleo emphasizes its commitment to data security and privacy, some users may still be uncomfortable giving a third-party app access to their financial accounts and information.

Conclusion: Overall, Cleo can be a useful tool for those looking to manage their finances more effectively through an app. However, users should be aware of potential inaccuracies in transaction tracking and the necessary trade-offs involved with sharing financial data with a third-party app.

8.

Stash

3.9

Stash is a user-friendly personal finance app designed to simplify investing and empower users to build wealth effortlessly. With its intuitive interface, diversified portfolio options, automatic investment feature, and transparent fee structure, Stash offers a seamless experience for beginners and seasoned investors alike. Explore today’s dynamic financial markets and develop smart financial habits with Stash’s personalized guidance and educational resources. Whether you’re saving for retirement, aiming to boost your emergency fund, or looking for sustainable investment opportunities, Stash’s robust platform and tools are ready to transform your financial journey.

Pros

- Stash offers a user-friendly interface that makes it easy for users to invest in different stocks and funds.

- There are no minimum account balances required, making it accessible to a broader range of investors.

Cons

- The monthly fee of $1 for beginner investors can add up over time and may not be cost-effective for those with smaller investments.

- Some users have reported issues with customer support and delayed response times to inquiries.

Conclusion: Overall, Stash is a useful investing app for beginner investors who are looking for an accessible and user-friendly way to invest in stocks and funds. However, users should keep in mind the potential costs associated with the app and the potential for customer support issues.

9.

Qapital

3.8

Qapital is an innovative personal finance app that combines smart savings techniques and seamless user experience, allowing users to save money efficiently and achieve their financial goals effortlessly. The app offers a variety of features such as customizable savings rules, real-time spending insights, and budgeting tools tailored to your lifestyle. Its intuitive interface and gamified approach to finance make saving money fun and engaging. Explore new ways to establish positive financial habits and take control of your financial future with the Qapital app.

Pros

- Qapital offers a unique approach to saving money by allowing users to set personalized goals and rules to save money automatically.

- The app has a user-friendly interface and offers features like a savings tracker, spending analytics, and the option to round up purchases to the nearest dollar and save the difference.

Cons

- Users must link their bank accounts to the app, which may raise security concerns for some people.

- The app charges a monthly fee for some of its features, which may be a deterrent for those who are trying to save money.

Conclusion: Overall, Qapital is a useful tool for those looking to save money and offers some innovative features. However, users should carefully consider the app’s fees and security risks before downloading.

Frequently Asked Questions

What is the best alternative to Brigit for budgeting and cash advance apps in 2023?

Some popular alternatives to Brigit include MoneyLion, Chime, Earnin, Branch, Albert, Empower, Varo, Cleo, Stash, and Qapital. The best app depends on your specific financial needs and preferences.

Are there any free budgeting and cash advance apps available?

Yes, some of the Brigit alternatives mentioned in the article offer free basic features or accounts, such as Chime, Earnin, and Branch. However, for more advanced features or tools, a paid membership or subscription may be required.

Which app offers the highest savings rates?

Varo offers high-yield savings accounts, often with competitive rates compared to traditional banks. However, it is essential to compare current rates offered by various banks and apps to find the best savings rate for your needs.

Is it safe to link my bank account to a budgeting or cash advance app?

Most budgeting and cash advance apps prioritize security and privacy, using encryption and other measures to protect your financial information. However, it’s essential to do your research and choose a reputable app before linking your bank account.

Can I improve my credit score using any of these Brigit alternatives?

MoneyLion offers credit monitoring features and can help users build their credit score through responsible borrowing and on-time payments. However, remember that maintaining a good credit score primarily depends on your financial habits and credit history.

Which app is best for someone new to personal finance management?

Albert and Cleo are user-friendly apps that cater to beginners, offering personalized financial advice and easy-to-understand tools for budgeting and saving. However, each individual’s preferences differ, so it’s essential to explore multiple options before choosing the best app for you.

Can I invest using any of these budgeting and cash advance apps?

Stash is an app that focuses on investing, providing a user-friendly platform for beginners to invest in stocks and funds. Additionally, MoneyLion and Albert offer investment options to users.

Do these apps offer resources for financial education and advice?

Many of the Brigit alternatives, such as Albert, Empower, and Stash, provide personalized financial advice and resources for users to better understand personal finance management and improve their financial habits.

Are these cash advance apps better than traditional payday loans?

Some of these apps, such as Earnin, offer cash advances without fees or interest, making them a more affordable option compared to traditional payday loans. However, each person’s financial situation is different, and it’s essential to weigh the pros and cons before choosing a cash advance app.

Can I use multiple budgeting or cash advance apps simultaneously?

Yes, you can use multiple apps to manage different aspects of your finances or to compare features and services. However, it’s important to consider the potential risks and benefits of sharing your financial information with several third-party apps at once.

What is the Brigit app and how does it function?

The Brigit app is a financial wellness service that helps users budget effectively, track expenses, and access funds to cover unexpected costs. Brigit facilitates short-term loan advances to cover users during periods of financial strain, thus avoiding overdraft fees.

Is the Brigit app free to use?

No, the Brigit app requires a subscription fee of $9.99 per month. This fee unlocks all of Brigit’s services including budgeting tools, personalized spending insights, and access to up to $250 cash advances without any interest rate or late fees.

How long does it take to receive funds from Brigit?

Once you request a cash advance from Brigit, it typically takes one to two business days for the funds to be directly deposited into your account. However, for an additional charge, Brigit offers an instant transfer option which allows users to receive the funds within minutes.

Can Brigit impact my credit score?

No, using Brigit does not affect your credit score. Brigit doesn’t report to any credit bureaus, and therefore, has no impact on users’ credit history or credit scores.

What are the requirements to use the Brigit app?

To use the Brigit app, you need to be at least 18 years old, have a regular monthly income source which is deposited to a checking account, and have sufficient activity in your account to allow Brigit to assess your financial habits. The detailed eligibility criteria are outlined on Brigit’s official website.

Can I cancel a loan once I have requested it from Brigit?

Yes, you can cancel a loan request within the Brigit app as long as the funds have not been sent to your account. However, once the funds have been issued, the process cannot be reversed.

Does Brigit offer any other services aside from short-term loans?

Yes, apart from short-term cash advances, Brigit provides budgeting tools, spending insights, overdraft predictions, and financial educational resources to help users maintain their financial well-being.

How does Brigit determine my cash advance limit?

Brigit determines your cash advance limit based on your income and spending habits. Users typically can get advances ranging from $80 to $250. The data-driven algorithms assess your financial behavior and calculate the cash advance amount accordingly.

How does Brigit make money if they don’t charge interest on the cash advances?

Brigit generates revenue through the $9.99 monthly subscription fee paid by its users. This fee gives access to money management tools, predictive alerts on potential overdrafts, and interest-free cash advances.

Can I use Brigit app with multiple bank accounts?

No, currently Brigit only supports linking to one bank account at a time. All cash advances and repayments must go through the linked bank account.

ping.fm

ping.fm